China One Step Closer to Becoming World’s Gold Hub

– Shanghai Gold Exchange one step closer to becoming the globe’s major gold hub

– China tests system at Shanghai Gold Exchange (SGE) to establish yuan-denominated gold price fix

– SGE opened last year allowing trade in physical gold as opposed to electronic futures contracts on COMEX

– Yuan fix, which has broad regional support, will rival the century old LBMA fix

– China now world’s largest producer and buyer of gold

– Chinese government, central bank and people have affinity towards gold

Chinese ambitions to become the world’s leading gold trading hub and international financial hub have taken another step forward.

Trials were quietly conducted to launch a yuan-backed gold pricing benchmark last month, according to Reuters today.

China, the world’s largest gold producer and buyer, feels its market weight should entitle it to be a price setter for gold bullion. It is asserting itself at a time when the established benchmark, the century old London ‘gold fix’, is under scrutiny because of long-running allegations of price manipulation.

The new Chinese gold price benchmark may be launched before the end of the year.

The Shanghai Gold Exchange (SGE) opened last year and trades in contracts for physical gold (1 kilogramme). It has quickly been establishing itself as the fastest growing gold trading hub in the world as many participants in the gold market move away from the COMEX.

Many investors and miners have grown disillusioned with the COMEX system due to concerns that the price of gold is being manipulated lower by dumping contracts for vast amounts of gold onto the market which leads to sharp price falls and curtails positive sentiment and momentum in the gold market and reduces investment demand.

The new yuan benchmark is set to rival the century old LBMA system. It has broad regional support with the participation of foreign banks as well as those from China including western banks.

“Top Chinese banks including Industrial and Commercial Bank of China (ICBC) and Bank of Communications are members of the exchange, along with foreign banks Australia and New Zealand Banking Group, Standard Chartered and HSBC, among others,” according to Reuters.

The LBMA has been under pressure in recent years due to lack of transparency in the price fixing process. While the yuan fix will be determined by “members of SGE’s international board”, it will be against a backdrop of contracts for physical gold trading at the SGE.

The LBMA benchmark, on the other hand, is determined by bullion banks on the basis of undisclosed “over the counter” trades. The LBMA said last week it was considering the possibility of creating an exchange for gold trading in the city, a shift away from the over the counter (OTC) system.

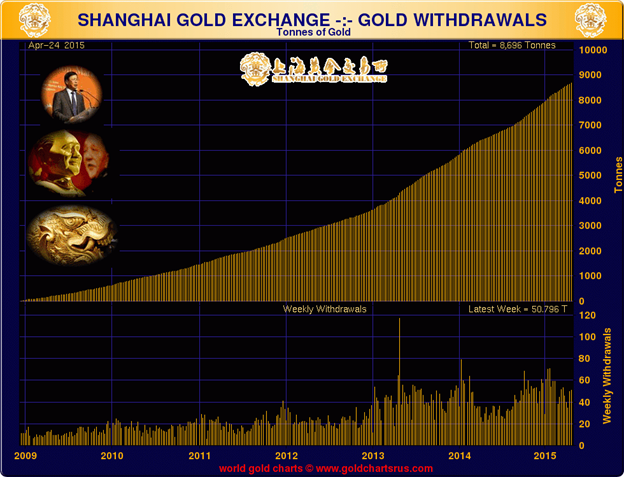

SGE Gold Withdrawals – 50.796 tonnes for the week ending April 24th

The LBMA has been engaged in a public relations campaign to regain its credibility. The old system was reformed last year but the current system is, however, little more transparent.

Central banks are now being considered for membership of the LBMA. This will further undermine the LBMA’s credibility among some participants in the physical gold market given concerns that certain central banks may be involved of gold price manipulation.

An LBMA statement excuses the association from providing transparency, stating, “the role of the central banks in the bullion market may preclude ‘total’ transparency, at least at public level.”

At the same time it should give extra clout to the besieged association who, in their restructuring program, were forced to give some Chinese banks seats on their board. These banks have no say, however, in determining the benchmark.

The move to establish a yuan-based gold pricing benchmark is only natural. China is the world’s largest gold producer and officially the second largest buyer of gold. Although many believe that China has surpassed India in terms of gold demand and SGE withdrawals suggest this to be the case.

As Reuters report, “China … feels its market weight should entitle it to be a price-setter for bullion and it is asserting itself at a time when the established benchmark, the century-old London fix, is under scrutiny because of alleged price-manipulation.”

It will be very interesting to see how the SGE and the LBMA interact in the coming years. The increasing importance of the SGE means that the physical gold market should assume more importance, as should the fundamentals of global physical supply and demand.

Shanghai and the SGE is emerging as the leading international gold bullion trading hub. This is a positive for gold due to the People’s Bank of China (PBOC) and Chinese governments favourable stance towards gold.

A favourable stance which is mirrored by the favourable disposition of the Chinese people – culturally the Chinese view gold as an important store of value.

Important Guide to Currency Wars: Currency Wars: Bye, Bye Petrodollar – Buy, Buy Gold

MARKET UPDATE

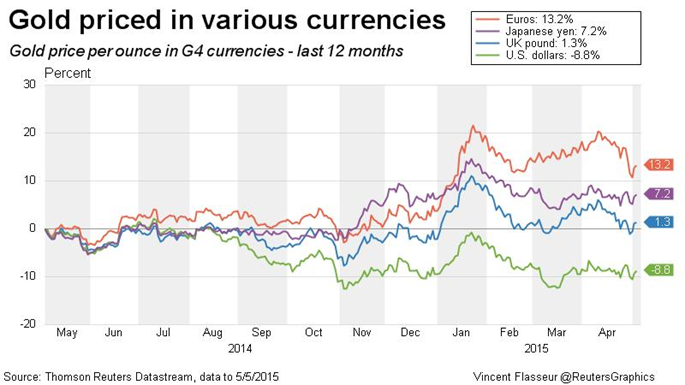

Today’s AM LBMA Gold Price was USD 1,191.25, EUR 1,063.41 and GBP 785.22 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,187.40, EUR 1,070.94 and GBP 785.59 per ounce.

Gold and silver saw small price gains yesterday of 0.35 and 0.73 per cent to $1,192.90 and $16.54 per ounce respectively.

In Asia overnight, Singapore gold prices ticked higher initially prior to giving up those gains and weakness has continued in London trading this morning.

European stocks stabilised after Asian stocks fell today in line with weak U.S. markets as equities investors were spooked by a vicious selloff in sovereign bonds globally and a very large U.S. trade deficit. The disappointing U.S. trade data for March painted an even bleaker economic picture of the first quarter and led to the dollar and stocks coming under pressure.

The sudden spike in bond yields is being mirrored by an equally rapid rally in resources. This means investors globally are becoming less concerned about the risk of deflation and more concerned about the risk of inflation or stagflation.

Oil prices rose again today and are 15% above their recent lows. Prices are holding near their 2015 highs, continuing a month-long rally that was supported by renewed weakness in the dollar and a disruption to oil supplies from Libya.

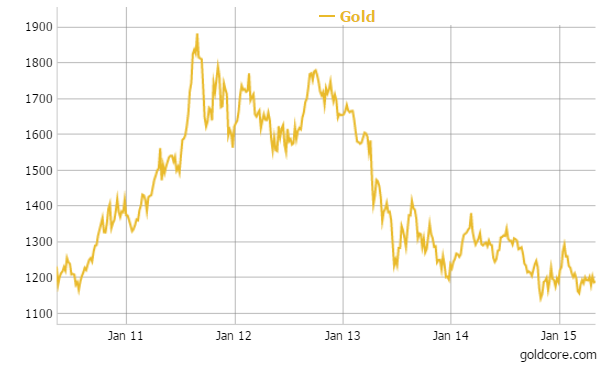

Gold in U.S. Dollars – 5 Years

Volumes in the global spot gold market have fallen to their lowest in a year, with shrinking liquidity and a slowdown in interbank trade making customers reluctant to transact on a large scale

As the first week of May draws to a close, Reuters reports that “sales of gold American Eagle coins by the U.S. Mint have had a relatively soft start to the month, with 4,500 oz of coins sold so far (April’s total was 29,500 oz, down by a third from March). Silver Eagle coins have totalled 783,500 oz.

In Europe in late morning trading gold bullion was flat at $1,192.44 an ounce. Silver was down 0.6 percent at $16.51 an ounce and platinum fell 0.1 percent at $1,146 an ounce.

Important Guide: 7 Key Gold Must Haves

Leave a Reply