The Dollar

Virtually no investor studies history and the few who do always think it is different today. The most important lesson is that people never learn. If they did, they wouldn’t be invested in a stock market that on any criteria is now at a bubble extreme. And they wouldn’t be invested in a global debt market which has grown exponentially in recent decades and which will become worthless in the next few years as debtors default. Nor would anyone hold paper money which is down 97-99% in the last 100 years and which is guaranteed to soon fall the final bit to take the value to zero.

The history of money clearly illustrates that “Plus ça change, plus c’est la même chose” (the more it changes, the more it is the same thing). The most constant factor in the history of money is the cycle of boom and bust or euphoria and despair. Cycles are part of nature just like the change of seasons.

But throughout history, mankind has always believed that they know better than previous generations and can eliminate the cycle of boom and bust. This is what the British prime minister Gordon Brown proudly declared before the economy collapsed in 2007. And the Nobel Prize winner in Economics, Paul Krugman, also believes that eternal prosperity can be generated by creating endless debt and printing unlimited money.

But history has time and time again turned hubristic know-it-alls into humbled has-beens.

FOR 6,000 YEARS GOLD HAS OUTLIVED ALL CURRENCIES

Whenever mankind has deviated from sound money, the consequences have without fail been catastrophic. The only money which has survived since it first came into use around 6,000 years ago is gold. All other money has been destroyed by greed and economic mismanagement. I believe I have quoted Voltaire for over 20 years and will continue to do so: “Paper Money Eventually Returns to its Intrinsic Value – ZERO”. Whether we go back 100 years, 300 years or 2,000 years, those superb 9 words is the most exact and scientific definition of economic history. This is the most important lesson that any student of Economics should learn. Armed with that knowledge, anyone can forecast the likely outcome of an economic cycle and especially the current one.

TULIP BULBS AND BITCOINS WILL NEVER PRESERVE WEALTH

So why are investors not taking heed and protecting themselves against risks that on a global scale have never been greater. The first reason is greed. Whether it is stocks, tulip bulbs or bitcoins, people never learn. Greed takes over and numbs any rational thinking. And that is why most investors will ride the bubble markets until they are virtually worthless.

Experience and a long professional life is a great advantage when it comes to understanding risk. Nothing beats personally experiencing major market crashes of 50% or more like in 1973, 1987, 2000 and 2007. This certainly makes you more aware of risk and therefore also the necessity to preserve wealth.

STOCKS ALWAYS GO UP!

Looking back at say the Dow since 1971, it is up 29x or 2,800 percent. So why worry because “stocks always go up”. Yes, it is absolutely true that in the last 47 odd years since Nixon took away the gold backing of the dollar, asset markets have boomed. But most of these gains have been illusory and due to credit expansion, money printing and currency debasement.

So investors are still certain that stocks will continue to grow over time. But they don’t realise what will happen to their investments when the punchbowl is taken away and interest rates increase substantially. Because that is what we will see in the next few years. Stocks have been going up only because of credit expansion and artificially low interest rates. These two factors are unlikely to be in play in coming years. Yes, central banks will panic and print unlimited amounts of money but the market will soon realise that this money is worthless and therefore will have no effect.

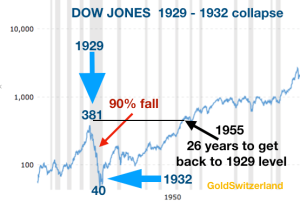

What investors don’t realise is that it can take a very long time for stocks to climb back up that high wall of worry after a big fall. In 1929 the Dow peaked at 481 and then fell 90% over less than three years to bottom at 40 in 1932. But what few investors realise is that it took 26 years before the Dow was back to the 1929 high.

THE DOW TOOK 26 YEARS TO GET BACK TO 1929 PEAK

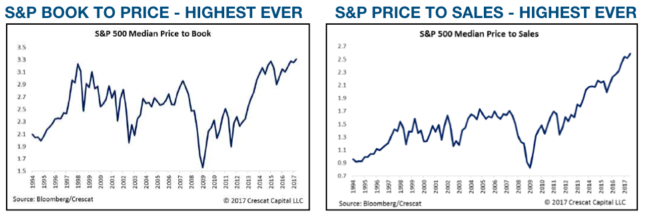

The almost 1,000 points drop in the Dow last Monday was a foretaste of things to come. We might not see the end of the multi decade bull market quite yet but risk is today colossal. Once the bear market starts, the Dow will experience days of several thousand points decline. The 1929 crash was 90% but since the current bubble is so much greater by any measure, the coming fall of US stock markets is likely to be at least 95%.

The post The Dollar appeared first on LewRockwell.

Leave a Reply