Gold Is Long Term Inflation Hedge – Leading Academic Expert

By Dr Brian Lucey

Recent research has begun to cast some doubt upon the inflation hedging capacity of gold.

The inflation experience over the last 40 years, since gold began to float freely, has been very mixed. In the 1970s we were concerned in relation to inflation, perhaps even fears of hyperinflation; now the talk is of deflation or disinflation.

The reality is that the relationship between gold and inflation is very time varying.

Research of mine (“On the Economic Determinants of the Gold-Inflation Relation”) found that when you exclude the 1980s there was in fact no stable relationship, on average. The nature of the time variation was mainly explicable by the trade weighted value of the US dollar (which of course is partially determined by inflation) and this strengthened the idea of gold as a money rather than as “just another asset”.

As important as gold being, or not, a hedge is over what period. It is conceivable to have an asset that performs a desired function over the short term but not over longer. More recent work (“Is Gold a Hedge Against Inflation? A Wavelet Time-Frequency Perspective”), using some sophisticated methods borrowed from audio processing and geophysics, allows us to decompose any hedge characteristic into various frequencies.

A further issue is around what kind of inflation – if we knew that inflation was to be 10% we could act. So it is important to look not only at realized but also at unanticipated inflation. Leaving aside the issue of how to obtain a decent forecast (to allow for a decomposition into anticipated and unanticipated) we find some very interesting findings.

First, yes, the 1970s and early 80s do see gold as a hedge against actual inflation.

But second, there are further periods when this happens.

And third, this happens not just in the USA but also in the UK, Japan (to some extent) and Switzerland.

Fourth, we find that gold works well at different frequencies.

Fifth, we find that it is not just CPI but also a variety of other inflation measures for which gold can act as a hedge.

And sixth, gold can act as a hedge against unexpected inflation but not unexpected deflation.

The paper contains detailed analysis for the UK, Switzerland and Japan, and also analyses gold bullion versus gold futures versus gold equities as alternative ways to seek exposure to gold’s hedging properties against a variety of inflation scenarios. Similar findings to the USA are found.

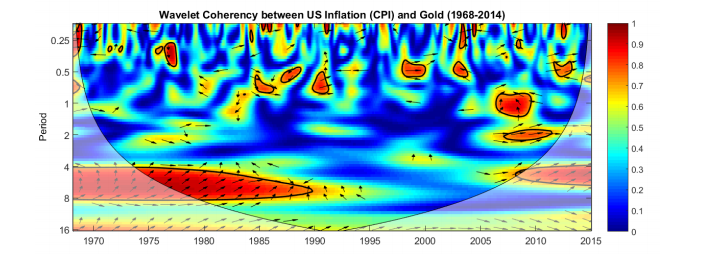

The graph above shows what we find for the USA. The horizontal axis is time. The vertical axis is the frequency, in months. Warmer colours represent stronger relationships. Upward facing arrows indicate gold leading inflation, downward the opposite.

Looking then at the USA we see a strong relationship from 1968 through 1990. This high coherency band suggests a strong long-run relationship between gold returns and changes in CPI, during a phase of above average inflation. Gold returns lead changes in inflation at this time.

An investment in gold acted as a strong long-run hedge against future increases in inflation.

Beginning from the early parts of the 2000s, a number of short but significant deflationary phases can be identified. In particular, a sharp period of decreasing inflation (deflation) occurred in the later part of 2008.

A band of high coherency centred on a period of one month is followed by a further band of high coherency centred on a period of 2 months. Declining gold presaged deflationary pressure. Furthermore, an extended period of high coherency is evident at periods between 4 and 8 months from 2008 onwards.

Advancing gold presaged increased inflationary pressure. The evidence found for the US indicates that gold returns have a positive relationship with changes in inflation during both inflationary and deflationary phases.

In other words, gold is generally not found to hedge against the risk of deflation, instead frequently displaying concurrent negative returns.

This relationship is particularly evident at long periods greater than four months, suggesting that gold’s inflation hedging properties are strongest for those with long investment holding periods.

In short, while gold can be useful as a hedge against inflation – this is consistently so only in the long run.

Dr Brian Lucey, Professor of Finance at the School of Business, Trinity College Dublin.

He studied at graduate level in Canada, Ireland and Scotland and holds a PhD from the University of Stirling. His research interests include international asset market integration and contagion; financial market efficiency, particularly as measured by calendar anomalies and the psychology of economics.

His research on gold has established that gold is important as a long term diversification due to gold’s “unique properties as simultaneously a hedge instrument and a safe haven.”

GoldCore will be conducting a Webinar next Thursday, October 22nd at 1600 (BST/ London/ UK time) in which we will open up the floor to attendees in our ever popular Question and Answer session.

Register Now and have your question answered by John Butler of Amphora Capital.

John will be giving a keynote speech at the Precious Metals Symposium in Sydney, Australia on October 26th and 27th and we are scheduling meetings with HNW clients for him while he is in Sydney.

Contact us at sales@goldcore.com if you wish to meet John in Sydney to discuss optimal strategies to access and allocate funds to the gold market today.

DAILY PRICES

Today’s Gold Prices: USD 1166.45 , EUR 1031.30 and GBP 753.94 per ounce.

Yesterday’s Gold Prices: USD 1174.40 , EUR 1035.08 and GBP 759.88 per ounce.

(LBMA AM)

Gold fell $9.90 yesterday to close at $1167.30. Silver was down $0.21 for the day, closing at $15.71. Euro gold fell to about €1029, platinum lost $16 to $1001.

Download 7 Key Storage Must Haves

Leave a Reply