Blogger Ben’s Basically Full of It

Ben Bernanke’s skin is as thin, apparently, as is his comprehension of honest economics. The emphasis is on the “honest” part because he is a fount of the kind of Keynesian drivel that passes for economics in the financially deformed world that the Bernank did so much to bring about.

Just recall that he first joined the Fed way back on 2002 after an academic career of scribbling historically superficial and blatantly misleading monographs about the 1930s. These were essentially zeroxed from Milton Friedman’s monumental error about the cause of the Great Depression. In a word, Friedman and Bernanke pilloried the Fed for not going on a bond buying spree during 1930-1932 and thereby stopping the shrinkage of money and credit.

In fact, excess reserves in the banking system soared by 12X during those four years, interest rates were at rock bottom and the US economy was saturated with idle cash. So there was no financial stringency——not the remotest aspect of a great monetary policy error.

Instead, what actually happened was that the US banking system was massively insolvent after a 12-year credit boom fueled by the Fed’s printing presses. This first great credit bubble arose initially from the Fed’s maneuvers to fund the massive war production surge of 1915-1919 and then from its fostering of a vast domestic and international credit bubble during the Roaring Twenties.

Alas, none of the Fed governors during the 1930-1932 credit contraction had graced the lecture halls of Princeton. But to nearly a man they knew you can’t push on a string, and that a healthy economy requires that busted loans and soured speculations must be purged from the financial system in order for sustainable growth to resume.

Bernanke has never had a clue about this truth. As I showed in The Great Deformation, what he got wrong about the early 1930’s—– he replicated in spades after the September 2008 financial crisis:

Upon becoming chairman of the Fed, Bernanke then foisted the Fisher-Thomas-Friedman deflation theory upon the nation’s economy in a panicked response to the Wall Street meltdown of September 2008. Yet monetary deflation was no more the cause of the 2008 crisis than it had been the cause of the Great Depression.

The monetary populists of the 1920s and 1930s, including Professor Fisher, had “cause and effect” backward. The sharp reduction after 1929 in the money supply was an inexorable consequence of the liquidation of bad debt, not an avoidable cause of the depression. The measured money supply (M1) even in those times consisted mostly of bank deposit money rather than hand-to-hand currency. And checking account money had declined sharply as an arithmetic consequence of the collapse of what had previously been a fifteen-year buildup of bad loans and speculative credit. During 1929–1933 commercial bank loans outstanding declined from $36 billion to $16 billion. Not surprisingly, as customer loan balances fell sharply, so did checking accounts or what can be termed “bank deposit money” as opposed to currency in circulation. The latter actually grew by $1.1 billion during the four years after 1929, to about $5.5 billion.

By contrast, it was the loan-driven checking account portion of M1 which dried up, declining from $25 billion to $17 billion over the same period. And the reason was no mystery: the way banks create demand deposits is to first issue loan credits to their customers. Indeed, in the modern world money supply follows credit, and rarely do central bankers inordinately restrict the growth of the latter.

In truth, loan balances and checking account money rose to inordinate heights during the financial bubble preceding the 1929 crash and unavoidably declined thereafter. This had nothing to do with causing the depression. The real reason the American economy was stalled in the early 1930s is that it had lost its foreign customers.

The reduction of M1 owing to the liquidation of bad credit, by contrast, was a sign of returning financial health. Indeed, the major component of bank credit shrinkage had been the virtual evaporation of the $9 billion of margin loans against stock prices that had reached lunatic levels before the crash. In blaming the Fed for the Great Depression, therefore, Professors Friedman and Bernanke implicitly held that the Fed should have underwritten the margin-loan-based speculative mania of 1926–1929 in order to keep M1 from shrinking!

That’s the essence of the matter. Bernanke thought the 2008 crisis was a replay of the fictional world of his so-called Great Depression scholarship. Given half the chance by the clueless White House pols—-so-called conservatives who appointed a thorough-going Keynesian to the most powerful economic job in the world——-this time he did underwrite the speculative mania that preceded the crash. So doing, he took the Fed balance sheet into the netherworld of monetary crankdom.

Had the 1930 Fed actually followed Bernanke’s spurious advice, the experiment back then would have been short-lived. There was only about $17 billion of public debt outstanding in 1929 or about 18% of that year’s GDP. In no time, the Fed would have owned 100% of the public debt, the chastened survivors of the crash would have been petrified by the central banks repudiation of all known rules of sound finance, and the economy would have remained mired in depression. The problem back then, like in 2008, was mountains of bad credit and massive over-investment, not a deficiency of that after-the-fact Keynesian chimera called “aggregate demand”.

Unfortunately, three decades of free lunch fiscal policy had left Uncle Sam with plenty of debt to monetize by September 2008, and Bernanke’s specious alarmism about an imminent Great Depression 2.0 resulted in a $1.5 trillion fiscal eruption within the space of 5 months (TARP and the Obama Stimulus). So there was nothing to stop the money printing experiment this time around, thereby enabling an academic scribbler to act out the Friedmanite fantasy.

The extent of the calamity will be evident soon enough. Bernanke’s monetary snake oil has been embraced by nearly every central bank in the world, meaning that the global financial system is flying blind on a perilous diet of massive liquidity, rampant speculation and a nearly obscene inflation of financial asset valuations that has showered the 0.1% with a stupendous windfall of unearned riches.

It is only a matter of time, of course, before Bernanke’s monumentally misbegotten experiment in defying the laws of sound finance and common sense alike comes crashing down. In the meanwhile, he appears to be taking every possible opportunity to insult our intelligence by using his new blog to proclaim prophylactically that the next crash is none of his doing; and, in fact, that the $3.5 trillion of fraudulent central bank credit conjured from thin air which the Fed has injected into the financial system is actually working.

Thus, in response to the Wall Street Journal’s devastating critique of his money printing mayhem at the Fed, the Bernank had the gall to argue that QE and ZIRP have been a roaring success for the working people of America. Indeed, according to the Bernank, the nirvana of full employment is nearly at hand:

The unemployment rate is a better indicator of cyclical conditions than the economic growth rate, and the relatively rapid decline in unemployment in recent years shows that the critical objective of putting people back to work is being met. Growth in output has been slow, despite solid job creation, because productivity gains have been slow—perhaps as the result of the financial crisis, which hammered new business formation and investment in research and development, perhaps for other reasons. But nobody claims that monetary policy can do much about productivity growth. Where it can be helpful is in supporting the return to full employment, and there the record has been reasonably good. Indeed, it seems clear that the Fed’s aggressive actions are an important reason that job creation in the United States has outstripped that of other industrial countries by a wide margin.

There is no point in mentioning that there are 102 million American adults who are not employed compared to about 75 million before Bernanke joined the Fed; that only about 43 million of them are retired on OASI benefits; that on a constant labor force participation basis the unemployment rate is still in the double digits; and that the median real household income at $53k is still barely at the level it attained in 1989—-not long after Bernanke got his PhD and began publishing spurious scholarship about the Great Depression and the wonders of central bank printing presses.

Here’s the thing. The Bernank thinks the Great Recession happened because teenage girls piled to the rafters in export company dormitories in China went on a savings binge. Purportedly, the Fed had nothing to do with expanding credit market debt outstanding by $22 trillion or nearly 6X the growth of nominal GDP during the short interval between the time he joined the Fed in 2002 and the massive Wall Street meltdown of 2008.

Accordingly, his madcap money printing spree after the Lehman bankruptcy—-during which the Fed balance sheet of $900 billion accumulated over its first 94 years was nearly tripled in the span of 13 weeks—-is held to represent some kind of Great Reset. That is, whatever happened before September 2008 is to be ignored because the crisis was caused by some kind of global “savings glut”, and that he single handedly had the “courage” to run the printing presses white hot to save the world.

Well, that’s self-serving poppycock. There was no Great Reset on his watch—-just a plunge into monetary madness. And contrary to his Keynesian palaver, the US is not remotely approaching full employment, nor can any serious adult accept the idea that the one-job-one-vote statistics published by the BLS are a valid metric of economic success. For crying out loud, the BLS counts a 10 hour per week lawn mowing gig and a $100,000 per year roughneck job in the shale patch as the same thing.

Well, here’s the real truth of the matter, and it comes from the government’s own statistics mill. During the entire time since the turn of the century——the era during which Bernanke was on the Fed—-there has been hardly a single net labor hour added to the nonfarm business economy.

You can look it up——even if you are the former Chairmen of the Fed.

That’s right. When it comes to an honest measure of employment gains, there are been none for 15 years. Zero. Nichts. Nada. Yet Bernanke has the gall to claim that his monetary policy disaster has given rise to nigh onto “full employment”?

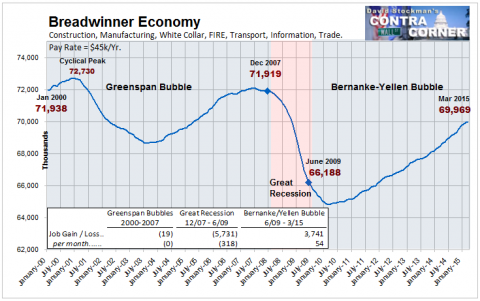

In fact, there are fewer breadwinner jobs in the US economy today than there were in the year 2000 when the Fed’s balance sheet stood at a mere $500 billion. That is, a 9X expansion of the Fed’s money printing fraud has accomplished nothing for main street’s standard of living; it’s just fostered serial financial bubbles on Wall Street.

So Blogger Ben has produced something that is “full”. Namely, a full load of self-serving economic BS.

Reprinted with permission from David Stockman’s Corner.

Leave a Reply