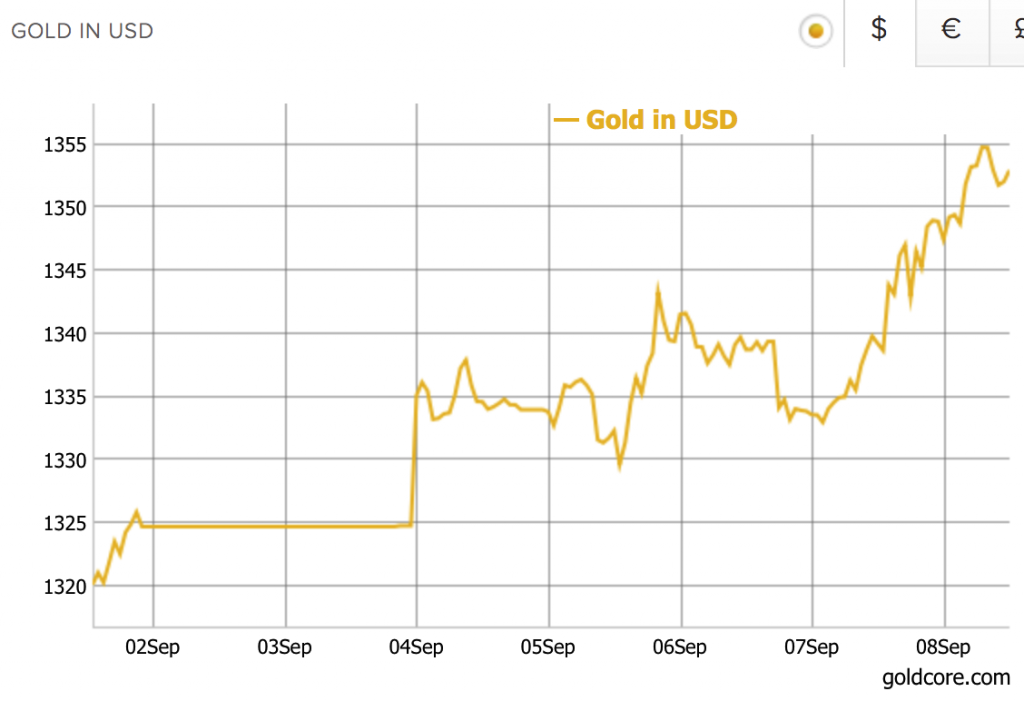

Gold Has 2% Weekly Gain,18% Higher YTD – Trump’s Debt Ceiling Deal Hurts Dollar

– Gold hits $1,355/oz as USD at 32-month low -concerns about Trump, US economy

– Silver and platinum 2.3% and 1.2% higher in week; palladium 3% lower

– Euro Stoxx flat for week – S&P 500, Nikkei down 0.65% and 2.2%

– Geo-political concerns including North Korea, falling USD push gold 2.1% in week

– Gold prices reach $1,355 this morning following Mexico earthquake

– Safe haven demand sees gold over one year high, highest since August 2016

– Silver touches $18.24 – highest level since April 2017

– Goldman, BoAML and Deutsche Bank all warn re markets this week

Editor: Mark O’Byrne

This morning the earthquake in Mexico likely contributed to gold eking out further gains to $1,355/oz, its highest since August 2016. The gold price is now up 2.1% for the week.

Sadly some of the short-term performance in both gold and silver is because of devastating events around the globe. From hurricanes and earthquakes to potential nuclear wars.

However, as explained earlier this week, while gold is reacting to geopolitical events in the short term, the real driver of gold will be the impact of these events which is government money printing and debasement of the currency. Only this week, Trump extended the debt ceiling – with the devastation of the floods in Texas and Hurricane Irma the latest reason to increase the US national debt.

Is the Euro too strong?

Yesterday the ECB decided to leave interest rates unchanged. On the back of the decision, the euro rose to $1.20 pushing the US dollar to a 32-month low. Draghi did not express concern over the currency’s strength.

Some indication was given as to the when the ECB would taper asset purchases – October is expected.

Relative to gold and silver in the last week, the euro has underperformed.

No increase in the US rates or the dollar

Meanwhile in the US weak economic data and events in Texas and Florida have likely pushed any chance of further rate hikes back. Data yesterday showed weekly jobless claims rose this week to their highest since 2015. Hurricane Harvey likely contributed to this and it is likely the start of a trend and will likely get worse.

Odds of the increase happening this year have slipped from 40% to 29%. For many a rate hike would be bad news for gold and silver prices. However so far this year this has not proven to be as damaging as some bears expected. Indeed, as we have shown with data and charts many times, rising interest rates generally corresponds with rising gold prices – as seen in the 1970s and from 2003 to 2006.

Click here to read full story on GoldCore.com

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Leave a Reply