Silver, Platinum and Palladium Bullion As Safe Havens – Reassessing Their Role

Precious Metals As Safe Havens – Reassessing Their Role

New research confirms that not just gold but also the other precious metals – silver, platinum and palladium bullion – act as safe havens, especially from ‘Economic Policy Uncertainty.’ This is something that is particularly prevalent today due to the ‘Hard Brexit’ impact on the UK and the Eurozone, risk of trade wars and heightened financial and geopolitical risk under the Trump Presidency.

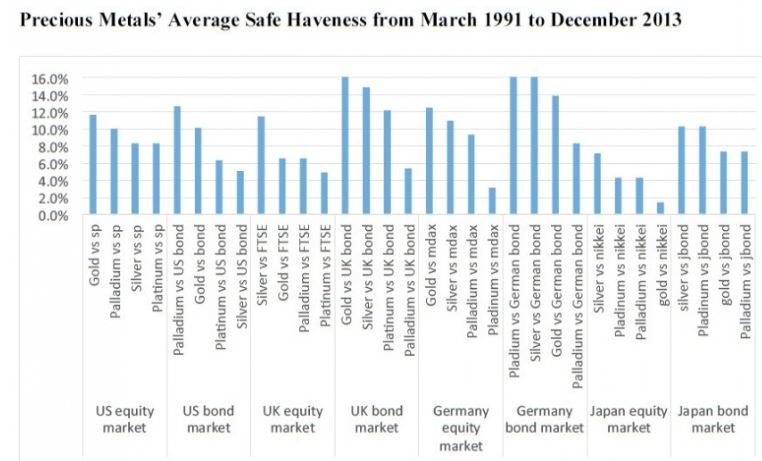

In their just released paper, Reassessing the Role of Precious Metals As Safe Havens – What Colour Is Your Haven and Why?, Dr Brian Lucey and Sile Li, of Trinity College Dublin and Trinity Business School, examine the “safe haven properties versus equities and bonds of four precious metals (gold, silver, platinum and palladium) across eleven countries.”

The research suggests that each of the precious metals “play safe haven roles” and that “there are times when one metal is not while another may be a safe haven against an asset.”

“Stock volatility, exchange rates, interest rate and credit spreads are also found to be significant” and the results are found to be “quite mixed for different markets and are fragile of model specification.” This is to be expected somewhat, given the broad range of the study of four precious metals performance versus a range of assets in 11 different countries.

Dr Brian Lucey and Sile Li attempt to “identify robust economic and political determinants of precious metals’ safe haven properties.” Of note is that they find that ‘Economic Policy Uncertainty’ is found to be a “positive and robust determinant of a precious metal being a safe haven” and that this “holds across countries”.

Leave a Reply