The Doomsday Clock Is Ticking

When the banking crisis crippled global markets seven years ago, central bankers stepped in as lenders of last resort. Profligate private-sector loans were moved on to the public-sector balance sheet and vast money-printing gave the global economy room to heal.

Time is now rapidly running out. From China to Brazil, the central banks have lost control and at the same time the global economy is grinding to a halt. It is only a matter of time before stock markets collapse under the weight of their lofty expectations and record valuations.

The FTSE 100 has now erased its gains for the year, but there are signs things could get a whole lot worse.

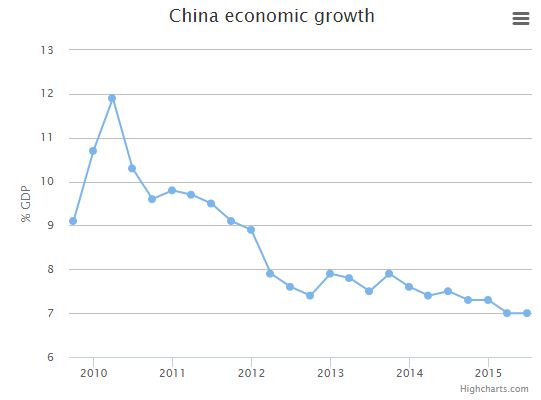

1 – China slowdown

China was the great saviour of the world economy in 2008. The launching of an unprecedented stimulus package sparked an infrastructure investment boom. The voracious demand for commodities to fuel its construction boom dragged along oil- and resource-rich emerging markets.

The Chinese economy has now hit a brick wall. Economic growth has dipped below 7pc for the first time in a quarter of a century, according to official data. That probably means the real economy is far weaker.

The People’s Bank of China has pursued several measures to boost the flagging economy. The rate of borrowing has been slashed during the past 12 months from 6pc to 4.85pc. Opting to devalue the currency was a last resort and signalled the great era of Chinese growth is rapidly approaching its endgame.

Data for exports showed an 8.9pc slump in July from the same period a year before. Analysts expected exports to fall only 0.3pc, so this was a huge miss.

The Chinese housing market is also in a perilous state. House prices have fallen sharply after decades of steady growth. For the millions who stored their wealth in property, it makes for unsettling times.

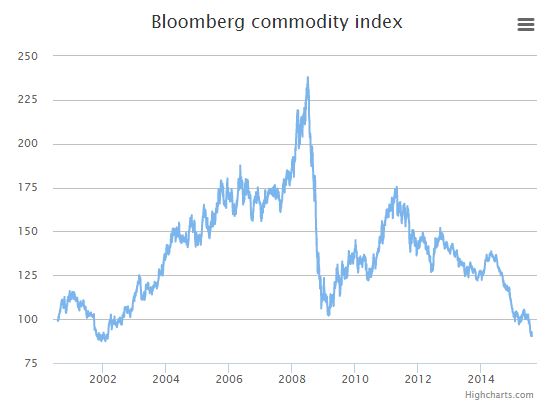

2 – Commodity collapse

The China slowdown has sent shock waves through commodity markets. The Bloomberg Global Commodity index, which tracks the prices of 22 commodity prices, fell to levels last seen at the beginning of this century.

The oil price is the purest barometer of world growth as it is the fuel that drives nearly all industry and production around the globe.

Brent crude, the global benchmark for oil, has begun falling once again after a brief rally earlier in the year. It is now hovering above multi-year lows at about $50 per barrel.

Iron ore is an essential raw material needed to feed China’s steel mills, and as such is a good gauge of the construction boom.

The benchmark iron ore price has fallen to $56 per tonne, less than half its $140 per tonne level in January 2014.

Leave a Reply