A Riot Is Coming

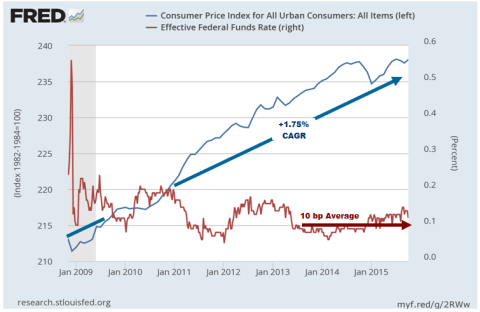

The chart below crystalizes why the Fed is stranded in a monetary no man’s land. By the time of next week’s meeting the federal funds rate will have been pinned at about 10 bps, or effectively zero, for 84 straight months.

Yet during that same period, the consumer price level has risen by 1.75% per year. And that’s if you give credit to all of the BLS gimmicks, such as hedonic adjustments for quality change, homeowners “imputed” rents and product basket substitution, which cause inflation to be systematically understated.

On a basis that is close enough for government work, therefore, the real money market interest rate has been negative 2% for seven years. But that’s so crazy, unjustified, and unprecedented that even the Keynesian money printers who run the Fed have run out of excuses.

Presumably, Yellen and her posse know that we did not have seven years running of negative real money market rates even during the Great Depression of the 1930s.

So after one pretension, delusion, head fake and forecasting error after another, the denizens of the Eccles Building have painted themselves into the most dangerous monetary corner in history. They have left themselves no alternative except to provoke a riot in the casino——-the very outcome that has filled them with fear and dread all these years.

Indeed, Yellen and Bernanke before her have made a huge deal out of communications clarity and forward guidance. But how do you explain to even the credulous gamblers and day traders on Wall Street that the business cycle has not been outlawed and that free money can not last forever, world without end?

Likewise, after all these years of saying that the dollar’s exchange rate is the responsibility of the US Treasury— and that the Eccles Building only does domestic monetary policy—– how will the Fed heads explain that they have wrapped themselves around the axle of an unrelentingly strong dollar?

And that they are impotent to stop the gale force of global deflation and recession being imported into the domestic economy by the inexorable unwinding of the massive dollar short that they have spent years fueling?

For years now the dollar has been a “funding” currency in the global casino—-something the gamblers borrowed or effectively sold short in order to pile into higher yielding EM debt, equities and commodities until they peaked awhile back.

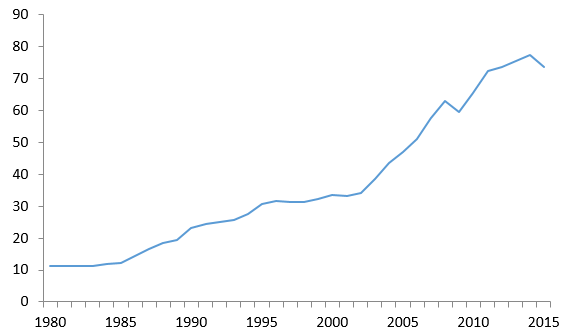

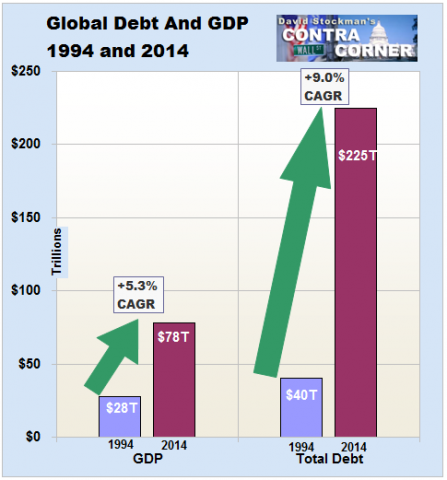

But the fantastic global credit bubble summarized below has now reached its apogee. China and the EM economies are rolling over into a debilitating deflation, thereby catalyzing the mother of all margins calls. This time subprime is lettered in Chinese and speaks with a Portuguese accent.

This time the correction will not be in the overbuilt and over-valued domestic (and other DMs like Spain) housing market. Instead, there will be a global CapEx depression and its contractionary cascade will cause the entire global economy to shrink for the first time since the 1930s.

In fact, it is already happening, even by the lights of the IMF. The world’s nominal GDP has dropped 5% in dollar terms during the past year, and that’s what counts because the world’s $225 trillion tower of debt is heavily denominated in dollars, or linked to it through exchange rates, most especially the Chinese RMB.

But unlike the short-lived recessionary dips of the past, the southward turn in the graph below still has a long way to go. Brazil is plunging into its so-called hard-landing and China is not far behind—-along with its supply chain and DM materials exporters like Canada and Australia.

Figure 1. Gross Planet Product at current prices (trillions of dollars, 1980 – 2015)

Source: IMF World Economic Outlook Database, October 2015.

Shrinking GPP (Gross Planet Product) is not even in the Fed’s vocabulary yet, and even when they do latch on to it, they won’t dare explain it honestly and cogently.

That’s because contracting GPP measures the abysmal failure of the two-decade long global experiment in massive central bank money printing, and the unsustainable credit fueled economic boom it enabled. And it is a stark reminder that the world’s effective leverage ratio will be rising—even as income and cash flow sink deeper into deflation.

So the Fed will have some heavy duty “splanin” to do, but it will be hard-pressed to come up with words that comfort the casino, rather than spook it.

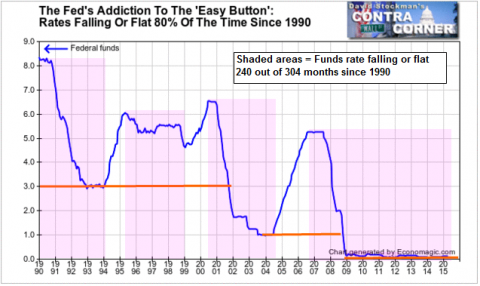

After all, for most of this century the Fed’s post meeting statements and minutes have been progressively degenerating into embarrassingly empty pabulum; and its seemingly rock solid voting consensus was an artifact of being on the Easy Button 80% of the time.

In that environment there was little to debate and less to explain. They simply delivered an economic weather report and urged Wall Street to hang on for the ride.

But now the Fed must emerge from the shaded zone shown above for the first time on a sustained basis since the 1980s. Yet as it seeks to explain a macro-economic slump that it absolutely did not see coming, and confesses to its complete lack of policy tools to reverse the worldwide deflationary tide now lapping at these shores, its statements will be reduced to self-evident and self-contradictory gibberish.

Likewise, the 19 members of the Board will take to noisy public quarrelling right in front of the boys and girls on Wall Street for the first time in their lives.

The reason that there will soon be a riot in the casino, therefore, is not owing to the prospect of a 25 bps pinprick after all this time on the zero bound.

The hissy fit will happen because the Fed’s words and actions starting next week will not say “we have your back, keep buying”.

The message will be “we are lost and you are on your own”.

And that’s not “priced in”. Not even close.

Evidence that a completely new monetary policy ball game is commencing comes from JM Keynes’ current vicar on earth himself, Larry Summers. Three days ago he penned a strange op ed in which he apparently reminded himself that the business cycle has not been outlawed——something most non-PhDs presumably already knew:

U.S. and international experience suggests that once a recovery is mature, the odds that it will end within two years are about half and that it will end in less than three years are over two-thirds. Because normal growth is now below 2 percent rather than near 3 percent, as has been the case historically, the risk may even be greater now. While the risk of recession may seem remote given recent growth, it bears emphasizing that since World War II, no postwar recession has been predicted a year in advance by the Fed, the White House or the consensus forecast.

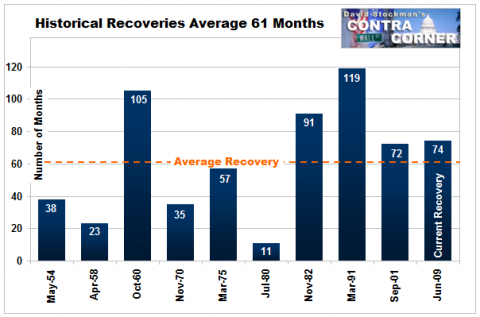

Well now. If you wait until month 78 of a business expansion to end the emergency policy, and then hesitate to venture more than a few basis points off the zero bound, you will indeed use up the remaining runway right quick.

That’s because the average of ten business cycle expansions since 1948 have lasted but 61 months; and the only expansion that was appreciably longer than the present tepid affair was the 119 month stretch of the 1990s.

But let’s see. Back then the Fed’s balance sheet was $300 billion, not $4.5 trillion. The world had less than $40 trillion of debt or about 1.4X GDP, not $225 trillion or nearly 3X global income.

And, most importantly, China was still a quasi-agrarian victim of Mao’s destructrutive experiments in collectivist economics and state generated famine, not today’s towering Red Ponzi.

That is, it was irrelevant then, but is now a bloated economic whale sinking under the weight of $30 trillion of debt and the most reckless spree of over-investment and mindless public and private construction in recorded history.

So as this domestic business expansion cycle get long in the tooth, the US economy is confronted by a veritable engine of global deflation in the form of China and its EM supply chain. After a 20-year credit driven boom, it now payback time. All of these economies find their exports stalled, their exchange rates falling, and their debt service exploding higher.

What this means, of course, is that Wall Street’s “decoupling” myth will soon be on the scrap heap. US exports and imports are now crumbling, and even the standard measures of goods transit are cliff diving.

Likewise, today’s wholesale report for November was a red alert warning that a big recession inducing inventory liquidation is just around the corner. Even if Janet Yellen won’t find this chart on her dash board of 19 lagging labor indicators, the message is unmistakable.

According to Dr. Summers, the thing to do when recession strikes is to cut interest rates by 300 basis points. But even he admits it ain’t going to happen this time.

Even if were technically possible to have a negative 300 bps federal funds rate, what is already a 2016 election year gong show would take on a whole new level of crazy. The brutally trod upon savers and retirees of American would well and truly revolt.

Historical experience suggests that when recession comes it is necessary to cut interest rates by more than 300 basis points. I agree with the market that the Fed likely will not be able to raise rates by 100 basis points a year without threatening to undermine the recovery. But even if this were possible, the chances are very high that recession will come before there is room to cut rates by enough to offset it. The knowledge that this is the case must surely reduce confidence and inhibit demand.

Central bankers bravely assert that they can always use unconventional tools. But there may be less in the cupboard than they suppose. The efficacy of further quantitative easing in an environment of well-functioning markets and already very low medium-term rates is highly questionable. There are severe limits on how negative rates can become. A central bank that is forced back to the zero lower bound is not likely to have great credibility if it engages in forward guidance.

So if the endlessly clever word-splitter who currently heads the church of Keynes on earth can do not better than the above ill-disguised punt, can you imagine what blithering incoherence will be contained in the meeting statements as the recession gathers force next year?

Yes, there will be a riot in the casino.

Reprinted with permission from David Stockman’s Contra Corner.

The post A Riot Is Coming appeared first on LewRockwell.

Leave a Reply