Gold Bullion Demand In ‘Chindia’ Heading Over 2,000 Metric Tonnes Again

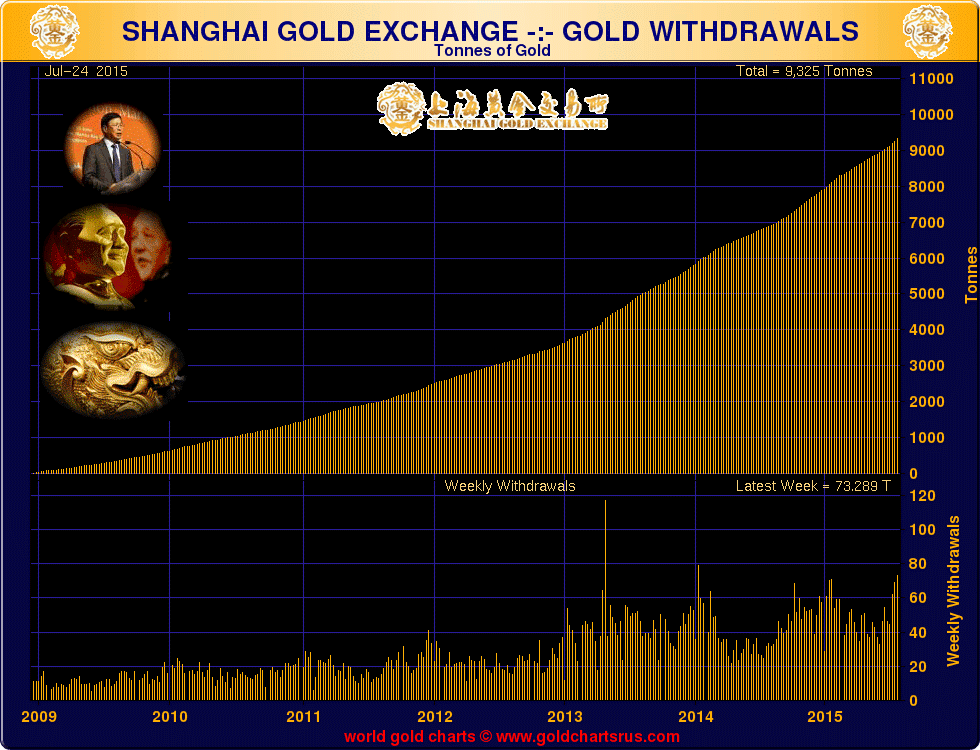

- Shanghai Gold Exchange deliveries at 73.289 tonnes last week

- 3rd largest week of gold withdrawals ever on SGE

- Both China and India heading for over 1,000 metric tonnes in 2015 … again

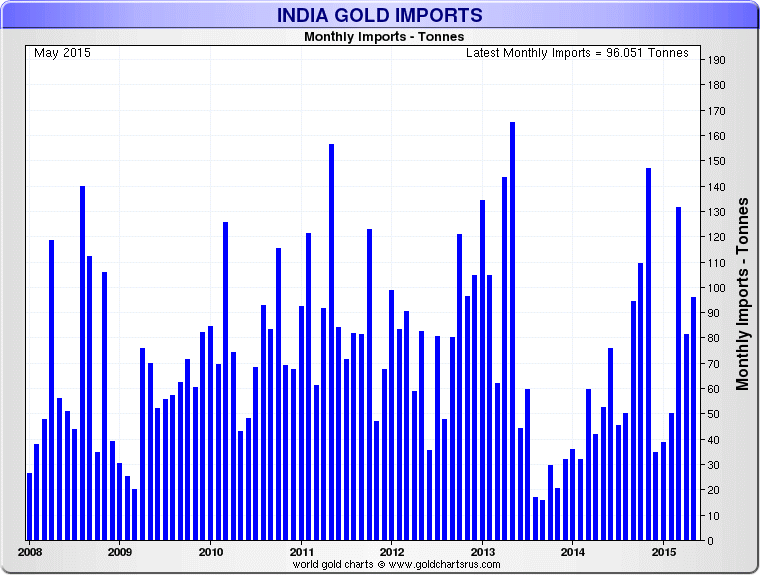

- India imports 96.1 tonnes in May alone

- ‘Chindia’ imports 296.55 tonnes in May – 14% greater than global production

- South Korean gold demand surges in wake of Chinese crash

- Asian and global gold demand robust contrary to anti-gold narrative

The recent lower prices in gold have not deterred investors internationally from buying gold coins and bars in large volumes again. Indeed the Perth Mint and the US Mint are struggling to fulfill demand for gold coins and bars.

This is particularly the case in the eastern hemisphere – especially in India and China – where demand has again increased significantly on price weakness.

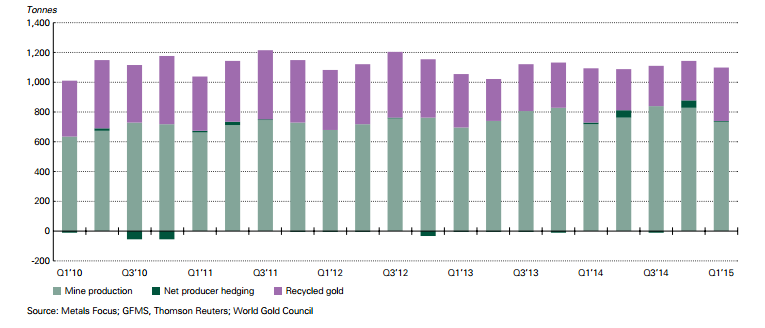

Between them, these two countries are on-track to import 2,000 tonnes of gold this year – that is more than two thirds of the total annual global gold mine production, which is set to be about 2,800 tonnes this year.

The Shanghai Gold Exchange, which deals exclusively in physical bullion, saw buyers take delivery of over 73 tonnes of gold last week, the third largest withdrawal on record. This follows two weeks of steadily increasing demand as investors pull or attempt to pull money out of the Chinese stock market.

Demand out of China is on track to surpass last year’s official figure of 974 tonnes and may reach 1,000 tonnes this year. Chinese demand has been steadily growing, with the encouragement of the government. The ban on gold ownership imposed by Chairman Mao in 1949 was lifted in 2003.

As such, demand from the nation of 1.3 billion people who have a strong cultural affinity to gold – and experience of monetary mismanagement and hyperinflation – has been rising from a base of nearly zero and has recently surpassed that of India to become the world’s top gold buying nation. Nonetheless, Chinese gold ownership remains very low when compared to that of India.

Prudent Indian households hold 11% of the world’s gold. That is more gold than the gold reserves that the U.S. Federal Reserve, the German Bundesbank and the Swiss central bank are believed to own put together.

Indian demand remains robust. In April and May alone the country imported over 155 tonnes of the precious metal.

Demand so far this year has greatly exceeded that of the same period last year – up 61% – as Indians take advantage of the low prices despite the fact that we are some months away from the typical gold buying season. Indian demand is also expected to hit 1,000 tonnes this year.

Together, “Chindia” imported 296.55 tonnes of gold in May. This surpasses current monthly mine supply globally by 14%. Clearly there is an imbalance in the gold market when demand from two countries alone exceeds total mine supply, which must then be supplemented by existing stocks.

Yet prices remain in a downward trend as speculative short selling continues to depress prices. Indeed it not just the huge Asian nations of China and India where demand remains high. There are reports of strong demand – including by the Perth Mint – in Thailand, Vietnam and Malaysia. Demand for gold in South Korea has surged in recent weeks, according to Reuters.

Koreans, nervous about the fallout from the crash in China’s stock market, are choosing to diversify into gold and take advantage of lower dollar prices.

This trend is likely to be repeated across east and south-east Asia in countries who are reliant on the increasingly important Chinese economy.

While it is unlikely to have significant impact on global demand – last year’s demand from South Korea amounted to only 17 tonnes – it demonstrates the psychological appeal that gold still has in times of economic crisis among people across the world – and especially in Asia.

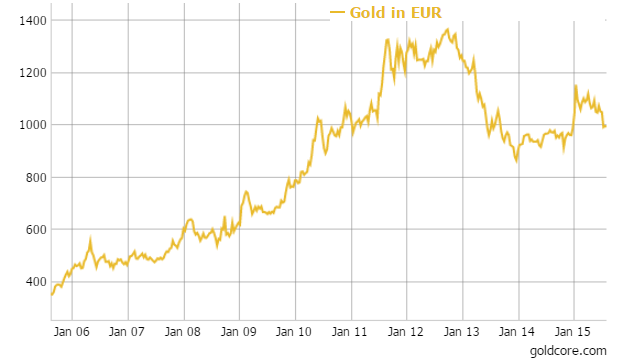

The triumphalism with which some Wall Street commentators have covered the temporary set-back in gold prices looks misplaced and misguided. This is especially the case when the bigger picture is taken into account – including the significant macreconomic, systemic, geopolitical and monetary risks of today.

These are being ignored for now – as they were in 2007 and early 2008.

Gold will continue to retain value well into the future – a claim we would not be too confident about making with regards to paper currencies and bonds issued by the most indebted nations in the world.

Own allocated, segregated gold coins and bars of which you can take delivery.

MARKET UPDATE

Today’s AM LBMA Gold Prices were USD 1,085.00, EUR 996.05 and GBP 694.56 per ounce.

Yesterday’s AM LBMA Gold Prices were USD 1,086.50, EUR 1,000.18 and GBP 697.82 per ounce.

Gold and silver on the COMEX were nearly unchanged yesterday – down $3.20 and up 1 cent respectively – to $1,085.00/oz and $14.60/oz.

Silver futures for September delivery fell less than 0.1 percent to $14.66 on the Comex.

Palladium for September delivery rose 0.8 percent to $602 an ounce on the New York Mercantile Exchange. Platinum for October delivery rose 0.3 percent to $955.90 an ounce.

Breaking News and Research Here

Follow GoldCore on Twitter, GoldCore on Facebook, GoldCore on LinkedIn

Leave a Reply