Gold “Extremely Rare” – All World’s Gold Fits In Average Four Bedroom House

– Gold is extremely rare and all gold ever mined would fit in giant bar the size of a four bedroom house

– Gold is a tangible asset which always retains value – unlike paper assets

– Growing Chinese, Indian and Asian middle class provide “fundamental pillar of support” to gold

– Jewellery is not a suitable vehicle for gold investment due to high mark-ups and VAT

– “Something romantic about gold” and a “premium product” said Bobby Kerr

– Risk of further weakness in short term but buying opportunity presenting itself

– History and academic research shows gold a “hedging instrument” and safe haven asset

Research Director and founder of GoldCore, Mark O’Byrne, was interviewed by Bobby Kerr on Newstalk’s “Down to Business” on Saturday morning. A range of aspects pertaining to gold and the gold market were discussed including the rarity of physical gold; the enormous demand for gold from China and India and gold’s proven safe haven qualities.

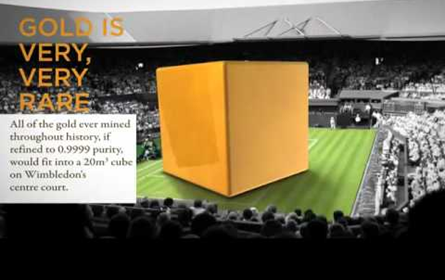

All the gold in the world in a giant gold cube (0.9999 pure)

When explaining the true scarcity of physical gold, Mark was asked whether all the gold ever mined would fit into a 4-bedroom house. Mark agreed, stating that if all above ground gold in existence were refined to 99.9% purity it would fit in a cube with 21-meter sides. This would be comparable to the centre court of Wimbledon or two olympic size swimming pools. It is therefore an extremely rare metal.

Gold is a tangible asset which, regardless of how poorly it may perform in the short term due to the ebb and flow of markets – always retains a value in the long term. When stocks and shares enter into crisis periods there is always the risk that their value can be completely erased as happened with Bear Stearns, Lehman Brothers and as almost happened to some Irish banks.

History and empirical data demonstrate that gold is a time-tested form of financial insurance said Mark O’Byrne. He cites Trinity College Dublin’s Brian Lucey and the work of Dr. Constantin Gurdgiev whose academic research shows that gold is a “hedging instrument” and a “safe haven asset”.

He refers to the old Wall Street adage that one should have 10% of one’s assets in gold and hope that it never works. The implication being that if the gold price is rising it is usually in an environment where stocks and shares, bonds, property and one’s business are suffering.

He emphasises that placing all of one’s wealth in gold is risky but an allocation is essential financial insurance.

When asked by Bobby whether the recent declines in prices were related to the crashing stock market in China, Mark pointed out that there have been a couple of months of weak demand from China but that on a quarterly or yearly basis demand remains robust. Chinese demand for this year is expected to amount to 1,000 metric tonnes.

The Shanghai Gold Exchange sees an average of 50 tonnes of gold bought each week but last week saw demand spike to over 60 tonnes. He points out that the middle classes of China and India do not trust banks or national currencies due to historical crises such as the Chinese hyperinflation of 1949.They therefore view gold as a currency and savings mechanism and prefer to save in that format.

In 1949, Chairman Mao banned ownership of physical gold in China and the market was not liberalised until 2003. Therefore, Chinese demand is coming from a population of 1.3 billion people who had no access to gold only twelve years ago. This offers a “fundamental pillar of support” to the gold price.

Mark explains that jewellery is not way to invest in gold. Investment grade coins and bars are 99.99% pure whereas jewellery in Ireland – mainly 9 carat – is 37.5% pure. The mark-ups on bullion coins and bars range from roughly 2% to 4% whereas the mark-up on jewellery can be as high as 300%. There is no VAT payable on bullion coins and bars whereas there is on jewellery.

Mark believes that some downward risk to the gold price remains due to the momentum of the recent severe correction in price. He points out that GoldCore had suggested on Bloomberg three years ago that a 50% correction in price was not unlikely at that time as is normal in long term bull markets.

However, in the long term gold should perform well due to the fact that the problems that led to the global debt crisis have not been addressed – too much debt globally. Indeed, debt levels have continued to surge which risks compounding the global financial crisis and risks a new and global debt crisis worse than the last one.

The Newstalk interview can be listened to here

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,098.60, EUR 992.42 and GBP 708.39 per ounce.

Friday’s AM LBMA Gold Price was USD 1,083.75, EUR 990.042 and GBP 699.89 per ounce.

Gold and silver fell over 3% and 1% respectively last week – to $1,098.70/oz and $14.69/oz.

Today, gold in Singapore ticked lower initially prior to seeing gains in late Asian and early Swiss gold bullion trading.

This morning in European trading, silver for immediate delivery was 0.3 percent lower at $14.78 an ounce. The metal slumped to $14.3842 on Friday, the lowest price since 2009.

Spot platinum fell 0.7% percent to $985 an ounce, while palladium fell 1.1% percent to $622 an ounce.

Must-read bullion guide: Gold and Silver Storage Must Haves

Leave a Reply