It’s ZIRP Time in the Casino

Based on the headline from the latest Jobs Friday report you wouldn’t know that we are still mired in an economic emergency—–one apparently so extreme that it might entail moving to the 81st straight month of zero interest rates at next week’s FOMC meeting. After all, the unemployment rate came in smack-dab on the Fed’s full-employment target at 5.1%.

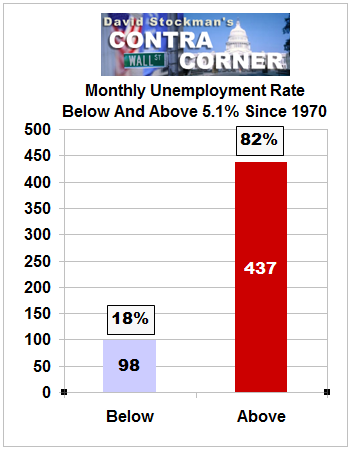

But that’s not the half of it. The August unemployment rate was also in the lowest quintile of modern history.

That’s right. There have been 535 monthly jobs reports since 1970, yet in only 98 months or 18% of the time did the unemployment rate post at 5.1% or lower.

In a word, the official unemployment rate is now in what has been the macroeconomic end zone for the past 45 years. Might this suggest that the emergency is over and done?

Not at all. The talking heads have been out in force insisting on yet another deferral of “lift-off” on the grounds that the economy is allegedly still fragile and that the establishment survey number at 173,000 jobs came in on the light side. Even the so-called centrists on the Fed—–Stanley Fischer and John Williams—–have gone to full-bore, open-mouth, two-armed economist mode, jabbering incoherently while they await more “in-coming” economic data.

Stated differently, the Fed has extinguished any and all market prices for money, and indeed any price at all; and in the process has caused the falsification throughout the capital markets of that which the money market funds—–that is, debt and equity securities and their derivatives. So Wall Street and its equivalents around the world have become little more than casinos where the gamblers trade against the croupiers domiciled in the major central banks.

But heavens forfend that our monetary central planners should admit to the unseemly bended knee estate to which they have been reduced. So in what amounts to mindless ritual incantation they persist in gumming about what is self-evidently seasonally maladjusted, constantly revised, inherently incomplete noise. At the end of the day that’s the frail reed on which the whole contemporary central banking enterprise is based.

The truth is, central banks emit credits conjured from thin air into a borderless planetary financial system that is now populated by the demons and furies of bubble finance. These free money enabled gamblers and speculators never stop confecting new forms of carry trades, collateralized finance and momentum chasing algorithms that rip the casino loose from the real economy.

Moreover, all the central bank interest rate pegging at zero is beside the point insofar as the real economy is concerned. That’s because over the last two decades the central banks have fueled a debt binge of staggering proportions. Overall credit market debt has grown from $40 trillion in 1995 to $200 trillion last year. That $160 trillion credit expansion was nearly 4X the modest global GDP growth of $45 trillion during the same period.

Accordingly, the world has simultaneously reached a condition of “peak debt” in the DM world, where 90% of households are tapped out or on welfare; and “peak capacity” in the EM world, where a digging, building and investment spree has left economies drowning in excess industrial capacity and white elephant public infrastructure.

In that context, the only thing that zero interest rates can do is fuel a few more spasms of “risk-on” rips in the casino; and supply a drip of cheap capital to DM companies wishing to buy back their own drastically inflated shares, and a temporary lifeline to EM and commodity sector zombies hemorrhaging cash.

But what it can’t do is anything to deliver the so-called Humphrey-Hawkins target of maximum employment; or the goal of price stability as per the Fed’s perverse definition of it as 2% on the PCE deflator—— less food and energy or whatever else the monetary politburo chooses to delete from the figure.

The measured inflation rate, of course, is now being powerfully suppressed by the very global deflation flowing from peak DM debt and peak EM capacity that the central bank money printers have generated over the last two decades. Beyond that, there is not a shred of valid evidence from economic history or logic that says you get more sustainable growth in living standards from 2% consumer inflation than from 0%.

But at the end of the day all of the Fed’s jawing in support of ZIRP is rooted in an utterly obsolete model of bathtub economics in one nation. That is, the notion that central bank credit is injected into a closed domestic economy, not a wide-open global casino, and that these injections will eventually cause an invisible economic ether called “aggregate demand” to rise to the brim of full employment.

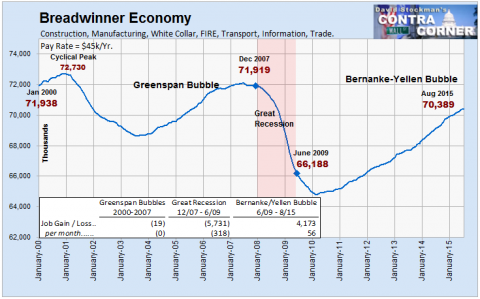

Since the year 2000 the Fed has emitted $4 trillion of central bank credit. But as the Friday Jobs report actually showed, 5.1% on the official unemployment rate has had nothing to do with filling the US economic bathtub to its purported full employment potential.

As shown below, notwithstanding hitting the 5% unemployment target three times since the late 1990s, the real measures of labor inputs employed by the US economy have gone steadily south. The civilian employment-population ratio is down by five full percentage points or 12.5 million workers, and total nonfarm labor hours deployed by the business economy have not broken the flat-line in 15 years.

Even more to the point, the number of breadwinner jobs paying a fulltime living wage was still nearly two million below its turn of the century level in Friday’s report.

Needless to say, Friday’s report perfectly underscores why basing Fed policy on “incoming data” like the BLS employment report is so copasetic to the casino.

If the Fed takes no action after the September release, it’s hard to imagine a report that wouldn’t support ZIRP or near-ZIRP in the minds of the money printers and the Wall Street gamblers they pleasure.

Reprinted with permission from David Stockman’s Contra Corner.

Leave a Reply