The Fall of Tyranny

Summary: Massive debt is sealing the fate of governments and central banks. As the cards collapse, radical developments in diverse areas of technology, combined with free market entrepreneurship, will destroy and rebuild the existing social order.

Trouble begins when bureaucracies replace free markets. In the U.S., we find money, the lifeblood of the economy, resting in the hands of a board of bureaucrats whose statements the financial punditry spends their waking hours trying to decipher. What does this portend for the foreseeable future? Ben Wright, Group Business Editor at The Telegraph, takes us through one possible scenario.

The total value of all global equities was around $70 trillion in June last year, according to the World Federation of Exchanges; meanwhile, the notional value of all outstanding derivatives contracts was more than $690 trillion. It is worth noting that the vast majority (around four-fifths) of all existing derivatives contracts are based on interest rates.

Derivatives are “essentially insurance policies – they are designed to protect the holder from adverse price movements,” such as a change in interest rates.

Let’s say that US interest rates do rise sooner and faster than the market expects. That means bond prices, which always move in the opposite direction to yields, will plummet. US Treasury bonds are like a mountain guide to which most other global securities are roped – if they fall, they take everything else with them.

Who will get hurt? Everyone. But it’ll likely be the world’s banks, where even little mistakes can create big problems, that suffer the most pain.

Banks are well-aware of this threat and have negotiated interest rate derivatives to hedge their risk. They bought these derivatives from other banks.

This creates what is known as counterparty risk. Bank A sells insurance to Bank B. But then Bank A gets into financial difficulties (a significant deterioration in their creditworthiness would be enough) and suddenly Bank B isn’t as well protected as it thought it was. . . .

Clearing houses are designed to deal with one or two counterparties going down. But what happens if more go kaput? The clearing house itself would face collapse, be judged too big to fail and, well, you already know how this story ends.

We do, but where does it begin?

Governments’ silent partner: Central banking

It originates in the wish of big bankers to create a government scheme to protect and amplify their wealth, while promoting it as a necessary corrective to what they say is an inherently flawed free market that suffers from periodic crises. This is often cited as the rationale for central banking. The central bank is supposed to eliminate crises by coordinating and restricting the credit expansion (monetary inflation) of its fractional-reserve member banks. In the event this doesn’t work, the central bank bails out the biggest banks under the flag of “lender of last resort.”

Most economists consider fractional-reserve banking a sound and ethical business practice. It consists of giving two people — depositor and borrower — a claim of ownership to the same thing. The free market penalizes fractional-reserve banking with bank runs and currency drains from less-inflationary competitor banks. Historically, bankers resented this. Governments, always looking for revenue, sided with the bankers and established central banking cartels. Governments changed money itself from a commodity to something the banks could inflate at will (paper and digits), with another government agency acting as an “insurer” of digital deposits to calm the natives. (See Rothbard, pp. 134-137)

The counterfeiting cartel called the federal reserve system has survived for over a century. What would its economic report card look like? It penalizes savers through deliberate monetary debasement. It makes honest price discovery impossible. It has created numerous financial crises, including two devastating ones. After the crisis hits it finds fault everywhere except home in its Keynesian hunt for causes. The bought economics profession becomes the barking dogs on the hunt. Those closely connected to the Fed, such as the government, benefit from the Cantillon Effect.

The claim that the economy needs a meddler to execute “monetary policy” is never seriously questioned. See, for example, FRBNY president William Dudley’s “Lessons Learned” speech given in 2009 at the BIS conference in Basel, Switzerland:

Dudley: If one means by monetary policy the instrument of short-term interest rates, then I agree that monetary policy is not well-suited to deal with asset bubbles. But this suggests that it might be better for central bankers to examine the efficacy of other instruments in their toolbox, rather than simply ignoring the development of asset bubbles.

If existing tools are judged inadequate, then central banks should work on developing additional policy instruments.

Got that?

Compare his comments to those of Milton Friedman, who Helicopter Ben once lauded for his view that the Fed failed to print enough money to offset price deflation following the Crash.:

If a domestic money consists of a commodity, a pure gold standard or cowrie bead standard, the principles of monetary policy are very simple. There aren’t any. The commodity money takes care of itself. Salerno, p. 356

Friedman expanded on this thought elsewhere:

If money consisted wholly of a physical commodity … in principle there would be no need for control by the government at all. . . .

If an automatic commodity standard were feasible, it would provide an excellent solution to the liberal dilemma of how to get a stable monetary framework without the danger of irresponsible exercise of monetary powers. Salerno, pp. 334-335

Of course, this is not the Friedman Bernanke-the-Keynesian extolled.

All folly must be funded, and the Fed is front and center with its “accommodating” printing press. But the Fed is not just an economic calamity for most of us — it has blood on its hands. Mostly, it’s the blood of everyday people, the ones who ultimately bail out the big boys involuntarily, with their money and their lives. Central banking is the pillar of the welfare – warfare state.

Without the Fed and its cohorts elsewhere, we likely would have had a relatively peaceful twentieth century instead of the record-setting slaughter we experienced. See David Stockman’s “The Epochal Consequences Of Woodrow Wilson’s War” for details. See also Wikipedia’s page on the Nye Committee findings or read highly-decorated Marine Major General Smedley Butler’s War is a Racket.

Senator Gerald Nye of North Dakota, Chairman of the Senate Munitions Committee, concluded that “We didn’t win a thing we set out for in [World War I]. We merely succeeded, with tremendous loss of life, to make secure the loans of private bankers to the Allies.”

Thanks to Thomas Woodrow Wilson and his warmongering handlers, and the Federal Reserve Act Wilson signed into law, perpetual war has become the norm in foreign policy, as long as the wars are conducted in sufficiently obscure and distant locations so as not to rattle the folks back home.

Keep the names, change the meaning

The Fed has funded a fascist state almost from its inception. With fascism we get good-old-boy economics in the name of free markets and the erosion of liberty in the name of liberty.

Keynes became an international hero among interventionists when he published an opaque treatise justifying government control of markets. In the preface to the German edition of The General Theory (1936), he wrote:

Nevertheless the theory of output as a whole, which is what the following book purports to provide, is much more easily adapted to the conditions of a totalitarian state, than is the theory of the production and distribution of a given output produced under conditions of free competition and a large measure of laissez-faire.

I agree that his “theory of output” is appealing to totalitarians. It’s also appealing to totalitarian-lite politicians and economists such as exist the world over. Little totalitarians’ fingerprints are everywhere we look.

As we’ve witnessed with Assange, Snowden, Manning, and others, those with the courage to expose government wrongdoing are immediately in its crosshairs as traitors.

Crises become an excuse to create more bureaucracies such as the DHS and its subordinate, the TSA. An airplane ticket serves as a waiver of Fourth Amendment rights.

Surplus war weapons trickle down to domestic enforcement agencies. The police are becoming indistinguishable from an occupying army, one that’s hostile to locals.

The “national security” mantra means we live by permissions and restrictions. Kids are prohibited from selling lemonade or shoveling snow without a permit. If they so much as point a finger at someone in the shape of a gun they can be suspended from school.

Many of these same kids will later be drawn into the military to kill on command for the state, while the alarming suicide rate of young veterans is brushed aside with “concerned” rhetoric. According to one site, 49,000 veterans killed themselves between 2005 and 2011, more than twice the number of civilian suicides.

The helping hand of big government always carries a penalty. Government loans are turning college students into debt slaves — in many cases, unemployed or underemployed debt slaves.

Where there’s perpetual war there’s perpetual spying. The NSA spies on everyone in virtually everything they do. As Snowden remarked in a recent radio speech, referring to the Sydney siege and Charlie Hedbo attacks, “[mass surveillance] is not going to stop the next attacks either. Because they’re not public safety programs. They’re spying programs.”

The government invokes Orwell with the Patriot Act, the Affordable Care Act, and now Net Neutrality, and most people, intellectually stunted from their government school experience, applaud or don’t care.

We can expect more of the same and worse when the next AIPAC- and CFR-approved candidate becomes president.

The trends favor liberty

The above scarcely begins to touch on the disaster the American state and its central bank have created. For libertarians, matters grow worse with each passing day. Fortunately, there are two unmistakable trends working in liberty’s favor: Massive debt and advancing technology.

Technology is ripping a hole in centralized social control and its Keynesian underpinnings, bringing power and freedom to individuals the world over.

Both Keynesianism and technology are on a cusp. One is on a road to collapse, while the other is about to kick into high gear.

On February 25, Boston University economist Laurence Kotlikoff told members of the Senate Budget Committee, “Our nation’s broke, and it’s not broke in 75 years or 50 years or 25 years or 10 years. It’s broke today. Indeed, it may well be in worse fiscal shape than any developed country, including Greece.”

Why? Because the U.S. has a $210 trillion fiscal gap. How can the government close this gap? Right now, it would “require an immediate 58.5 percent increase in all federal taxes or a 37.7 percent permanent, across-the-board decrease in federal spending.”

It’s not going to happen. Congress will kick the can. Creditors will get stiffed. Government promises will be broken. The bill for the Keynesian free lunch will come due, and the government check will bounce.

Where will that leave us? With a weakened and discredited government, and the bogus Keynesian ideas that supported it, we will have to become more self-reliant. The cry for the government to “Do something!” will be answered with an echo. Free markets will emerge where they’ve been suppressed because much of government will be ineffective or no longer exist. A free market in combination with a revolution in technology will remake our world.

The technology revolution: Subversive and seductive

Unlike other revolutions, the revolution in technology will not end. It started when someone first used a stick to extend his reach. It is ongoing, ever accelerating, and reaching into virtually every area of life. Nor does it centralize power. As we’ve witnessed with computers, it is radically decentralizing and price deflationary.

Information technology has been growing exponentially since the 1890 US census. More technologies have become information technologies, putting them on an exponential growth curve.

The exponential is not easy to grasp. Futurist and entrepreneur Ray Kurzweil explains why:

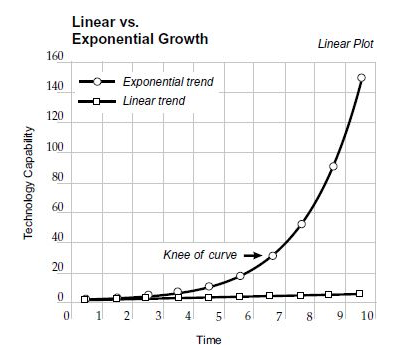

- Linear growth is steady, while exponential growth becomes explosive.

- Exponential growth will always seem linear when viewed over a short-enough time span.

- Exponential growth is seductive. In its early stages it acts like linear growth. It becomes explosive after it reaches the knee of the curve. Most of us still view the distant future from a linear perspective.

- The rate of change is itself accelerating. We won’t experience one hundred years of technological advance in the twenty-first century; we will witness on the order of twenty thousand years of progress (at the rate in the year 2000).

- Many scientists are skeptical of the exponential. They are trained to be skeptical. When progress moved along the linear portion of the exponential this was understandable. We’re at the knee of the curve today in many areas of technology (see chart).

- Awareness of exponential phenomena sometimes produces overly-optimistic expectations. Exponential growth picks up speed over time but it is not instantaneous.

(From The Singularity is Near, Ray Kurzweil, p. 10)

Kurzweil refers to exponentially-growing technology in various disciplines as the law of accelerating returns. As he explains:

It’s the economic imperative of a competitive marketplace that is the primary force driving technology forward and fueling the law of accelerating returns. In turn, the law of accelerating returns is transforming economic relationships. Economic imperative is the equivalent of survival in biological evolution. We are moving toward more intelligent and smaller machines as the result of myriad small advances, each with its own particular economic justification. Machines that can more precisely carry out their missions have increased value, which explains why they are being built. There are tens of thousands of projects that are advancing the various aspects of the law of accelerating returns in diverse incremental ways. The Singularity is Near (2005)

The price-competitiveness of entrepreneurship will spread technology in various forms around the globe. Recent headlines reveal major technology companies working to bring internet service to regions that have been without it, using airborne devices such as drones, satellites, or balloons. With internet service and affordable devices will come educational opportunities for millions of people who have never had any.

The massive impact of 3D Printing

Two years ago Allister Heath of The Telegraph wrote about 3D printing and what it will do to our world.

Remarkably, 3D printing allows actual objects to be designed and created (or “printed”) surprisingly quickly with a computer connected to a printer-like device, using special material (often plastic, but increasingly almost anything) as “ink” and “paper”. With the costs of the machinery nearing mass-market levels, 3D printing is poised to take off, blurring the distinction between digital and physical realms, democratising manufacturing and turning large chunks of the global economy upside-down. . . .

Making things using one’s own equipment may even become almost as common as cooking one’s own food or uploading one’s own pictures to a social network. . . .

Given that economies of scale will no longer be so essential, 3D printing will drastically reduce the barriers to entry to start-ups. Anti-trust policy will become obsolete. The influx of new competitors will shake up many industries, just as old oligopolies built around intellectual property have already been smashed.

Choice will have no bounds. Already, 3D printers can manufacture things like furniture, cutlery, and machine tools, but this is only the beginning.

Far more complex items will become printable, a development which would truly change the world. Anthony Atala, of the Wake Forest Institute for Regenerative Medicine in North Carolina, recently harnessed a 3D printer with living cells as the “ink” to create a transplantable kidney. Even restaurants could be partly automated. Jeff Lipton, of Seraph Robotics, argues that food will be 3D printing’s killer app, and has demonstrated how scientifically precise cakes can be produced, feeding all the usual ingredients into the machine.

This is Joseph Schumpeter’s “creative destruction” in action. But it applies to more than markets.

Eventually, even governments will be threatened by the 3D printing revolution. In a world of endless choice, who will put up with one size fits all public services and flawed, bureaucratic decision making?

Atomically Precise Manufacturing (APM)

Eric Drexler, the father of modern nanotechnology, sees 3D printing as a precursor to a more exacting manufacturing method he calls Atomically Precise Manufacturing (APM). Because APM will use common feedstocks instead of scarce materials, its full development will result in radical abundance.

According to Drexler the science of APM is settled. We are not waiting for some “Eureka!” moment.

We’ve come a long way, and there’s a long way to go, but the road has no gaps, no chasms to cross. . . . The fruits of [APM] research appear in scientific journals, with more papers published daily than anyone could read.

Zyvex was founded in 1997 with the goal of developing atomically precise manufacturing. Several of its products had been commercialized by 2007. Its website describes nanotech in everyday terms.

Todays manufacturing methods are very crude at the molecular level. Casting, grinding, milling and even lithography move atoms in great thundering statistical herds.

It’s like trying to make things out of LEGO blocks with boxing gloves on your hands. Yes, you can push the LEGO blocks into great heaps and pile them up, but you can’t really snap them together the way you’d like.

In the future, nanotechnology (more specifically, molecular nanotechnology or MNT) will let us take off the boxing gloves. We’ll be able to snap together the fundamental building blocks of nature easily, inexpensively and in most of the ways permitted by the laws of nature. This will let us continue the revolution in computer hardware to its ultimate limits: molecular computers made from molecular logic gates connected by molecular wires. This new pollution free manufacturing technology will also let us inexpensively fabricate a cornucopia of new products that are remarkably light, strong, smart, and durable.

Eliminating disease and rejuvenating our bodies

“[Biologically,] we are fundamentally information,” Ray Kurzweil tells us in his movie, Transcendent Man. “At the core of our ten trillion cells are genes, and genes are sequences of data. And they evolved thousands of years ago. Many of them go back millions of years.”

The software in our bodies is ancient but we’re learning how to change it. Changing it will revolutionize medicine.

A hybrid scenario involving both bio- and nanotechnology contemplates turning biological cells into computers. These “enhanced intelligence” cells can then detect and destroy cancer cells and pathogens or even regrow human body parts.

Biotech programmers will treat aging as they treat diseases.

Biotechnology will provide the means to actually change your genes: not just designer babies will be feasible but designer baby boomers. We’ll also be able to rejuvenate all of your body’s tissues and organs by transforming your skin cells into youthful versions of every other cell type. . . .

Already, new drug development is precisely targeting key steps in the process of atherosclerosis (the cause of heart disease ), cancerous tumor formation, and the metabolic processes underlying each major disease and aging process.

Technology and medicine

Advances occur almost daily in a wide range of technologies. What follows is a random sampling of medical research and applications.

Three years ago researchers at the University of Michigan 3D printed a windpipethat held an infant’s airway open. It likely saved its life. Glenn Green, an ear nose and throat specialist, helped develop the device.

The use of 3-D printed devices and body parts is still in its infancy. Cartilage and bone will be the first solutions to reach wide use, Green says, adding there is a “gigantic potential,” for the future.

While nanotechnology still has years of research ahead of it, there are some promising developments for the near future. Dr Thomas Webster, the chair of chemical engineering at Northeastern University in Boston, is conducting research that attaches drugs and possibly metals and minerals to nanoparticles that then bind themselves to cancer cells and viruses, leaving healthy cells unharmed. They’re not at the level of the nanobots in Michael Crichton’s novelPrey that “roamed through patients autonomously hunting down medical problems,” but they’re getting close.

Meanwhile, researchers the University of Manchester have used graphene oxide, a non-toxic material, “to target and neutralize cancer stem cells (CSCs) while not harming other cells.” CSCs spread cancer within the body and are responsible for 90% of cancer deaths.

Another study using gold nanotubes integrates “diagnosis and therapy in one single system.”

The researchers injected the gold nanotubes intravenously. They controlled the length of the nanotubes for the right dimensions to absorb near-infrared light (which penetrates tissue well) from a pulsed infrared laser beam.

By adjusting the brightness of the laser pulse, the researchers were able to control whether the gold nanotubes were in imaging mode or cancer-destruction mode.

Lung cancer is the number one cancer-killer in the U.S. Detection of lung cancer is usually done with an invasive biopsy when the tumor has reached a diameter of 3 centimeters and is often metastatic. Yong Zeng and his fellow researchers at the University of Kansas have developed a lab-on-a-chip that could detect lung cancer much earlier using a small drop of the patient’s blood. “In theory,” Zeng says, “it should be applicable to other types of cancer.” They are continuing research with this goal in view.

Conclusion

Things can always go wrong. Nuclear war could erupt and wipe out humanity. Smart robots could take over the world and wipe out humanity. Terrorists could invent a killer virus that wipes out humanity. The possible downsides to sophisticated technology are seemingly endless.

But as noted earlier, there are two trends today that are real and visible: Massive debt and advancing technology. Follow the implications. There will be pain, but then recovery and real growth.

There are other facts working in favor of positive outcomes. People generally want to live long, healthy, enjoyable lives. Technology is working to make that a reality. People generally don’t like dealing with bureaucracies, paying taxes, or making war on their neighbors. Collapsing governments will make this a reality.

And there are other thoughts to consider.

The free market is the expression of economic law. Keynesianism consciously violates it. Governments the world over have bet the farm on Keynesianism. They’re about to lose the farm.

Technology, meanwhile, will continue its accelerating advances, benefiting most people in the process. The benefits will become increasingly radical, remaking our world.

It will be a world where killer diseases can be detected and treated quickly at low cost.

It will be a world where aging is more of a choice rather than an imposition of nature.

It will be a world where people can afford to own machines that can make just about anything they want or need from ordinary materials. Abundance will replace scarcity. Poverty will cease to exist.

It will be a world in which energy is plentiful and cheap. War for oil or other scarce resources will be relegated to history.

It will be a world where people are easily connected through technology, wherereal-time translation software destroys the language barriers that exist today.

It will be a world in which people will be able to get the education they want through digital technologies.

I, for one, look forward to it.

Reprinted with permission from Barbarous Relic.

Leave a Reply