Gold Demand in China Heading For Record and Reserves Increase 14 Tonnes In October

While gold prices continue to languish in the doldrums and are on course for their worst month since 2013, global demand and especially Chinese retail, investor and official demand continues to remain very robust. Indeed, China looks likely to see a new record demand for gold annually again in 2015.

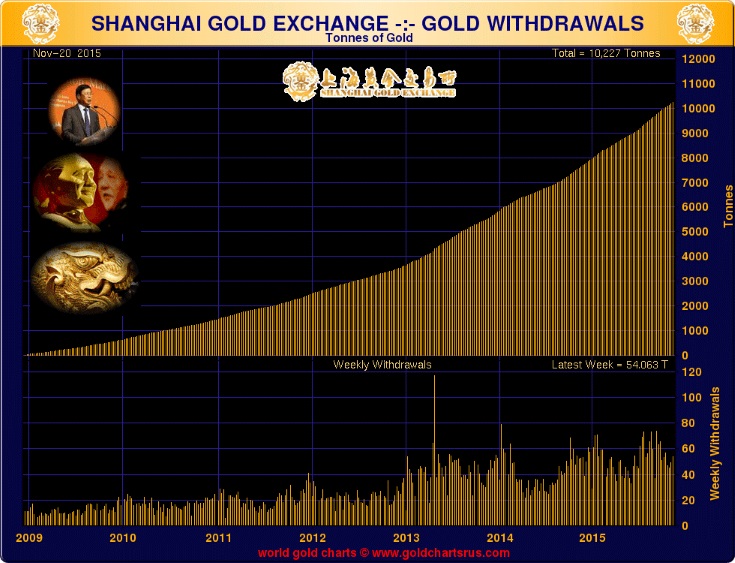

Shanghai Gold Exchange (SGE) deliveries as reported last Friday were again very robust with another 54.063 tonnes of bullion deliveries for the week ending November 20th. Shanghai Gold Exchange (SGE) deliveries remain the best indicator or proxy for actual Chinese demand and appear to show Chinese gold demand is heading for a new record in 2015 (see charts below).

China added another 14 tonnes or 450,000 troy ounces of gold bullion to its foreign exchange reserves in October.

Gold reserves rose to 1,722.5 metric tonnes or 55.38 million troy ounces at the end of October. This was up from 54.93 million at the end of September, data from the People’s Bank of China (PBOC) showed today.

China’s increasingly powerful central bank has been adding between 14 tonnes and 19 tonnes of gold every month. The strong demand and positive view of gold comes as the country looks to diversify its massive foreign exchange reserves of over $3.5 trillion.

China’s diversification into gold was again healthy and robust in ounce or weight terms but remains small in dollars terms at just $477 million at today’s prices – 0.00136% of fx reserves or 1.6% of fx reserves on an annualised basis.

China’s sharp devaluation of the yuan this summer sparked another gold bar and coin “buying spree” in China according to the World Gold Council in their recent Gold Demand Trends report. Prudent Chinese store of wealth buyers are again protecting their wealth from volatility and sharp falls in stock markets and indeed in some property markets.

Contrary to the widely held belief that gold bullion demand is subdued, it is actually very robust and, indeed, surging in key markets such as China. Data shows that surging demand for coins and bars and a rise in buying by central banks pushed physical gold demand up 7% in the third quarter. Demand for gold coins and bars jumped by 26% year-on-year in the last quarter, GFMS analysts at Thomson Reuters reported in the Q3 update of their Gold Survey 2015.

Retail investment surged in top buyers China, India and Germany – rising 26 percent, 30 percent and 19 percent respectively. Those three markets alone accounted for an additional 26 tonnes of bullion buying.

This data was confirmed by the World Gold Council. Their data shows global investment demand saw a significant rise of 27% to 230 tonnes, up from 181 tonnes in Q3 2014. Overall demand increased by 8% year-on-year to 1,121 tonnes as selling of futures contracts and ETFs contributed to a price dip, 6% in July, which buoyed gold bullion demand around the world.

Another example of how large concentrated liquidations in the futures market on the COMEX is for the moment leading to lower prices – artificially so – was seen in trading on Friday after the Thanksgiving holiday on Thursday.

More peculiar trading on the COMEX was seen when 18,000 gold futures contracts, worth nearly $2 billion, were dumped on the market at a time when the market was less liquid.

The nature of the selling again appeared to suggest that the seller may not have a profit motive in mind. The selling did both psychological and technical damage to gold. Gold sentiment already battered will not have been helped by the move and technically gold prices have fallen below what Goldman Sachs and others see as a “crucial level” technically.

As has been the case on a number of occasions in the course of gold’s bull market, gold prices are ignoring positive real world physical supply and demand factors as the futures market wags the tail of the gold dog.

We expect very robust Chinese and global bullion demand to bark soon and re-assert themselves and speculative players short the market may incur a nasty bite as will those with no allocation to physical bullion.

The deterioration in the fundamentals of the global economy are so important that the Fed are suggesting that they will increase interest rates.

Despite this, all eyes are again on the Fed and the possibility of a meager 0.25% interest rate rise. The Fed has been suggesting that this would happen for many months and, as ever, it is always best to watch what they do rather than what they say.

Ignore the noise of the Fed and continue to focus on the long term fundamentals driving the precious metals market. Even if they do increase interest rates today, negative real interest rates look set to continue for the foreseeable future.

Gold’s long term diversification value and benefits continue to be largely ignored in favour of simplistic analysis and a superficial focus on gold’s nominal price action in solely dollar terms.

Short term speculators and weak hands have again been washed out of the futures market due to the recent price weakness and many speculators are now short due to the poor technicals.

Prudent investors will continue to gradually accumulate physical bullion on dips like the Chinese. Given the variety of macroeconomic, systemic, geopolitical and monetary risks in the world today, owning gold and silver bullion in the safest vaults in the world has never been more prudent.

Read more on GoldCore.com

DAILY PRICES

Today’s Gold Prices: USD 1055.65, EUR 998.20 and GBP 703.05 per ounce.

Friday’s Gold Prices: USD 1064.65, EUR 1005.79 and GBP 707.73 per ounce.

(LBMA AM)

Gold in USD – 1- Years

Gold lost $12.00 on Friday closing at $1058.60, down 1.73% overall for the week. Silver closed at $14.10, down $0.09 which is a 0.56% loss for the week. Platinum continued its slide losing $15 on Friday, closing at $833.

IMPORTANT NEWS

Gold prices under pressure as dollar climbs – The Bullion Desk

Gold Heads for Worst Month Since 2013 as Central Banks Diverge – Bloomberg

Gold poised for worst monthly dip in 2-1/2 years – Reuters

Holiday shopping unlikely to cheer many investors – Reuters

IMF to make Chinese yuan reserve currency in historic move – The Telegraph

IMPORTANT ANALYSIS

“Very bullish outlook for the gold industry” – Bloomberg

Is This The Gold Cartel’s End Game? Gold Eagle

Paul Craig Roberts On Gold and “Massive Government Corruption” – ZeroHedge

Thanksgiving amid the Threats of War and Terrorism – Maudlin – Goldseek

Economy needs more than Luck – We Need a Plan B – McCarthy – Independent

Elites still can’t see just how much damage they are doing – Independent

Even after rate hike, Fed will probably keep rates unusually low for years – Bloomberg

More News & Commentary on GoldCore.com

Download Essential Guide To Storing Gold Offshore

Leave a Reply