Take Cover Now!

If Donald Trump has even a partial clue about the nation’s monumental economic mess one of his first acts will be to demand Janet Yellen’s resignation. And for sheer incompetence among countless other failings.

She was out there again today talking in completely incoherent circles. On the one hand, Yellen robotically insisted that the U.S. economy is moving steadily toward the Keynesian nirvana of full employment.

At the same time, she struck a profile in cowardice that was downright pathetic. Yep, after 90 months of ZIRP the Fed has decided to wait for further confirmation from the “incoming data” before concluding that even one more baby step toward interest rate normalization is warranted.

Needless to say, our paint-by-the-numbers school marm has no clue that a money market rate of 0.38 bps has nothing to do with the Fed’s so-called dual mandate. Its sole impact has been to flood the canyons of Wall Street with zero cost carry trades and endless cheap debt for corporate financial engineering and other leveraged speculations.

So the Fed kicked the can again for one simple, pathetic reason. It is petrified of a Wall Street hissy fit. Effectively, it has seconded monetary policy to day traders and robo-machines.

By contrast, the Fed’s massive spree of money pumping never got anywhere near to the main street. It couldn’t deliver honest full employment through cheap money inducements to borrow and spend because households are still stranded at Peak Debt.

Based on the most recent flow-of-fund report for Q1, households now have record debt of $14.3 trillion. Anyone who can scratch an application signature has been given a student loan and all who can fog a rearview mirror have been loaned 120% of the cost of a new car. And, of course, the castles of main street families are still mortgaged to the hilt.

So just exactly what is the point of ZIRP?

Likewise, the Fed’s perverse pursuit of 2.00% inflation on the flawed PCE deflator less food and energy is also pointless. The deflationary tide impacting commodities and manufactured goods is global and can’t be reversed; it’s the morning after effect of massive excess capacity and malinvestments that stemmed from 20-years of financial repression by all of the world’s central banks.

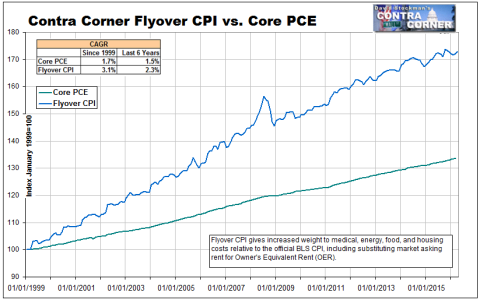

Besides, most of Flyover Zone America has been hammered by the four horseman of household inflation—- food, energy, housing and medical costs—-to the tune of 3.1% annually for two decades running. Yellen’s claim that inflation is only up by 1.3% during the past year—–and therefore that the Fed has not achieved its inflation goal and must defer normalization—–is just plain laughable.

Isn’t a 70% increase in the main street cost of living since 1999 enough inflation?

Our Keynesian school marm rattles on about the need for a higher core PCE deflator—–which measures barely half the actual cost of living rise—-but fails to see that the overwhelming share of households is already tapped out by too much inflation in the cost of necessities.

Yet the incompetence we are addressing here goes far beyond Janet’s bogus bathtub model of GDP, and the spurious notion that it can be pumped full to the brim by stimulating an invisible economic ether called “aggregate demand”.

Instead, what we are talking about here is the plain vanilla failure to acknowledge that the US economy is badly impaired from a structural viewpoint and is already sinking into another recession before any meaningful recovery from the plunge of 2008-2009 has actually occurred.

The data which demonstrates that Yellen and her band of money printers are either lying or just plain stupid just keeps on coming. Thus, while the Fed’s Wall Street lap dogs got all heartened about yesterday’s seasonally maladjusted 0.5% gain in retail sales, the actual data behind the headline tells an altogether different story.

To wit, retail sales have been flat-lining for two years!

Yesterday’s monthly figure (unadjusted) for May of $471.4 billion was barely above last May’s $462.6 billion and only marginally higher than the $459 billion figure for May 2014. In fact, the nominal growth rate of retail sales during the last two years have been just 1.37% per annum.

Even the Fed’s short-stick inflation measure is running higher than that, meaning that real retail sales have stalled out for two years.

And yet this robotic Keynesian—— who falsely assumes that consumption and spending are the elixirs of economic growth and prosperity—-can’t see that even our vaunted main street consumers are flat on their financial posteriors.

Once upon a time, economist closely tracked inventories and their ratio to sales. They knew that real world businesses can’t remain profitable if they allow their balance sheets to become piled with excess inventories.

Yet exactly that has happened. Retailer inventories are now up by nearly 50% from the post-recession bottom, but the failure of sales to take off has resulted in a dangerous climb in the inventory/sales ratio. Indeed, it is well into the recession zone already.

The industrial heartland of the US economy is in even worse shape. Industrial production declined (0.4%) again in May, marking the 7th drop in 10 months and the longest streak of declines outside of a recession in the last 100 years.

So exactly how do the internals shown in the graph below square with an economy purportedly steaming toward full employment?

The overall production index—which covers utilities, mining/energy, and manufacturing—–is down nearly 3% from it November 2014 high, while mining/energy production is down 17%. At the same time, production of capital goods like machinery is off by 12% from its 2012 peak level, and the production of consumer goods has not even recovered at all.

That’s right. Consumer goods production is still 9% below its November 2007 level, but all is supposedly well. Virtually every measure of industrial production is heading south, yet Yellen pretends that just a few more months of ZIRP will do the trick.

Not only did Yellen give no hint about this rapidly weakening direction in US output, but also seemed totally perplexed as to its implications for capital spending. Instead of wondering why CapEx has been softening so much during recent months, she might have noted the Fed’s own figures on capacity utilization.

At 74.9%, the May capacity utilization rate was at the lowest level since October 2010 and has been virtually cliff-diving since November 2014. Why should anyone who is actually paying attention, therefore, be surprised that business fixed investment has faltered?

Alas, Janet isn’t paying attention. She is intellectually mummified in a 50-year old Keynesian time warp that assumes the Fed can regulate the level of employment, inflation and output in a closed economy through the primitive tool of pegging the money market rate of interest.

That’s hideously incorrect. Yellen and her merry band of money printers are simply prolonging the inevitable day of reckoning when the third great financial bubble of this century comes crashing down.

If you think she sounded like a clueless deer in the headlights today——just wait.

When the signs of recession become undeniable and the remaining punters in the casino stampede for the exits on the realization that the Fed is powerless, the S&P 500 will rip downward through 1600 and keep heading lower .

You don’t want to stay tuned for that press conference. Yellen’s incoherent blather will be reduced to speaking in monetary tongues.

Reprinted with permission from David Stockman’s Contra Corner.

The post Take Cover Now! appeared first on LewRockwell.

Leave a Reply