Gold Is Real Money That Protects The Wealth of Nations

Editors Note: With the New York Times once again trying to convince us that the Gold Standard is a barbarous relic from the past (see below), we are happy to publish an interesting and informative piece by one of our contributors David Bryan.

Gold is real independent money that can be explained in terms of physics and ensures the economic health of a nation. Counterparty liability money is a monetary ideology that empowers central bankers who issue currency that destroys the economic wealth of nations.

Science invalidated belief five hundred years ago and proved the earth is round.

Science has since advanced knowledge that the entire universe is comprised of energy and matter.

Economic Science is an attempt to understand how the dynamic of energy and matter contributes to the economic benefit of one and all.

Enterprise is the energy that drives productivity and creates real economic wealth. To sustain life there is no scientific substitute for enterprise and yet banks and socialist politicians would have us believe that enterprise is not needed for wealthy creation.

Banks and socialist politicians have us believe in a monetary ideology that uses fake money so that we lose monetary independence, economic freedom and wealth security to their central planning and control.

Money defines our prosperity, financial independence and economic freedom, to protect us from harm it must have real wealth.

Counterparty money is the liability owed to the issuing central bank and it has no value apart from a legal stipulation that prevents real money from being used in competition.

Virtual money is almost or nearly as described, but not completely according to strict definition, it does not physically exist as such but is made by software to appear to do so.

Gold is Monetary Science that is Par Excellence.

Gold used as real monetary wealth to fund enterprise has the interaction of energy and matter, science based on physics to underpin the productive dynamic of nations and maintain a continued cycle of economic renewal.

Gold has no issuer’s counterparty liability.

Gold is money outside the banking system that protects wealth from the corrupt actions of governments and financial institutions.

Gold has a natural inbuilt compound interest that over time reflects economic progress and increases it’s monetary worth.

Gold in excess of $1033.50 an oz today has increased by 5000% from $20.67 an oz when the Federal Reserve Bank was formed in 1913. The people of the United States were tricked into losing their monetary independence to this privately owned central banking institution.

Falsely pretending something that does not have value as monetary worth is a crime, a sham and a fraud intended to take something valuable from another person. Since it became money the Federal Reserve’s Ponzi counterfeit dollar has been steadily devalued by 97% to just 3% of its original purchasing power.

Gold is real independent money with intrinsic worth that cannot go broke.

Gold is the mortal enemy of central bankers. It is an independent monetary asset that would prevent the central banks from using their Ponzi of counterparty paper to exclusively manage, control and centrally plan the economy.

Gold would prevent paper monetarism being used to steal the wealth and productivity of nations. Portugal, Italy Greece, Spain termed the PIGS nations and almost every other country in the world are now locked in a debt-induced depression caused by banker counterparty finance.

Gold is real wealth and cannot be printed into existence. It does not have or need the risks that come from the central bankers financial engineering to manipulate and rig the value of every asset class.

Gold would prevent paper monetarism being used to fund the global agenda of countless wars and the use of mercenaries to destabilize entire regions that cause the problems of massive cultural migration.

Gold as money would end gross injustice, where an industry that decides on the allocation of capital itself produces nothing of real value and yet it is the main beneficiary of wealth.

Gold as measured by the trusted Exter’s pyramid of risk assets, cannot be stopped by the manipulation policies of central bankers from being the ultimate safe haven.

Gold is economic science to reset the world from the social and economic devastation caused by adopting corrupt dogma that divide rich from poor of debt monetarism, corporatism, socialism, capitalism, communism and globalism.

Gold is the monetary means to rid the world from central banking and end the massive amounts of finance to institutionalize ownership of business and labor. Endless new money is used to incorporate resources beyond the reach and hope of most people on the planet. In the last seven years debt finance has increased 40%, this $57 trillion in new money has distanced $50,000 in assets and capital from every family in the world.

Interest charged on make-believe money is no more than a private tax that kills enterprise and jobs. Interest on the US national debt is $216 billion per year equivalent to $1,500 tax on each man woman and child.

Gold or silver over several thousand years, have allowed every country in the world to exist without the need for income tax.

Gold provides the monetary basis for establishing free markets without the Bank for International Settlements occupying the role of counterparty to all counterparty currencies.

Gold and silver over several thousand years have been safely used by every country in the world to guarantee national economic independence and provide confidence in the monetary value of their currencies.

Gold does not have a national currency and is internationally recognized as monetary wealth everywhere in the world.

Gold provides the means to trade without multiple currencies.

Gold is mined from ore and has real value as natural refined wealth.

Gold held in the vaults of the national treasury is wealth that belongs equally to each of its citizens.

Gold in the nations treasury, when used as backing for their currency, provides citizens with monetary independence and the economic freedom of using their own wealth to fund productive enterprise.

Gold is time proven to be independent monetary wealth and an accepted unit of value for exchange, as well as providing a monetary measure par excellence to value all goods and services.

Gold is physically indestructible and has a lasting independent monetary worth that will safely protect wealth for future generations.

Gold as a monetary asset provides a stable economic environment with the certainty of using money that has real wealth to make binding commercial transactions.

Gold and silver coins in the United States are respectfully engraved to promote endeavor that serves to advance the public good “IN GOD WE TRUST”.

Gold is chosen for wedding rings because it is a precious metal, the circle is the symbol of eternity and the ring signifies the never ending love between a couple.

Ideology:

“Do not believe in anything simply because you have heard it. Do not believe in anything simply because it is spoken and rumored by many. Do not believe in anything because it is found written in your religious books. Do not believe in anything merely on the authority of your teachers and elders. Do not believe in traditions because they have been handed down for many generations. But after observation and analysis, when you find that anything agrees with reason and is conducive to the good and benefit of one and all, then accept it and live up to it” – Buddha

Further reading:

– The Good Old Days of the Gold Standard? Not Really, Historians Say – New York Times

– For additional science and the brilliance and wisdom of the Tibetan ancients see www.thetibetansecret.blogspot.com

DAILY PRICES

Today’s Gold Prices: USD 1066.90, EUR 1007.68 and GBP 708.80 per ounce.

Yesterday’s Gold Prices: USD 1069.25, EUR 1009.25 and GBP 708.55 per ounce.

(LBMA AM)

Precious metals gained in trading yesterday with gold up by $4.00 to close at $1069.00. Silver also managed a slight gain of $0.04 to close at $14.17 and Platinum was up by $9 to $837.

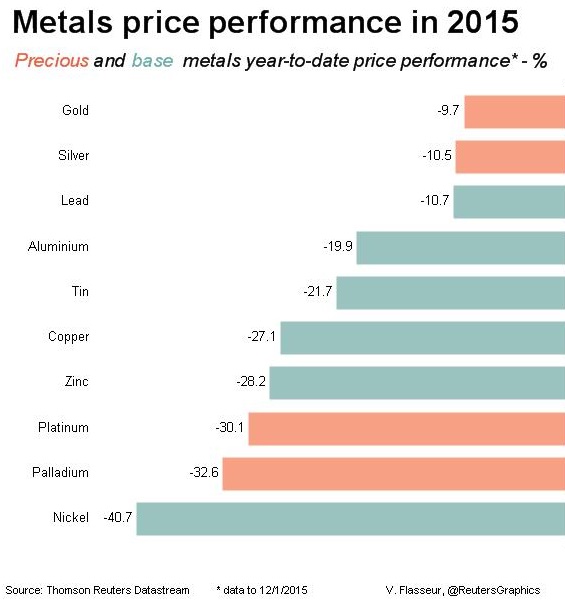

With sentiment very poor towards gold and silver today, it is important to realise that gold and indeed silver have outperformed other base and indeed the precious metals.

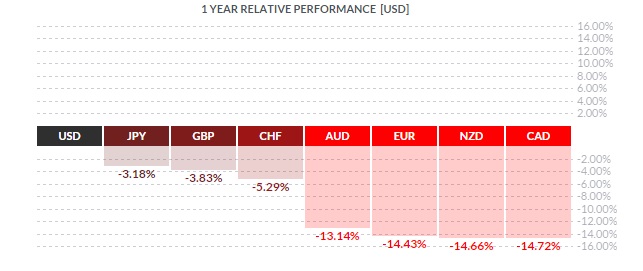

In fact, they have held up quite well in terms of the wider commodity sector. Indeed, they have also held up well in terms of other leading currencies such as the euro, Canadian dollar, New Zealand dollar, Australian dollar and other non dollar currencies. These have all fallen quite significantly against the dollar and indeed against gold year to date and in the last 12 months. Emerging market currencies have seen even greater routs against the dollar.

Gold is again acting as a hedge against currency depreciation and devaluation. Dollar and sterling investors have not needed a hedge in recent months given the buoyant dollar and indeed U.S. and UK equities and property.

This is likely to change in the coming months and then gold will come into its own as a hedging instrument and a safe haven asset.

Read more on the GoldCore.com blog

Download Essential Guide To Storing Gold Offshore

Leave a Reply