‘The Economist’ Anti-Gold Article – Case Study in Disinformation

- ‘The Economist’ publishes unbalanced and misleading anti gold article

- Leading magazine tries to convince readers that gold is a poor and unethical investment

- Writes gold’s obituary and echoes of Businessweek “Death of Equities” front page

- Attempts to steer investors into shares and bitcoin?

- Economist quotes Dent and Turner — ignores their views on gold as diversification

- Article completely ignores facts and history of gold as store of value

- Ignores academic research showing gold as diversification is safe haven

‘Gold prices – Buried’ – The Economist

In a remarkably unbalanced and lazy article on gold this month the Economist magazine attempts to dismantle the case for investors and others to own gold. Both from an investment point of view and also from an ethical point of view.

Besides attempting to paint gold as an unethical investment, it also attempts to portray those who diversify into gold as crazed, irrational investors and the stock pejorative name calling of gold “bugs.”

The overall tenure of the piece is that everything that “gold bugs” have predicted would unfold in the past number of years has come to nought and therefore gold is the preserve of irrational, gullible fools.

It comes complete with a picture of a presumably impoverished young African man panning for gold in an artisanal gold mine and the subtitle “An ever more marginal existence.”

The article is so laughably one sided that it resembles propaganda rather than journalism. Therefore, we take pleasure in dissecting the article misleading sentence by misleading sentence.

What follows is italicised excerpts in red from the article followed by our comment.

The article’s headline is “Gold prices – Buried”

The barbaric relic of gold is dead and buried and the Economist appears to be heralding the death of gold here.

Alas, for the poor Economist, it has been writing gold’s obituary for many years now. It has been proven badly wrong as during and after the financial crisis, gold acted as a hedging instrument and a safe haven asset and outperformed all assets.

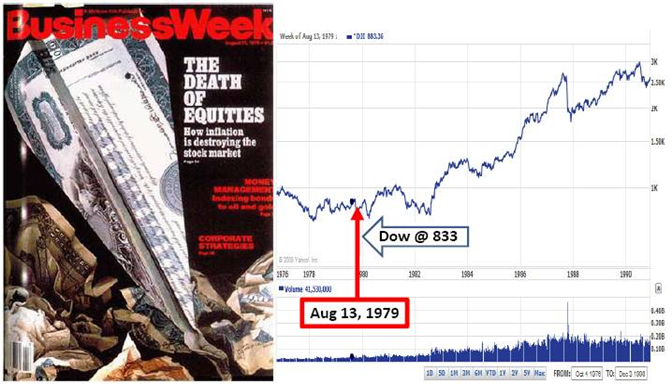

BusinessWeek Front Page – August 1979 and DJIA 1976 to 1994

From an investment perspective and a contrarian perspective this is bullish as it confirms that sentiment towards gold and “gold prices” remains very poor. This suggests that weak hands and momentum buyers have been washed out of the gold market.

In fact it brings to mind the famous Business Week front page article and headline “The Death of Equities.” Thereafter, stocks embarked on one of their greatest bull runs ever.

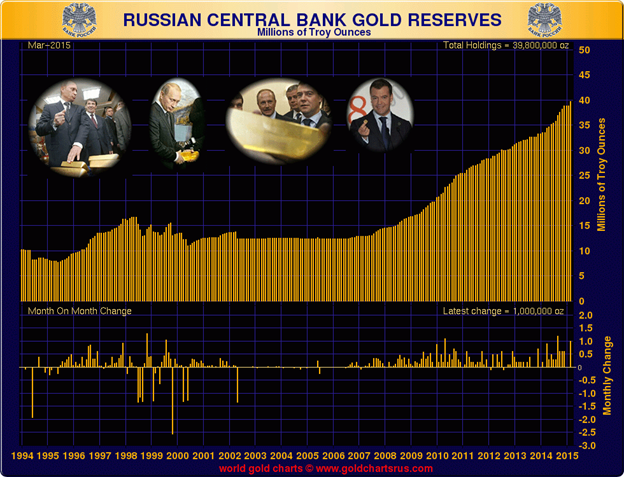

“Russia is buying gold, but few others are”

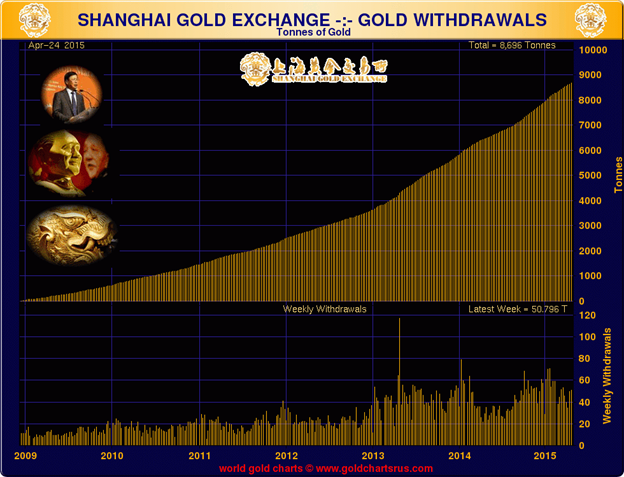

This subtitle is factually inaccurate. The largest buyer of gold in the world today is China. The second largest buyer is India.

Barely acknowledging the massive demand from these two vast and increasingly economically powerful nations and the two billion people in both countries is poor journalism.

As is the failure to acknowledge that the largest buyers of gold today are the Economist magazine’s beloved central banks including the significant clandestine gold buying of the People’s Bank of China (PBOC). Something the Economist has failed to cover to date.

Never let important facts get in the way of a good argument.

“An ever more marginal existence”

This photo title is designed to associate gold with the “marginal existence” and poverty of Africans.

Thus, before even getting to the text of their argument, the Economist makes the strongly negative association between gold and the desperate working conditions suffered by miners for gold in sub-Saharan Africa and between gold and poverty in Africa.

This image and caption is both deeply hypocritical and, in the case of gold, not representative of the actual facts.

Firstly, gold has not created poverty in Africa. Nor has water, land, food, oil or any natural resource or commodity.

What has created poverty in Africa are complex socioeconomic factors, including colonialism – past and present, the corruption of African politicians and developing nations by corporations, banks and supranational institutions (IMF, World Bank etc.) so beloved of the Economist.

What has created poverty is how man has interacted and exploited these natural resources, not the commodities themselves.

Certainly, people are exploited by some local and international precious metals mining companies across Africa and South America. As are those who work for companies who mine copper, iron ore, and other metals and natural resources that western corporations want. So too are those who work for companies who decimate rainforests for lumber and other raw materials.

Does that mean that investing in forestry is unethical?

The fact that workers and the environment are ravaged by some artisan mines and mining companies is a function of the poverty, system of government and corruption in those countries and internationally.

Many corporations seek to access the raw materials they want, sometimes at great human cost. But we are rarely reminded of such desperation when media such as the Economist discuss oil, iron ore, copper and countless other commodities.

This is especially the case with oil — the commodity the western world is most dependent on. Oil arguably has the most unethical practices associated with it — in terms of exploitation, environmental devastation, war and local populations not getting the benefits of their natural resource.

Many commodities internationally are sourced in an unethical manner. Many commodity exporting nations have atrocious human and workers right records. The Economist rarely if ever sees the need to associate these abuses with the commodities that corporations need and consumers use on a daily basis, such as oil.

Secondly, the image of the exploited African artisanal miner or child labourer barely relates to the realities of the gold mining industry today.

China is the largest gold producing country in the world. Followed by Australia, the U.S. and Russia.

Together these countries make up over 40% of global mine production. Furthermore, when Canada and South Africa — where mine workers have strong unions — are added to the mix these countries make up over 50% of global production.

The other countries who make up the list of the top 14 gold producers include only one African country — Ghana.

Indeed sub-Saharan Africa produces a tiny amount of annual global gold production. A fact never pointed out by the Economist in their effort to paint gold as an unethical investment.

Any thinking person realises that the problem is not gold itself per se but with man and today large corporations’ interaction and exploitation of gold and other natural resources.

Ironically, it is important to note that a sharply rising gold price and much higher prices for Africa’s commodities and natural resources in general would benefit impoverished people and communities in Africa — particularly if they can root out the corruption. With higher prices for their exports comes extra income for industry and indeed pay for workers.

“UNCERTAINTY is supposed to lift the gold price. But neither upheaval in the Middle East, nor the travails of the euro zone, nor startlingly loose monetary policy in the rich world is brightening the spirits of those who swear by bullion.”

The Economist is subtly suggesting that those who invest in gold are mean-minded individuals who wish to see upheaval, suffering and war — presumably in order to profit from it.

Firstly, it should be pointed out that none of our clients or community ever express glee at the financial, economic, geopolitical turmoil which seems to be spinning out of control across the globe.

The truth is that gold buyers are concerned about developments in the world in the same way that others are. They simply view gold as hedge against macroeconomic, geopolitical, systemic and monetary risks in the world today.

Gold buyers have hearts. They have wives, husbands, children, family, relations, friends and people they care about. The vast, vast majority would care as much about suffering, impoverished Africans as non-gold investors.

Shylock’s famous utterance is apposite — “If you prick us, do we not bleed.”

“After a big rally during the financial crisis, the price has sagged to about $1,200 an ounce, a third below its peak in 2011. Little seems likely to turn it round. “We’ve seen everything gold bugs could hope for: endless money printing, 0% interest rates (both short-term and long-term adjusted for inflation), rising debt and debt ratios in the public and private sectors…So where’s the damn hyperinflation?” asks Harry Dent, a newsletter publisher, in a recent blog post.”

Mr. Dent is correct, apart from the assertion that these are factors that any rational observer would desire or “hope for” such trends.

Since 2001, central banks have engaged in increasingly reckless, irresponsible and desperate money creation to preserve their unstable debt-based monetary system. They have not succeeded in restoring any kind of equilibrium to the system; indeed, greater imbalances have been achieved.

Data out of the U.S., Europe and China show the world is teetering on the brink of depression.

When will the debt levee break? No one knows but it will and it is clear that the system is spiralling out of control.

It is worth pointing out that while Harry Dent views gold as a bad investment, his latest website clearly advises having an allocation to gold:

“Investors might was to keep a little “insurance” gold for diversification.”

It might be worth considering the strong possibility that gold prices may turn around and have not rallied higher … yet.

“The biggest pressure on the gold price comes from the expectation that interest rates in America will rise later this year. Matthew Turner of Macquarie, a bank, says that low interest rates cut the opportunity cost of owning gold. Higher interest rates, by contrast, raise the cost of holding non-interest-bearing assets. Mr Turner thinks expectations of rising rates are already built into the gold price; if they do not materialise as quickly as expected, there could even be a rally.”

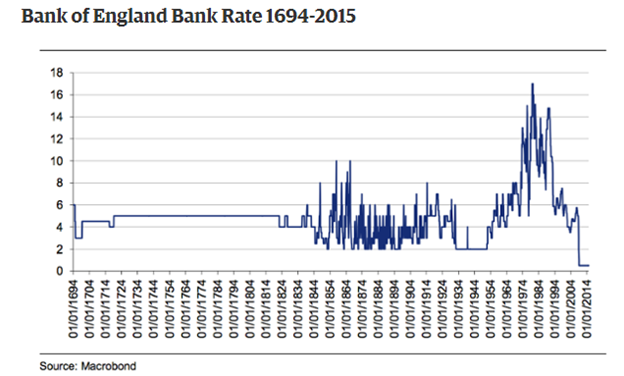

We believe the effect of an anticipated rise in interest rates has been overstated. Indeed, interest rates rising from near record lows will be bullish for gold as was seen in the late 1970s and again in the October 2003 and October 2006 period.

The prospect of rising rates has not had an impact on the very frothy stock, bond and property markets nor do most analysts hint that it will. If market history and common sense is any guide, they will.

Our clients generally view gold as a form of financial insurance. Physical gold is an asset that is independent of the banking system and all paper currencies. Should a major monetary or systemic crisis arise, they are confident that a portion of their wealth is securely stored outside today’s unstable financial system.

Furthermore, should the Fed or other central banks decide to actually raise rates as opposed to only talking about it, it would almost certainly lead to a major crisis as government and public debt becomes unserviceable.

I know Matthew Turner, having met him at an LBMA conference some years ago in Montreal. If the journalist had ascertained his views on gold, I am confident Matthew would acknowledge, like Harry, that gold has value as a diversification.

“One reason may be that investors have so many more options nowadays. Humble citizens who distrust their own currencies can buy assets ranging from shares to bitcoins.”

Is the Economist attempting to steer “humble citizens” into bitcoin and shares? It certainly looks that way.

Despite the fact that stocks look overvalued and have all the hallmarks of another bubble and bitcoin remains untested as a store of value in a major financial crisis.

Cryptocurrencies such as bitcoins have their place in a diversified portfolio but ultimately, like paper currency, they have no intrinsic value.

Gold is firmly rooted in the psyche of all peoples throughout the world and especially in Asia and countries that have experienced hyperinflation such as Germany.

It is argued that gold cannot be eaten. This is true — but neither can property, paper or digital currency. Gold is finite whereas today paper currency is infinite in practical terms and digital currency is by its nature infinite.

If and when faith is lost in fiat currencies, people will not be engaging in philosophical debate over the logic or otherwise of owning gold as money. In a panic situation they will rush to own the one asset that has been regarded as money for all of recorded history — gold.

“Laurence Fink, the chairman of BlackRock, the world’s biggest asset-management firm, said in March that gold had ‘lost its lustre’, thanks to the wider availability of property and even contemporary art. ’it’s become much more accessible for global families worldwide to store wealth outside their country.’ ”

We would dispute that gold has lost its lustre. It has suffered a temporary setback. The notion that art or property are viable substitutes is spurious.

Carefully selected works of art and property have their place in a diversified portfolio but both have been selling at record high prices and are clearly in bubble territory. Property in particular is vulnerable to the interest rate cycle.

“The Kremlin’s growing stockpile does not so much reflect a belief in gold’s prospects, however, as a distaste for the American dollar. Whatever Vladimir Putin’s other qualities, most investors would hesitate to take him on as a financial adviser.”

More than distaste for the dollar is Moscow’s ambition to supplant the dollar as global reserve currency — with a gold-backed Chinese yuan or pan-Asian currency bloc possibly backed by gold.

As for Putin’s economic credentials we would point out that under his stewardship living standards in Russia of consistently improved whereas in the same period living standards for the bulk of people in the West have been in decline.

Conclusion

The completely one-sided, ill-informed and anonymous article – “Gold prices – Buried” – is a case study in selective information and disinformation about gold. In the annals of shoddy and unbalanced articles on gold this is one of the best yet.

It is a crude, tabloid style attempt to portray gold and those who invest in gold as unethical. This is clearly seen in the peculiar decision to use a photograph of a desperately poor African scrambling in the dirt — as we know a picture paints a thousand words – and the tabloid style headline.

It would be unfortunate if an article about gold — one of a very few in recent years — in the Economist led to people not diversifying into and having an allocation to gold, especially if gold again outperforms other assets in the coming years, which is very likely.

Whatever the Economists’ other qualities, investors should be cautious of using it as a financial adviser.

Breaking News and Research Here

MARKET UPDATE

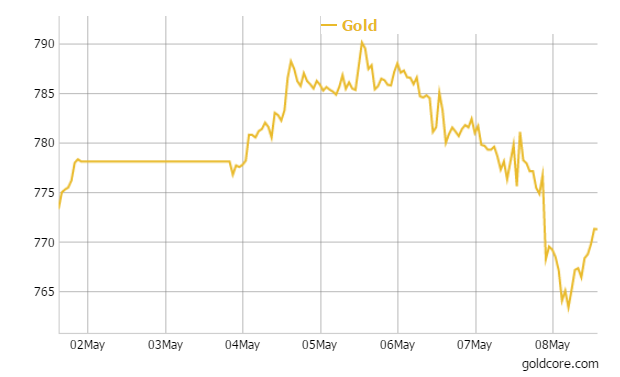

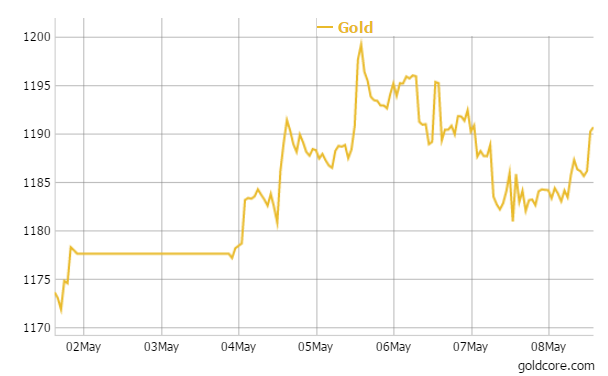

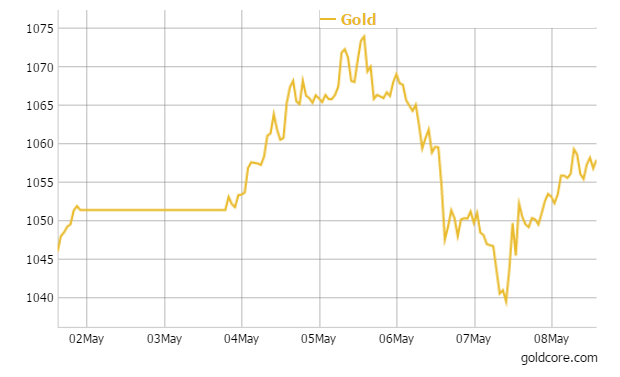

Today’s AM LBMA Gold Price was USD 1,185.25, EUR 1,054.26 and GBP 767.46 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,183.00, EUR 1,039.84 and GBP 776.94 per ounce.

Gold and silver saw small price drops yesterday of 0.74 and 1.15% per cent, closing at $1,185.90 and $16.31 respectively.

In Asia overnight, Singapore gold prices ticked marginally higher and were flat in London trading this morning.

Gold jumped to session high just above $1,190 per ounce, furthering gains for the week, after the jobs number was flat and largely as expected but not a great report overall.

In the light of recent poor data, participants may be concerned that the U.S. economy is weakening.

Gold in GBP – 1 Week

World bond and stock markets rose on today after a week of falls. Sterling surged to a two-month high against the dollar after the business-friendly Conservative party won Britain’s parliamentary election.

Sterling jumped 1.3 percent against the dollar but was flat against gold after gold recovered from initial losses.

London’s FTSE led equity markets with a 1.9 percent move higher to help European shares rebound from two-month lows and wipe out what had looked like being a second week of losses.

Download: 7 KEY GOLD MUST HAVES

Leave a Reply