Neofeudalism 101: Strip-Mining the Upper Middle Class

This Neofeudal structure is unstable by its very nature.

I have often examined the Neofeudalist structure of the U.S. economic hierarchy, and the many social and financial fault lines running through this creaking structure. For example:

America’s Nine Classes: The New Class Hierarchy (April 29, 2014)

Are You an Elitist? Class Warfare and the New Nobility (April 26, 2014)

Protecting Elites and the Clerisy Class That Serves Them (September 26, 2014)

Bifurcation Nation (June 24, 2013)

The Three-and-a-Half Class Society (October 22, 2012)

Tyranny of the Majority, Corporate Welfare and Complicity (April 9, 2010)

Today I’d like to examine the neofeudal strip-mining of the class that pays most of the taxes. These taxes support the bottom 50% who pay the 7.65% payroll taxes and receive substantial income tax credits, and enables the super-wealthy to pay lower tax rates on their vast unearned income.

Let’s take a quick glance at payroll and income taxes for context.Individual income taxes and Social Security/payroll taxes total $2.4 trillion.Corporate and other taxes add $600 billion, for a total of $3 trillion in Federal tax receipts.

2 out of 3 taxpayers pay more in payroll taxes than income taxes:

Put together, people making under $40,000 a year get $81.1 billion from the income tax; that is, they get more refundable credits like the Earned Income Tax Credit than they pay in taxes. But that same group pays $121.5 billion in payroll taxes.

So people making under $40,000 a year–63.9% of all taxpayers, according to theSocial Security Administration, paid a net of $40 billion out of the $2.4 trillion in payroll and income taxes. This is truly a drop in the bucket.

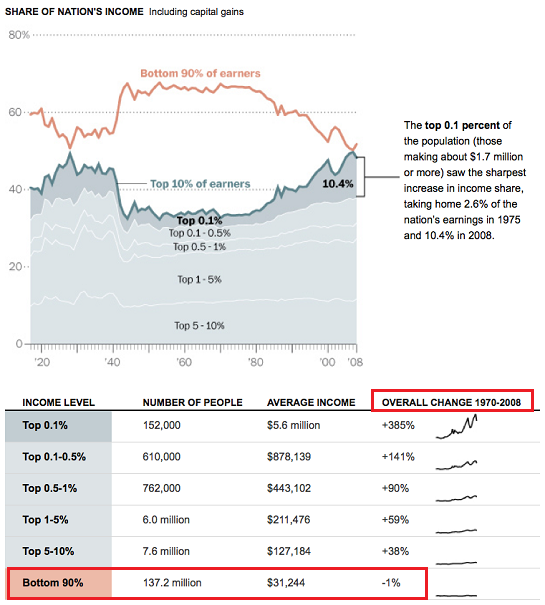

Meanwhile, the wealth of the top .01% has pulled away from the top 10% and even the top 1%:

The Richest Rich Are in a Class by Themselves: top .01% and top .1%

A household income of around $150,000 a year qualifies as a top 10% income:

$145,000 to $149,999: 90.20%

$105,000 to $109,999: 81.09%

$190,000 to $194,999: 95.21%

Because the super-wealthy are in the top 10%, 5% and 1%, the average incomes of these groups are heavily skewed by the enormous incomes of the top 01%. As a result, it would be more accurate to remove the top .1% from the top 10%, 5% and 1%, but I haven’t found any statistical charts that reflect this.

For their part, the top 10% (roughly 15 million taxpayers in a nation of 317 million people) pay the vast majority of income taxes: CBO:Top 40% Paid 106.2% of Income Taxes; Bottom 40% Paid -9.1%

The Distribution of Household Income and Federal Taxes (CBO; highly recommended)

The top 20% pay 93% of all federal income tax and 45% of all payroll taxes. The top 10% pay 77.4% of all federal income tax and 27% of all payroll taxes.

Most of the income gains have flowed to the very top of the income pyramid:

So what makes this structure Neofeudal? Simply this: the tax donkeys who pay most of the tax support the large class of modern-day serfs (working poor and state dependents) while their labor generates the great wealth enjoyed by the Financial Aristocracy.

The class of tax donkeys earns most of their income by their labor, and this income is exposed to both payroll taxes (up to $111,000 annually) and income taxes. Unless they are fortunate enough to be granted stock options in bubblicious tech companies, they do not own the capital needed to skim millions of dollars annually in unearned income like the Financial Aristocracy.

This Neofeudal structure is unstable by its very nature. For every person in the bottom 50% looking with resentment at someone earning $150,000, there’s somebody like me (who doesn’t earn $150K) paying $300 cash for a small tube of medication (that’s long been off-patent) because I can’t afford gold-plated health insurance but earn too much to get healthcare and all medications for free.

This class in the middle–making too much to qualify for federal subsidies, but not enough to afford healthcare, higher education, etc.–has its own fault lines, fractures I will discuss tomorrow.

Leave a Reply