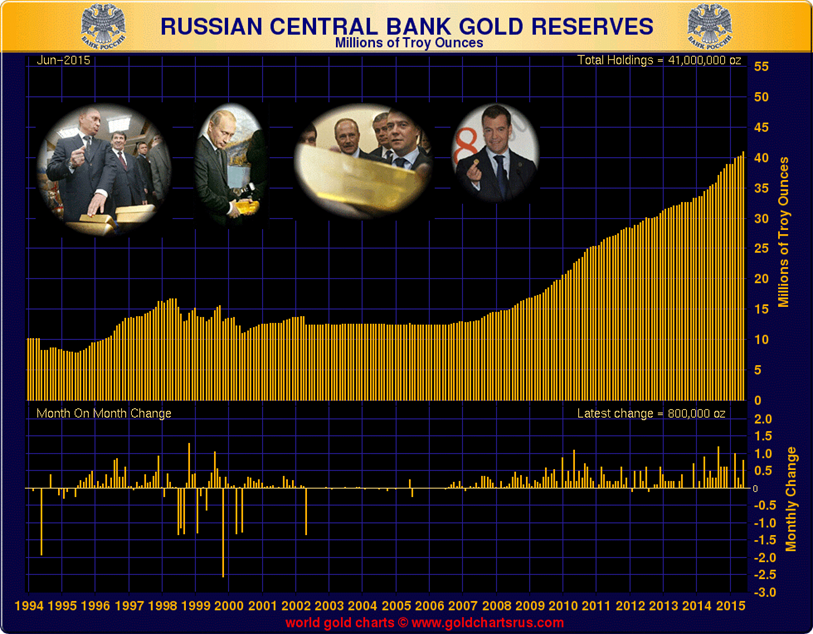

Russians Buy Gold Again In June – Another 25 Tonnes

– Russia adds another 800,000 ounces or 25 tonnes to gold reserves in June

– Russia’s has sixth largest gold reserves in the world

– Allocates 13% of FX reserves to gold

– Central bank buys all Russian gold production

– Other Russian gold demand imported

– If billionaire oligarchs diversify into gold, prices will rise sharply

– Russia views gold bullion as “100% guarantee from legal and political risks”

With all the focus on the Chinese lowballing their total institutional gold holdings, combined CIC, SAFE and PBOC, this week and the continuing attacks and manipulation of the gold market on Sunday night, the latest large increase in Russia’s gold reserves has gone largely unnoticed and barely covered by commentators – especially the more vocal bearish ones.

Russia continues to add to its gold reserves and added another 800 million ounces in June or another 25 metric tonnes, and analysts believe this buying will continue in the coming months.

Its total gold reserves now amount to 41 million ounces or around 1,275 metric tonnes, with a current value of just $48 billion. Russia’s total FX reserves are $362 billion and their gold allocation is now 13% of their total reserves.

In contrast, the U.S. is believed to have over 8,400 metric tonnes of gold and no foreign exchange reserves. The share of gold in foreign exchange reserves is much lower than in many other countries such as the U.S., Italy and France.

This ranks Russia in sixth place globally in terms of gold reserves behind the U.S., Germany, Italy, France and China after their PBOC announcement last Friday.

In 2014, Russia bought more gold in than in any year since the break-up of the Soviet Union. The country acquired over 173 metric tonnes according to World Gold Council figures. Reserve diversification intensified after April — averaging almost 20 tonnes per month.

Much of the gold bought may have come from Russian gold production which is currently at about 25 metric tonnes per month. In 2014, Russia was the third largest gold miner in the world at 266.2 tonnes, just six tonnes short of Australia in second place and China in first place.

Thus, the Russian central bank is generally consuming all of Russian gold production and sometimes having to import gold. Therefore, all domestic demand for gold and Russia is an increasingly wealthy nation with thousands of millionaires and hundreds of billionaires including mega rich oligarchs.

If any of these oligarchs decide to begin accumulating gold, then the already delicate supply balance in the physical gold market will be impacted and we will see much higher prices.

Data show that throughout the last year’s financial crisis Russia continued to add to its gold reserves. In December – when the rouble had crashed to 68.5 roubles to the dollar, down from 43 roubles six weeks previously – the Russian central bank intervened by selling $2 billion of currency reserves to support the rouble.

Despite the magnitude of the crisis in Russia – or perhaps because of it – the Russian central bank did not sell any gold. Indeed, since early 2007 has only sold gold on two occasions – both in 2012 and both times for relatively small amounts.

As the pressurised economy began to stabilise the central bank refrained from adding to its reserves buying no gold in January and February. In March it compensated by reentering the market with its second largest purchase in almost five years.

Clearly, Russia puts great strategic importance on its gold reserves. Both President Putin and Prime Minister Medvedev have been photographed on numerous occasions holding gold bars and coins as a display of economic stability and strength.

The successful stewardship of Russia’s economy out of crisis by its government in spite of sanctions has even led many investors surveyed by Bloomberg to view Russia as a good destination for investment.

While its gold reserves may not be on a par with western nations it is worth noting that neither is Russia’s debt. It’s Government Debt to GDP ratio is less than 18% whereas that of the U.S. and the UK are 101% and 82% respectively. Many European nations have much higher debt levels.

In the event of a new global debt crisis and an international monetary crisis, Russia is less fragile than many debt-laden western economies.

Investors would be wise to follow Russia’s example by reducing their exposure to debt and having an allocation to physical gold.

Must-read guide: Gold and Silver Storage Must Haves

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,096.80, EUR 1002.468 and GBP 702.38 per ounce.

Yesterday’s AM LBMA Gold Price was 1,108.00, EUR 1,021.15 and GBP 711.47per ounce.

Gold fell a marginal $3 to $1100.20 per ounce and silver rose 0.6% or 10 cents to $14.81 per ounce yesterday.

Today, gold in Singapore ticked lower, prior to gold bullion in Zurich moving sideways..

Silver for immediate delivery fell 0.6% to $14.86 an ounce. Spot platinum rose 1% percent to $973 an ounce, while palladium fell 1.2 percent to $622 an ounce.

Breaking News and Research Here.

Leave a Reply