Preying on People Over 50

If the risk-on euphoria of punters borrowing billions of dollars in margin debt doesn’t materialize, stocks could languish for years after falling 50%.

The financial service industry’s Prime Directive is to exploit humanity’s core drives of Greed and Fear. Financial service companies promise high returns (fulfilling our greed) that are low-risk, i.e. “safe” (placating our fear of losing our nest-egg).

But the safety of many supposedly low-risk investments is illusory. The risk is not actually near-zero; rather, the risk has been buried, masked or obscured, for the obvious purpose of persuading the marks (i.e. the investing public, non-financial institutions, etc.) that the promised gains are essentially risk-free.

One example of selling the illusion of safety is the financial service industry’s promotion of index funds–funds that mirror the return of the entire S&P 500 index (or other diverse index of stocks) as reliably low-risk investments.

In a narrow sense, an index fund that in effect owns 500 stocks is lower risk than a mutual fund that owns 15 stocks, as one stock blowing up in a portfolio of 500 stocks is going to do less damage than a stock blowing up in a portfolio of 15 stocks.

Index funds have very low administrative fees, reducing the drag on total returns created by high management fees, and this feature is also touted as lowering the risk to investors.

What is left unsaid is that if the broad market declines 50%, index funds also plummet 50%. The supposedly low-risk nature of index funds is completely illusory once the entire market tanks.

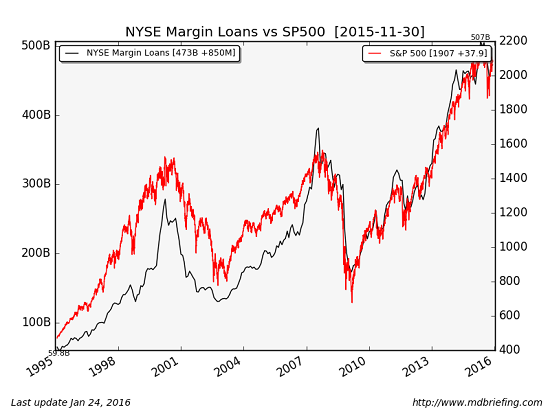

What’s also left unsaid is the possibility that the market might not just drop 50%, but that it might not bounce back. Here is a chart (courtesy of mdbriefing.com) of the S&P 500 (SPX) and margin debt. Notice the tight correlation between margin debt (money borrowed against a portfolio of stocks to buy more stocks) and the S&P 500: once the risk-on euphoria of borrowing money to buy more stocks rolls over, stocks follow margin debt down.

The two are self-reinforcing: once stocks crater, those who have borrowed to the hilt on margin get the dreaded margin call–a demand to either add cash to the account or reduce the margin debt by selling stocks.

The post Preying on People Over 50 appeared first on LewRockwell.

Leave a Reply