“Like A Blind Man In A Dark Room Looking For A Black Hat Which Isn’t There”

Originally published May, 2004

For many months now I have been spending many long, enjoyable and fruitful hours reading hundreds of excellent essays in the modern day equivalents of the public library. These websites, their owners and contributors are similar to Martin Luther nailing his 95 theses to the door of the Castle Church in Wittenberg which lead to the Reformation. There are also analogous to the pamphleters of the American Revolution.

Excellent and informative websites such as www.gata.org, www.gold-eagle.com, www.lemetropolecafe.com,www.lewrockwell.com, www.dailyreckoning.com, www.financialsense.com, www.321gold.com,www.prudentbear.com, www.depression2.tv, www.urbansurvival.com, www.fiendbear.com,www.truthout.org, www.silver-investor.com, www.zealllc.com, www.usagold.com, and many others are the modern equivalent of Luther’s scroll or the American pamphleteers.

I am not exaggerating when I say that they have in effect given me a free financial, economic and monetary education.

The musings of the many wonderful minds who preach to goldbugs, contrarians, real anarchists, real patriots, conservatives and republicans, moralists, real believers in genuine free markets, solution seekers and a combination of them all, have had a significant impact on my worldview and indeed the direction in which my life is going.

Read our full article here.

DAILY PRICES

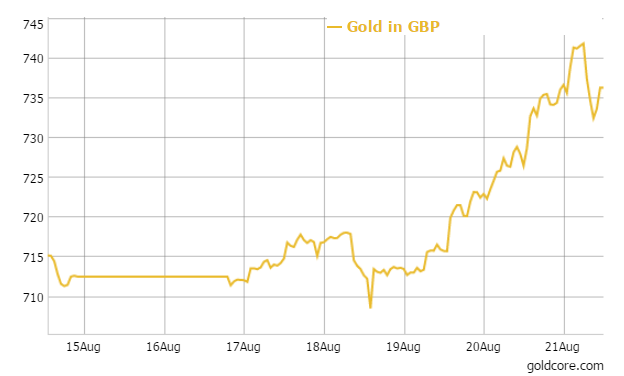

Today’s gold prices: USD 1,149.35, EUR 1,021.33 and GBP 732.75 per ounce.

Yesterday’s gold prices: USD 1,137.95, EUR 1,019.80 and GBP 7128,54 per ounce.

(LBMA AM)

Gold in USD – 1 Week

Yesterday, gold finished trading with a gain of 1.8% or $19.30, closing at $1,152.00/oz. Silver rose 1.5% or $0.22, closing at $15.48/oz.

Gold in EUR – 1 Week

China fanned worries that the world’s second largest economy may be slowing sharply. This and concerns about the Fed’s inability to increase interest rates led to safe haven demand.

The dollar’s is under pressure after comments by Federal Reserve officials this week suggesting they could not yet pin down a September rate rise given the weak global economy.

Asian and European stocks fell, following Wall Street, as fears took hold of a China-led deceleration in global growth. Activity in China’s factory sector shrank at its fastest pace in almost 6-1/2 years in August as domestic and export demand collapsed, a private survey showed.

Falling property and stock markets are fanning economic uncertainty and there is a new debt crisis which is exposing cracks in the $430 billion loan guarantee industry – a financial pillar of the country’s economic revival plan.

Geopolitical risk is also supporting gold as North Korean leader Kim Jong-un has ordered his frontline troops to be on a war footing, after an exchange of fire with the South across their heavily fortified border, state media report.

The KCNA report said Mr Kim declared a “semi-state of war” at an emergency meeting late Thursday. It threatened action unless Seoul ends its anti-Pyongyang border broadcasts.

Elsewhere, Prime Minister Alexis Tsipras resigned on Thursday, showing the fragility of the Greek financial situation.

BREAKING NEWS

Spot gold near five-week top as China worries spark safe-haven demand – Reuters

Asia Stocks Tumble as China PMI Hits Six-Year Low; Gold Climbs – Bloomberg

Gold prices up in Asia as China PMI flash survey shows dim picture – Investing.com

Top Metals Forecaster Says Fed Will Still Tighten, Hurt Gold – Bloomberg

Don’t be fooled by recent run-up in gold prices, say pros – MarketWatch

IMPORTANT COMMENTARY

Investors should plan for the worst – MoneyWeek

Interest rates must rise sooner rather than later, says Kristin Forbes – The Telegraph

Why Are So Many People Freaking Out About A Stock Market Crash In The Fall Of 2015? – InvestmentWatch

World shipping slump deepens as China retreats – The Telegraph

Click on News and Commentary

Download Essential Guide To Storing Gold Offshore

Leave a Reply