As Sisyphus Fails

Welcome to 2018 – a year that will be the culmination of at least 105 years of mismanagement of the Western financial system by governments, central bankers and the elite.

2018 will be a year of major volatility in many markets. Stocks are now in a melt-up phase and before the major bear markets start in virtually all countries around the world, we are likely to see the final exhaustion moves which could be substantial. The year will also be marked by inflation increasing a lot faster than expected. This will include higher interest rates, much higher commodity prices, like food and oil as well as a falling dollar. And many base metals will strengthen. Precious metals finished the 2-3 year correction (depending on the base Currency) in 2015 and are now resuming the move to new highs and eventually a lot higher. More on this later.

For a century, a reckless elite has controlled the system for their own personal gain and thus accumulated massive wealth. Ordinary people have been totally cheated into believing that they have benefitted by having all the material things that most of them can’t afford – be it a house, car, computer or iPhone. All on credit of course.

Whilst the elite owns most of the assets, ordinary people own the debt. Not just their own debt but also the public debt burden which irresponsible governments have built up including unfunded liabilities like pension and medical care. And when the financial system fails, ordinary people will suffer the most.

THE $2 QUADRILLION SISYPHEAN TASK

We have seen a century of debt buildup from virtually zero to $240 trillion. Global debt has doubled since the beginning of the Great Financial Crisis in 2006. This has led to asset bubbles and overvaluations never seen before in history. If unfunded liabilities and derivatives are included, the total burden amounts to $2 Quadrillion.

That is the enormous Sisyphean task that the world will have to struggle with in coming years. Although central banks and the elite seem clueless, they can clearly not be unaware of the gigantic size of the problem.

We know that these liabilities can never be settled. What happened in 2006-9 was only a rehearsal. In the last minute central banks orchestrated a massive rescue programme which included interest rate reduction, money printing, guarantees, liquidity injections plus allowing banks to value toxic debt at maturity instead of market. These measures temporarily postponed the inevitable collapse. They are unlikely to work next time but since the central banks have few other options left, they will try the same things again. But this next time they will fail.

CRYPTO$ – CRYPTO€ – CRYTPO£

In my mid December article I discussed a new Phoenix world currency based on cryptocurrency technology and the likelihood of governments introducing such a system. This would have the benefit of fudging the fact that fiat money is worthless. The new “money”, based on crypto technology, would have a fake value which would make it hard to relate to the “old” currency. The same happened when the Euro was created. Also, just like existing cryptos, the value would be inflated massively through manipulation as well as by demand from a gullible public. Governments would use this new office cryptocurrency to divert attention from the insoluble global debt problem.

The governor of the Bank of England (BoE), Mark Carney, has just declared that the BoE is seriously considering introducing an official cryptocurrency in 2018 already and also that the BoE is in discussion with other central banks on this matter. The BoE has worked on this project since 2015. The technology was tested satisfactorily in the summer of 2017 according to Carney. He stated: It is a most interesting application that is beneficial for financial stability and efficiency. He also said: “We are on the case”. It obviously has nothing to do with financial stability since another fiat currency, this time electronic, can only very temporarily conceal that the world is bankrupt.

So it is clear that central banks, as I discussed in my last article, are already on the case for some time and see official cryptos as a solution to the global debt problem as well as the perfect way to control money. Through manipulation they can easily create unlimited cryptos and hype the value. They can also electronically totally control individuals’ money and their transactions. This is the perfect Big Brother system and thus another frightening attempt to severely limit the money and freedom of individuals.

It is now very likely that Western governments will attempt to introduce such a cryptocurrency system in the next few years. There could be a USCrypto, EUCrypto and a UKCrypto etc. It is also possible that there will be a SDCrypto (Special Drawing Rights).

CHINA AND RUSSIA HAVE DIFFERENT PLANS

But there will be many obstacles since it is extremely unlikely that countries like Russia and China will accept a US, EU or UK cryptocurrency. These countries understand that all the new fake cryptocurrencies would be just as worthless as the currencies they would replace. China and Russia have a very different plan. They will introduce a gold and oil backed (crypto)currency which will be far superior to any new money that the West would produce. With this currency, China and Russia will become the dominant economic powers as the West declines into obscurity.

These major changes in economic trends clearly don’t happen quickly but over an extended period. Nevertheless, 2018 is likely to be a significant year, marking the beginning of the end of the latest, but certainly not last, corrupt financial system which has lasted 105 years.

On virtually any criteria, stocks worldwide are now massively overvalued and a very dangerous investment market. But that wont stop this market to reach even dizzier heights before it collapses. Global equities were valued at $25 trillion in 2008. Today they are at $80T. Will they reach $100T before the collapse?

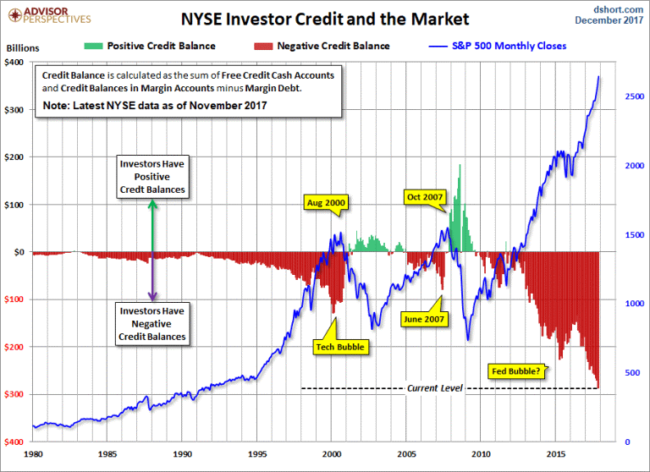

What has been driving stocks since the 2009 bottom is clearly a massive expansion of debt. Investor credit and margin debt are now at historical extremes and far worse than in 2000 or 2007 as the chart below shows.

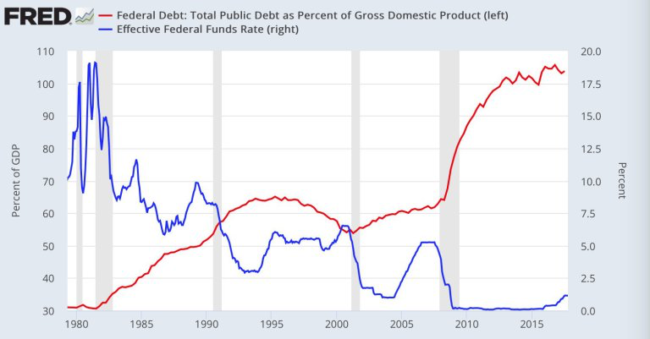

US debt to GDP has gone from 30% in 1980 to over 100% today:

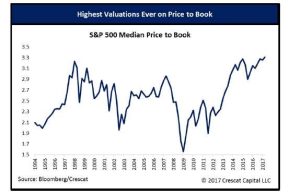

Values based on Stock Price to Sales as well as Stock Price to Book Value are now at all-time highs as the graphs below show.

The post As Sisyphus Fails appeared first on LewRockwell.

Leave a Reply