Peak Gold?

‘Peak Gold’ is happening which has important ramifications for the gold market and is another long term positive fundamental. This is why we were one of the first analysts to consider the peak gold phenomenon back in 2007 and 2008 (see here) and have considered peak gold frequently over the years.

One of the more astute gold analysts today, Frank Holmes also believes that peak gold is happening and may even have occured in 2015. Peak gold and the fact that total annual global gold production is likely to have peaked is an important supply side factor in the gold market. This is one of the bullish factors which will support prices and indeed should contribute to higher prices in the coming years.

Holmes latest article is a must read:

The Last Known Gold Deposit

Instead, most companies are in cost-cutting mode, using this opportunity to pay down debt and liquidate assets. According to Reuters, North American gold producers have managed to lower their debt levels 30 percent since late 2014.

Speaking to Mining.com, Newmont Mining CEO Gary Goldbergsaid his company, the second-largest gold producer in the world, is one of the few that’s currently building new mines—specifically the Merian project in Suriname and Long Canyon in Nevada. Because of the lack of new mines being built, he sees supply falling 7 percent between now and 2021.

Demand for the yellow metal, on the other hand, should remain strong during this period, helping to support prices even more.

Massive Inflows into Gold Funds

In the meantime, gold continues to find support from global monetary policy and low to negative government bond yields. Last week the Bank of England cut rates as part of a stimulus package, which both weakened the British pound 1.5 percent and gave the yellow metal a jolt.

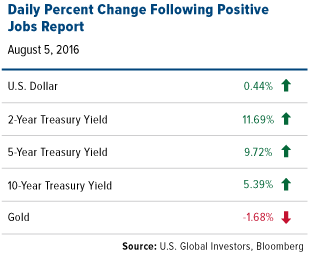

These gains were erased, however, following Friday’s better-than-expected U.S. jobs report, which sparked a rally in Treasuries. This contributes to the narrative that gold and government debt are inversely related, a key component of the Fear Trade.In the meantime, gold continues to find support from global monetary policy and low to negative government bond yields. Last week the Bank of England cut rates as part of a stimulus package, which both weakened the British pound 1.5 percent and gave the yellow metal a jolt.

When priced in the local currencies of the U.S., Canada, South Africa or Australia—four of the largest gold-producing countries—bullion is up, which has boosted miners’ profits. Gold stocks, as measured by the NYSE Arca Gold Miners Index, have appreciated 128.92 percent in the last 12 months.

For the first half of 2016, inflows into commodities have been the strongest since 2009. Gold and other precious metals account for about 60 percent of the new money, which has pushed commodity assets under management above $235 billion. Barclays believes 2016 could be the best year on record for gold-related ETFs and other funds, with many big-name hedge fund managers, from Stan Druckenmiller to Paul Singer to Bill Gross, singing the praises of the yellow metal.

Reprinted with permission from GoldCore.

The post Peak Gold? appeared first on LewRockwell.

Leave a Reply