Silver Bullion Demand Robust – Delivery Delays and Premiums Surge

– Silver imports into U.S. surge 33%

– Silver Eagle demand very robust

– Silver Eagles and Maples see 25% surge in premiums and shortages

– Silver price falls over 3.8% on same day as U.S. Mint runs out of silver eagles

– Total ETF Silver holdings remain robust – over 500 million ounces

– Increase in demand seems to becoming from large entities buying bars

– Silver is great value sub $20 per ounce

Demand for silver has been surging this year as seen in U.S. silver imports, while silver eagles coin sales and silver ETF holdings remain robust. Despite this, silver has again under performed other assets and has seen price falls again this year to multi year lows at $15 per ounce.

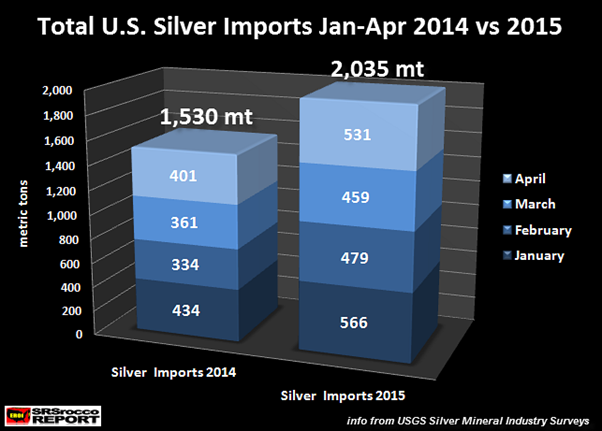

Silver imports into the U.S. have been substantially higher in every month so far this year compared to the same months last year according to the USGS data. So far, 2,035 metric tonnes have been imported into the U.S. this year – 33% more than the same period last year.

In the same period, industrial usage of silver has been fairly flat, the build-up in Comex inventories has been negligible and sales of U.S. Silver Eagles has been flat – partly because the U.S. Mint lacked the stock to meet demand.

Given that the three sources of demand listed above – which are typically the main sources of demand in the U.S. – have not contributed to the rise in silver imports it would appear that there may be new sources of demand in the silver market with large buyers – private or institutional – buying significant volumes of large silver bars

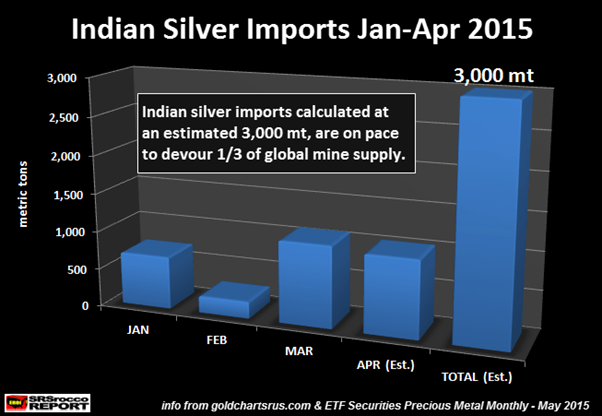

There is also significant demand for silver in India and indeed in Turkey:

There is a clearly a major disconnect between the price of silver as traded on exchanges and the supply and demand fundamentals. Since the end of January silver prices have declined by nearly 20% – from $18.28 to $15.40 even as demand rises.

Demand for Silver Eagles spiked in the first week of this month leading the U.S. Mint to run out of its entire August inventory of coins. This coincided with a counter-intuitive 3.8% plunge in price last Monday.

It would appear that prices are being forced down. This is likely being done to scare investors away in order to protect some large banks who are net short silver – and for whom a surge in price would be damaging – and possibly to facilitate large unknown entities to accumulate large volumes of silver at a knockdown prices.

Total Silver ETF Holdings – 2006 to July 13, 2015

Whoever these large buyers of physical silver may be it seems likely that they are well connected and well informed. It is speculated that JP Morgan may be among them or at least is acting on behalf of their clients.

It would appear that something significant is again happening under the surface of the silver market. Indeed, premiums for silver eagles and maples have surged 25% in recent days and there are increasing delays in getting delivery of silver bullion coins.

Silver is down 1.5% in 2015 (year to date) and by 35% over a one year period (July 13, 2014). It remains great value vis a vis most risk assets today. Equities, bonds and indeed many property markets look increasingly overvalued and ripe for serious corrections and potential severe bear markets and even crashes.

An allocation to physical silver will again provide essential insurance against financial instability and systemic risk.

Must Read Guide: 7 Key Gold & Silver Must Haves

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,154.95, EUR 1,043.13 and GBP 741.59 per ounce.

Friday’s AM LBMA Gold Price was USD 1,162.40, EUR 1,041.20 and GBP 750.30 per ounce.

Gold rose $1.60 or 0.14 percent Friday to $1,163.00 an ounce. Silver also grew $0.12 or 0.78 percent to $15.58 an ounce. Gold for immediate delivery fell for the first time in four sessions, declining 0.7 percent to $1,157.07 an ounce at late morning trading in London.

Gold retreated overnight despite considerable uncertainty regarding the outlook for a deal between Greece and its increasingly aggressive creditors. Gold fell prior to Greece securing a deal and a potential path to a new bailout

Gold had a third weekly drop last week, after falling to $1,147.36 on Wednesday, the lowest level since March 18.

This morning, the increasingly compromised Greek PM Tsipras, has agreed with creditors the reforms needed to start formal negotiations over a third bailout program in five years and remain in the euro.

Concerns about a possible fracturing of the common currency has added to gold’s safe haven appeal this year, but the price has remained tethered to the $1,200 price level despite many risks which would have been expected to see gold rise in price.

Bitcoin has collapsed 10% this morning – showing it may not be the “safe haven” asset that some have recently claimed.

As ever, it pays to keep an open mind but until bitcoin can display the long term and historical store of value characteristics that gold has done over the centuries and in recent times, it remains prudent to err on the side of caution and favour an allocation to gold bullion and indeed silver bullion over cryptocurrencies.

Breaking News and Research Here

Leave a Reply