Greek Contagion Abyss Looms – Wealth Preservation Strategies

- Greece, EU and Banks Staring Into Abyss

- Markets Are “Irrationally Exuberant” – Gods Punish Hubris

- “Invisible Hand” Propping Up Sanguine Markets

- Short Term Considerations

- Long Term Considerations

- Best Case Outcomes

- Worst Case Outcomes

- Wealth Preservation Strategies

We are here, staring into the abyss. The greatest monetary experiment of the modern world – the euro, encapsulating the largest middle class market of consumers ever assembled is about to face its greatest test to date.

To say anxieties are high is an understatement. Normally the broad markets will weigh up downside risk as the markets formulate and assimilate varying views on matters of importance, but not so in this case.

The markets are decidedly sanguine, as if an “invisible hand” is propping them up, guiding them, nudging them, buying any dips in stock and bond markets and maintaining calm.

The VIX measure of U.S. stock volatility, is languishing at 15 – not even whimpering. Gold, that other key barometer of risk, has only seen slight gains and languishes at $1,200 per ounce.

It is as if the fire alarms have been turned off despite the fire beginning to rage.

Is the Working Group on Financial Markets or Plunge Protection Team (PPT) working tirelessly through proxy Wall street banks to keep gold depressed and prop up leading benchmarks such as the S&P 500 and thus the wider markets?

There are many that believe that Wall Street banks and central banks work closely together and coordinate policy and market interventions. They are sometimes dismissed as “conspiracy theorists.” Despite much evidence showing that banks have manipulated and rigged markets frequently.

Ironically, those that dismiss this as conspiracy theory are the same people who would say that if the central banks and governments are not propping up and intervening in markets, they should be.

If central banks are not already “market makers of last resort” then it seems likely that they soon will be and indeed overnight the IMF has called for this.

Such interventions simply paper over the cracks for a period of time – meanwhile the fire is burning, the structure is crumbling and will ultimately collapse.

A Greek exit from the euro would change everything. The greatest change being simply doubt and fear regarding the outlook for other vulnerable EU nations, EU banks and the EU banking and financial system.

From that day forward every statement from every EU official will have a risk premium attached to it.

They will say this and that, but the market will here “maybe” this, “maybe” that. As such the costs of participation in every financial transaction will alter, as the accounting for “what if” scenarios slowly gets priced in.

This change in risk perception and pricing, rather counterintuitively, is in fact a good longer term development. The markets have become increasingly captive by non elected and elected officials within the world monetary apparatus.

These ‘hidden hands’ have, and are, over anxious and seek to to quell market volatility and market dislocation in what they believe to be in the interest of the public good. They believe that market volatility is a bad bad thing – when in fact nothing could be further from the truth.

It was this same hubris and “super man” mentality that created the first global financial crisis and indeed financial crises throughout history.

The same mistakes are being made over and over again. Market hubris and official hubris is rife. How apt – Greek gods liked to punish those guilty of being overconfident and arrogant.

We are seeing this misdiagnosis being played out in the current negotiations between the Troika and the Greek government. Ultimately the effect of a Greek exit could manifest in any number of ways, with far reaching consequences for our interconnected global capital market with all of its regulatory gaps, opaque credit structures and massive $200 trillion and growing debt burden.

Short term considerations

- capital controls and extent of

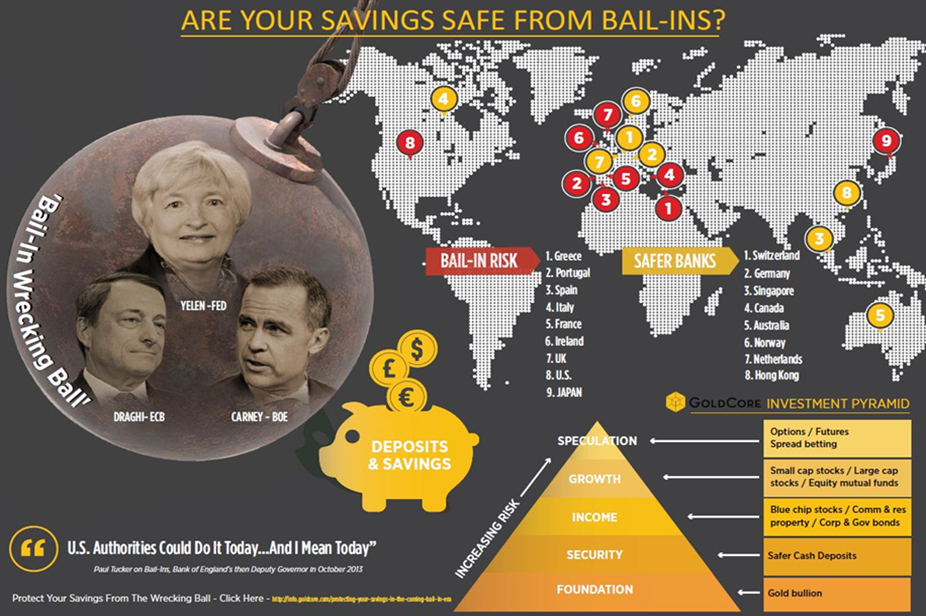

- bank collapse and bail-ins

- credit market contagion

- Greek euro exit

- rising government bond yields and interest rates

- geopolitical considerations and Russian influence

Long term considerations

- higher interest rates

- stock market fall

- “PIIGS” contagion

- global contagion?

- effect on Germany (arguably the greatest Euro benefactor)

- loss of confidence in ECB, monetary union and euro

- increase in nationalism

- makes Brexit more likely?

Best case outcomes

- Greek default – ECB blinks and continues liquidity support

- Greek get a deal to peg debt obligations to growth and spread repayments over the very long term

- stability returns, bailout countries return to more solid economic growth as interest rates begin to slowly normalise

- Greece and its new currency start recording significant growth in a post debt overhang world

Worst case outcomes

- capital controls across Europe until Greek exit is managed

- Greek exit in a messy way, euro credit seizes up as collateral bombs go off – “Lehman II”

- bail-ins imposed on depositors across world – further devastating depositors, small and medium enterprises and our economies

- banks and hedge funds smell blood and start rounding on the next weakest member, shorting bonds and local markets, forcing an exit

- likely Italy, Spain, Ireland, Portugal and in time France targeted in terms of interest rate sensitivity

- Euro becomes a lame duck currency, all countries start to prepare for an exit orderly or otherwise. New euro launched with exclusively northern European industrial economies

- collapse of western banking system…for a period of time

Wealth preservation strategies

- Speculate by going short euro and long drachma and Greek assets

- Own USD, NOK, HKD, SGD, CHF in safe banks in safe jurisdictions

- Diversify cash holdings to non European banks and offshore institutions

- Own physical precious metals in safe vaults in safe jurisdictions

Short term considerations

Greek banks have haemorrhaged over €30 billion since October. Over €2 billion was withdrawn between Monday and Wednesday and likely as much since then as the talks intensified and the situation worsened this week.

The problem can only have been exacerbated by an ECB official’s suggestion at a closed door meeting on Thursday – in response to a direct question from Dutch Fin Min Jeroen Dijsselbloem – that the Greek banks would not open on Monday as reported by Reuters.

The ECB later denied that this was the case but clearly capital controls are on the table. That being said Bloomberg reports that “the Governing Council of the European Central Bank plans to hold an unscheduled call on Friday to discuss Emergency Liquidity Assistance available for Greek lenders, according to two people familiar with the plans”.

Whether the ECB agrees to raise the ceiling on the ELA is not certain. The leak reported by Reuters suggests that certain parties are happy to provoke bank runs in order to force the hand of the Greek government.

We may soon see capital controls imposed in Greece as depositors are bailed-in to try keep the banks afloat.

At the start of June the European Commission ordered 11 EU countries to enact the Bank Recovery and Resolution Directive (BRRD) within two months or be hauled before the EU Court of Justice. EU regulators ordered 11 countries to adopt the new EU deposit bail-in rules.

Were another serious crisis to materialise with regard to European banks and markets in the coming days on the back of a Greek default it seems likely that emergency legislation would be put in place that would allow bail-ins to take place.

Whether the ECB provides ELA to save all Greek banks, just the strategically important banks or none at all will likely be decided as much by political factors as financial ones.

A widespread banking crisis would weaken the resolve of the Tsipras government but would present unforeseeable contagion risks to Europe’s interconnected financial system despite Dijsselbloem’s assurances that the EU is prepared for all eventualities.

In January, JP Morgan highlighted in a report that exposure to Greek debt among banks in France and Germany is relatively low but warned that peripheral nations – particularly Italy – were at risk of contagion.

It is unclear if core eurozone banks can absorb losses from Greek exposure but in the short term it would likely lead to a tightening in capital markets as distrust among financial institutions cause them to hold their reserves.

Italian, Spanish and Portuguese bond yields rose in a very jittery market after a eurozone finance ministers’ meeting ended yesterday with no breakthrough in the deadlocked Greek debt talks.

Italian, Spanish and Portuguese 10-year yields were five to seven basis points higher at 2.35 percent, 2.34 percent and 3.16 percent, respectively this morning.

In the short term, government bond yields could surprise and yields decline again. However in the medium and long term, government bond yields are only going to go one way and that is higher with attendant consequences for our $200 trillion in debt saturated world.

Longer term considerations

Geopolitical considerations are to the fore and yet rarely considered by most analysts.

Greece may decide that its interest – painful though it may be in the short term – lies outside of the eurozone. Certainly its experience since the launch of the euro in 2001 has been an unmitigated disaster.

Between 1960 and 2001 Greece enjoyed more or less constantly improving prosperity. Total production increased 600% in that period – more than double that of Germany. Post-euro Greece’s productivity has plummeted 26%.

Were it to pull out of the single currency, it would not be without powerful friends in the region. Today, Tsipras is visiting St. Petersburg for a meeting with President Putin where they will sign a non-binding agreement on bringing Russian gas into Europe via Greece.

The “Turkish Stream” project would see a pipeline from Turkey go through Greece and eventually to Austria via Serbia and Hungary. Russia seeks to bypass Ukraine and to bring NATO member Greece into its sphere of influence would greatly undermine NATO.

While the Greeks have insisted that they have no intention of availing of Russian financial assistance it is a fact that such assistance has been offered and remains an option.

The BRICS New Development Bank comes into operation next month.

Faith in the ECB would be greatly undermined and with it faith in the euro currency. For half of it lifetime the euro has been in crisis. With the exit of Greece it will be apparent that the architects of the euro system may not be omniscient and that the euro is by no means guaranteed a permanent existence.

Were Greece to exit the euro, wilfully or not, it would lead to surge in nationalism in Europe. We have seen hostility towards Greece being whipped up in sections of the German media and vice versa.

Among peripheral states there are large swathes of the population who now view the EU as a destructive force in their societies. As mentioned above, Greece was economically successful prior to the launch of the euro.

Both Spain and Italy were also industrial powerhouses pre-2001. But having to compete with their northern neighbours on an equal currency footing has destroyed their export capacity. In these countries many people believe that austerity has has been foisted upon them to protect a project that has not benefited their societies particularly well.

In the core of the eurozone there is also a surge in nationalism as taxpayers resent what they see as their subsidising of inefficient and unproductive welfare states. However, Germany has derived enormous benefit from the euro project through its ability to export across Europe to countries whose currencies should be much weaker than its own.

Germany and the other core nations may ultimately decide to go it alone and establish a new joint currency of the costs begin to outweigh the benefits of the current system. Indeed, plans were drawn up to do just that in 2011.

Alternatively the terrible experience of the single monetary union may out the German people and elites and indeed other Northern Europeans completely off monetary unions and we may see a reversion to national currencies.

The scepticism towards the EU displayed by many voters in the UK can only be reinforced as the current fiasco continues to unfold. David Cameron’s promised referendum on Britain leaving the EU will likely receive more support as Europe’s unmanageable problems continue to fester.

Stock markets, currently levitating on the panglossian narrative that we live in the best of all possible worlds – despite dismal PE ratios and stagnation in real economies around the globe – would likely be jolted from their slumber. With rising rates the ability to prop up markets with practically unlimited QE cash would be greatly impaired.

The contagion would likely spread to peripheral eurozone nations like Italy, Spain, Ireland and Portugal whose banks are still on life support. The ability of the powers that be to contain the cumulative effect of multiple bank crises on the eurozone core is debatable.

Wealth preservation strategies

In the short term the dollar is regarded as a “safe-haven”. So long as the prevailing psychology remains the dollar should provide a degree of protection for those seeking to avoid euro contagion.

U.S. assets are still extremely popular despite increasingly poor fundamentals.

Allocations to global equities and bonds should be reduced.

Cash should be diversified and spread around in different non-European banks and institutions. For high net worth seeking wealth preservation in the form of cash, owning a few of the safer currencies remains advisable. These include the Norwegian krone, Singapore dollar, Hong Kong dollar and the Swiss franc.

The most effective hedging instrument and safe haven asset remains gold bullion. We advise clients to own physical gold and silver in the safest vaults in the safest jurisdictions in the world.

Must-read guides:

Protecting Your Savings In The Coming Bail-In Era

From Bail-Outs To Bail-Ins: Risks and Ramifications – includes 60 safest banks in the world

MARKET UPDATE

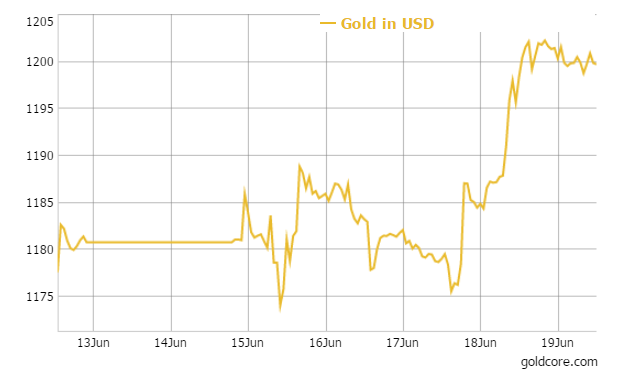

Today’s AM LBMA Gold Price was USD 1,198.15, EUR 1,058.86 and GBP 755.65 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,198.00, EUR 1,050.65 and GBP 752.42 per ounce.

Gold rose $15.00 or 1.26 percent yesterday to $1202.10 an ounce. Silver climbed $0.03 or 0.19 percent to $16.20 an ounce.

Gold in Singapore for immediate delivery was essentially flat at $1,200.11 an ounce near the end of the day, while gold in Switzerland was also flat. Gold is tethered to the $1,200 an ounce level and remarkably gold traded in an extremely tight range of just $3.40 in the last 10 hours – between $1,198.20 an ounce and 1,201.60 an ounce.

Gold is on track for its second weekly rise aided by a softer dollar, the Greek debt debacle and the U.S. Federal Reserve chairperson, Janet Yellen’s, dovish comments from this week’s monetary policy statement.

The Fed said yesterday that a rate hike would come only after further improvement in the U.S. labor markets and more confidence that inflation would rise. The Fed is estimating lower rates now in 2016-2017, than those which had been forecasted in March. In addition, most policy makers are in favor of hiking rates only once this year or waiting until next year.

Shanghai Gold Exchange premiums were at $2 an ounce to the global benchmark, from a premium of about $1-$2 yesterday. In China, surging stock markets appear to have drawn investors away from the yellow metal in recent months but the recent sharp falls in the Chinese stock market may lead to renewed Chinese demand.

In India, gold bars are now trading at discounts, which shows a dip in demand, attributed to the beginning of the rainy monsoon season.

The European Cental Bank (ECB) has called an emergency meeting today and the European Union (EU) has one scheduled on Monday. Trying to get an agreement for Greece to meet its debt repayments due at the end of the month is the agenda. The debtors and creditors are deeply divided.

Gold has seen safe haven haven demand increase as a Grexit probability rises although many are surprised that the gains have been quite muted. This may be a case of muted so far and gold will likely outperform other assets in the coming days if the situation further deteriorates which seems likely.

In late morning European trading gold is up 0.02 percent at $1,200.57 an ounce. Silver is down 0.25 percent at $16.14 an ounce, while platinum is up 0.15 percent at $1,084.76 an ounce.

Breaking News and Research Here

Leave a Reply