War in Ukraine Intensifies – EU Threatens Russia, Greece Pivots to Russia

EU foreign ministers are meeting in Brussels today to discuss imposing further sanctions on Russia following an upsurge in fighting in east Ukraine.

A woman pushes a cart as she visits a hypermarket of French grocery retailer Auchan in Moscow, Jan. 15, 2015. A new poll shows 80 percent of Russians would give up Western food for a stronger economy. Reuters

The EU and the US have already imposed sanctions on Russia and slapped asset freezes and travel bans on Russian individuals and businesses.

NATO says hundreds of Russian tanks and armoured vehicles are in east Ukraine. Moscow denies direct involvement but says some Russian volunteers are fighting alongside the rebels.

Tensions between Russia and the West are intensifying. President Obama’s suggestion that Russia would be cut out of the SWIFT banking transfer system was met with a degree of hostility and threatening words that has not been customary of the Russian government.

Prime Minister Medvedev warned that the “Russian response – economically and otherwise – will know no limits.”

The EU‘s push for further sanctions on Russia may be imprudent and only help ‘bait the bear’. Measures under discussion include asset freezes, travel restrictions on certain Russian individuals, and restricted access to capital markets.

The consequences of such a move could be dire. China have made it clear that it can provide liquidity to Russia if necessary, an offer the Russians have not felt the need to avail of as yet. Russia still sits on vast dollar reserves which it could dump on the market and buy Chinese yuan and other allied nations fiat currencies and indeed precious metals such as gold and palladium.

Or Russia could choose to cut off natural gas to Europe causing a crisis for homes and industry across Europe and paralysing industry and agriculture in already struggling periphery economies.

The war in Ukraine, in which 5000 people have already died, is growing in scope and intensity.

At some point Russia may directly enter the conflict – which it would justify given that the ethnically Russian people of Donetsk voted to secede from Ukraine following the overthrow of democratically elected, albeit corrupt, President Yanukovych.

Moscow’s intervention in Ukraine and its continued support for rebels in the east of the country is not “not a wise course for Russia”, former UK foreign secretary and leading government politician William Hague has told CNBC.

“If Russia continues on this course of the last few days there will be a further grave deterioration in relations between the European Union and Russia,” Hague who is close to NATO told CNBC’s Worldwide Exchange.

The risks now fomenting in Greece as well the escalating tensions with Russia, along with the tacit admission that the EU is already in serious crisis by initiating emergency QE measures, mean that that the risk of banking contagion and collapse, economic collapse and currency collapse are real threats.

Bail-ins of deposits remain a real possibility.

In the event of any and all of these possibilities gold and silver bullion will perform well as a currency of last resort.

Comprehensive Guide to Bail-ins: Protecting Your Savings in the Coming Bail-in Era

MARKET UPDATE

Today’s AM fix was USD 1.275.50, EUR 1,129.36 and GBP 842.25 per ounce.

Yesterday’s AM fix was USD 1,287, EUR 1,131.93 and GBP 846.71 per ounce.

Gold and silver both dropped yesterday. Gold lost 0.76% or $9.80, closing at $1,284.90/oz. Silver fell 0.55% or $0.1 and closed at $17.99/oz.

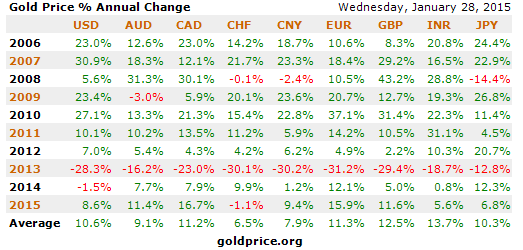

Gold Performance since 2006 and in 2015

In Singapore, gold for immediate delivery fell by 0.5 per cent to USD 1,278.27 an ounce and silver by 0.9 per cent to USD 17.84 an ounce and that weakness continued in European trading.

On the wider markets this morning, European shares are down 0.7% on concerns about the health of the Eurozone economy and risks of a new crisis.

Global economic growth concerns pushed stock markets lower in Asia overnight. Non-gold safe haven assets such as German bund futures rose sharply, mirroring an earlier move in U.S. Treasuries.

Greek Prime Minister Tsipras challenged to international creditors by halting privatisation plans agreed under the country’s bank bailout deal, prompting a third day of heavy losses on financial markets in Greece.

The U.S. Federal Reserve remains remarkably sanguine on the U.S. economy and signalled that it remains firmly on track to raise interest rates this year, despite an uncertain global outlook. As ever, we prefer to watch what the Fed actually does rather than what it says it will do.

Get Breaking News and Updates Here

Leave a Reply