The ghosts of Hammersmith & Fulham vs Goldman Sachs – The return of toxic council derivatives

BACK TO THE FUTURE WITH COUNCIL FINANCE, SWAPS AND DERIVATIVES – reposted via @debtresistuk

Ask around your typical local authority after the “1989 Hammersmith and Fulham vs Goldman Sachs case” and all but the most grey haired of councillors, treasurers and managers are likely to meet your question with puzzled faces and blank stares.

Poorly known outside of City law firms and council treasury offices, the landmark ‘Hammersmith case’ as it became known by industry insiders has shaped local government financial policy for more than 25 years, ensuring interest rate swaps and derivatives use by local government was banned, until its repeal by Eric Pickles with the 2012 Localism Act (which introduced a “general power of competence).”

Or at least thats what we thought!

In the 1980’s 137 Councils including Hammersmith and Fulham had been encouraged to enter into hundreds of “interest rate swaps” agreements – where in theory, councils exchanged floating interest rates with a bank, for the “security” of a fixed rate.

In the fish hooks of the contracts, Hammersmith would pay the banks if interest rates fell, whilst the banks would pay Hammersmith when interest rates rose. In effect, Hammersmith council had wittingly or otherwise had entered into a one-way bet that interest rates would fall.

Hammersmith, the largest player in the interest rate swaps market had signed hundreds of swaps contracts placing UK taxpayers on the hook for $6billion in potential losses as interests rates moved against the council in favour of Goldman Sachs.

Terrified council executives were quickly phoning the Audit Commission, Big Four Accountants and City law firms for expert advice as to their options to extricate themselves from a growing budgetary black hole.

This sordid tale of local government incompetence, predatory bank lending and UK Government legal chicanery, is craftily retold by Duncan Campbell Smith in “Closing the Swaps Shop.”

UK Government as the “lender of last resort” to councils via the Treasury Public Works Loan Board (PWLB) took a keen interest in the Hammersmith case, as the debts snow-balled and council defaults and Government bailouts to repay the bank lenders became a realistic proposition.

The case was further complicated because some councils had “guessed right” with their interest rate bets, and were profiting handsomely from the trades, whilst others, such as Hammersmith taxpayers faced a potential bill of some $6.2 billion!

In the Hammersmith case, UK High Courts ruled it was not council’s role to be speculating upon interest rates, and taxpayers should not be held liable, much to the anger of bankers in Wall Street and the City of London.

Enter Financial Engineering aka Regulatory Arbitrage in the City of London

What the bankers did next from the early 1990’s was to find inventive new ways of “engineering around” the new restrictions imposed upon the use of derivatives – a process known as regulatory arbitrage.

This gave rise to psuedo-public bodies – including Arms Length Management Organisations (ALMO’s) Quasi-Autonomous Non-Governmental Organisations (Quango’s) and Special Purpose Vehicles (SPV’s) which allowed the City to sell complex financial products to public authorities (such as Private Finance Initiatives – PFI’s) without the restrictions of the Hammersmith regulation, which only protect public authorities from exotic finance, not ALMO’s and Quango’s.

Many any of these arms length management bodies such as housing associations are conveniently outside the scope of FOIA legislation.

Private Finance Initiative (PFI) – A response to Hammersmith and Fulham?

From the mid 1990’s, public authorities have managed to rack up an astonishing £79billion capital spend in Private Finance Initiative (PFI) projects, with PFI repayments which extend 60 years, in excess of £300 billion.

PFI contracts contain swaps and derivatives of the type outlawed by the Hammersmith ruling, so the cost exposure for the UK public sector of these derivative products is potentially similar to that detailed in the Hammersmith case.

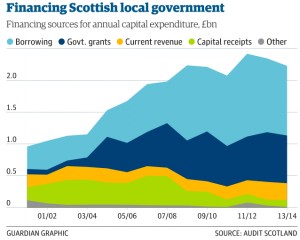

A recent report for the Scottish Guardian published Thursday 05 March 2014 found that Scottish Local Government borrowing and debt repayments had ballooned alarmingly since 2008, and PFI was a major factor:

“Although Scottish authorities had assets worth £39bn, debt repayments surged from £946m in 2009-10 to £1.5bn last year, including repaying privately-financed PFI projects.”

Making accurate comparison between English, Welsh and Scottish public sector debt is difficult because of varying accounting and financial regulatory standards.

Part of the reason Scottish debt looks comparatively high is because a) Scottish local government shows housing association/ social housing debt on their own balance sheets, and b) Financial Reporting Standard 102 accounting rules which come into force in April 2015 will prompt authorities to show the full ‘mark to market’ derivatives liabilities of public authorities on balance sheet, and authorities are awakening to the added debt this exposes.

A Scottish Government spokesman insisted local authority debt was partly due to the: “hugely damaging legacy of PFI contracts”, but refused to say whether ministers had made any assessment of the impact of record borrowing [or the embedded derivatives positions attached to the loans] on council finances.

PFI contracts embed swaps and derivatives of the type outlawed by the Hammersmith ruling, but it is next to impossible to determine what impact these complex financial products have on PFI affordability, as the PFI contracts are deemed “commercially sensitive” and the loan contract terms and conditions are not available for public scrutiny.

As for the legality of PFI contracts, and swaps and derivatives use by local authorities more generally, the practitioners guide: ‘Local Government in Britain – Everyones guide as to how it works‘ by Tony Byrne, 2000, states page 388:

“From the local government point of view, a major advantage is that the capital investment undertaken by way of PFI does not (since 1996) count against their quota in the capital control system (which is a real relaxation since the control system created in 1989 [i.e. following Hammersmith case] was established to prevent councils various creative accounting methods of evasion, including leasebacks, which is what many PFI projects amount to).

Banks and other private sector sources had become wary of such ventures in view of the various cases* which resulted in some local authorities escaping from debts after the courts declared their actions to be “ultra vires” [Hammersmith] and the contracts involved therefore void, such that the banks could not reclaim the money they had loaned or guaranteed.

The Local Government (Contracts) Act 1997 clarifies, (although does not actually extend) local authorities power to enter into contracts and partnerships with the private sector, especially regarding capital finance.”

According to Byrne, the legal status and case for local government use of complex swaps and derivatives remains unclear.

Lender Option Borrower Option (LOBO) loans

Unlike PFI which has at least received some degree of public scrutiny, a lesser known form of local government bank borrowing originating in the 1990’s post Hammersmith and Fulham – the somewhat misleading Lender Option Borrower Option (LOBO) loan has flown entirely under the radar of slumbering UK financial regulators, who conveniently ignore public sector financialisation.

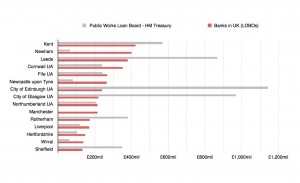

Interrogation of public data available from DCLG in the form of 2013/14 ‘Borrowing and Investment Live Tables‘ conducted by Joel Benjamin for Move Your Money shows approximately 210 UK councils have LOBO’s on their books, significantly more than during the 1989 Hammersmith and Fulham crisis.

LOBOs are a form of variable interest, teaser rate loan, which embeds derivatives into the loan product, proving very popular with local authorities and housing associations (ALMO’s) in the lead up to the 2008 financial crisis, where councils experienced significant losses in Icelandic banks.

The top 15 UK local government LOBO borrowers are shown below (in red) via Vica Rogers – Debt Resistance UK.

With the Hammersmith ruling, councils were outlawed from entering ‘stand-alone’ swaps and derivatives contracts, so the banks simply ‘baked’ the offending derivatives into a loan agreement and continued to (mis)sell them.

To my knowledge, the legality of these derivatives based LOBO loan products has never been tested in UK courts, despite near identical derivatives mis-selling to European municipalities by London based banks being extensively challenged in Italy, France and Germany as covered by Joe Lynam for the BBC in September 2012.

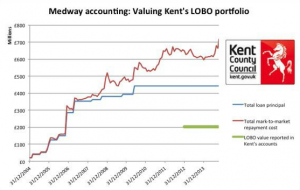

Our analysis of Department for Communities and Local Government (DCLG) official figures places LOBO debt at £11billion (note: DCLG do not mention LOBOs or derivatives at all), however expert analysis of LOBO loan contracts (obtained via Ranjan Kumaran Move Your Money FOI’s) undertaken by Gary Kendall and Nicholas Dunbar for Kent County Council confirms the actual “mark to market” LOBO loan liabilities are understated by more than half, relative to the loan representations shown in council accounts as audited by the big four accountancy firms.

Kent’s audited accounts represent LOBO loan liabilities at just £200 million, whilst Nick Dunbar’s analysis shows a ‘mark to market’ actual loan value in excess of £700 million. As Nick Dunbar notes, the difference between the book and real LOBO loan values represents the entire amount of Kent County Councils annual social welfare budget!

Kent LOBO accounting analysis via Nicholas Dunbar

Because housing associations are arms-length bodies, not expressly subject to FOIA requests, confirming the full stock of housing association LOBO loan borrowing has not been possible to date, via housing association or the Housing and Communities Agency (HCA) which oversees them.

Data provided by the HCA for 2013/14 suggests total borrowing for the social housing sector of £70billion, although it is not clear what proportion of this debt is via derivatives laced LOBO loans. The full mark-to-market exposure of these LOBO loans will be multiples of the £70billion figure.

Austerity and political choice. Is Councils role to protect and serve residents? or underwrite City of London profits?

As the Governments back-loaded local government austerity cuts begin to bite from 2015, the risks posed by financialisation of local government are becoming increasingly acute, as viewed through the lens of LOBO loans and unsustainable PFI debts.

A recent report by the London Assembly – Aloan Again, London’s Debt Problem found that the drivers of personal debt have changed markedly in recent years, from consumer debt and credit cards, to council tax and utility bills, as austerity has transferred a banking crisis onto the shoulders of the working poor, via local government cuts.

This is occurring whilst councils like Newham could be paying as much as a £10-20million annual interest rate premium on LOBO loan borrowing, relative to available fixed rate loans from the Treasury Public Works Loan Board.

Decisions must be made by local authorities in places like Newham as to whether they act decisively to protect front line services and residents from the worst of the cuts, or continue paying out on unaffordable derivatives laced loan contracts with City of London banks, which if challenged in a court of law, may be declared “ultra vires” and illegal for use by UK local government.

With the Local Government Audit Commission set to close at the end of March 2015 as a result of Eric Pickles austerity cuts, it is unlikely the LOBO loan derivatives fiasco will receive the required scrutiny from Government or regulators.

It’s time for local government to demonstrate civic leadership and decide whose side they are on. The side of local residents facing the cuts, or the banks who caused them…

Leave a Reply