Central Banks Have Pushed the Middle Class Down into Neofeudal Serfdom

In traditional feudal systems, serfs were the landless peasantry who worked the land of their feudal lords in exchange for protection. In our present-day neofeudal system, serfdom has a different definition: present-day serfs own little or no productive capital and have few opportunities to ever acquire any.

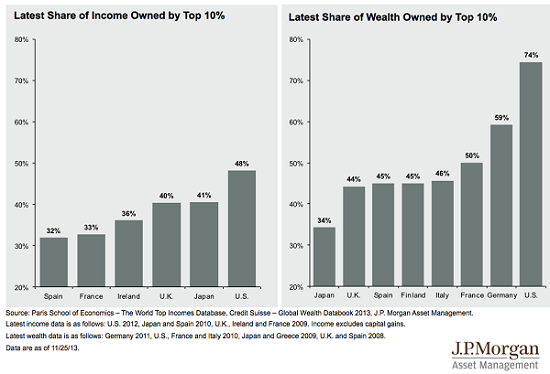

The Marxist term wage-slaves describes those who, lacking capital, have only their labor to sell. This describes the vast majority of people in both capitalist and socialist systems, but what makes the present system neofeudal is the central banks: by extending essentially unlimited credit at near-zero interest rates to financiers and corporations, the central banks have given the top .01% the ability to outbid mere savers for income-producing assets (i.e. productive assets).

Just as the feudal-era serf had no choice but to enslave himself and his family to the manor-house lord, the modern-day serf must indenture himself to banks to “own” a car or home or “buy” a college education.

The X22 Report and I discuss this and related topics in the podcast Central Bankers Are Creating A World Where We Are All Serfs (38:10).

As I outlined in The Flaws in Basic Income for Everyone, all the guaranteed basic income schemes being proposed as solutions to automation are merely institutionalized serfdom as they sentence the unemployed to the marginalized political status (equivalent to powerless serfs) of state dependents while stripping them of purposeful work and the opportunity to acquire the means of production and productive capital.

Guaranteed basic income is thus the perfection of neofeudal serfdom.

The central banks are the critical enforcers of this neofeudal system. Without access to unlimited credit at near-zero rates, financiers and corporations would not be able to outbid savers for productive assets.

Here’s an example that illustrates how central banks have created a neofeudal system. In an economy not suffering from extremes of central-bank financial repression, home mortgages in recent decades were around 7.5%. This rate of interest (coupled with strict lending standards) was high enough to make credit-fueled bubbles difficult to inflate, so homes cost $100,000.

Those who had saved $50,000 had an advantage over financiers who were borrowing the full $100,000. The base operating costs of buying the home as a rental (investment) property was roughly $4,000 more annually for the financiers than for the savers: the savers’ $50,000 mortgage cost around $4,000 a year (not including property taxes and other expenses of ownership) while the financiers’ mortgage was around $8,000 annually.

This difference was large enough to make the property unprofitable for the financiers to buy and rent out, and large enough to make it a risky bet to buy the home and hope appreciation exceeded the annual expenses.

If the home rented for (say) $1,200 per month, the financiers’ higher mortgage expenses put them at a disadvantage to the saver/owner, who had a significantly lower monthly expense.

Contrast this with the world of today, where financiers can borrow essentially unlimited sums at rates far below what savers can get. As a direct result of ultra-low rates for banks, corporations and financiers, even high-earning wage-slaves cannot outbid the financiers for productive (i.e. income-producing) assets.

If a person is unable to earn enough to save, and is unable to compete with financiers and corporations for productive assets, that person is a modern-day serf, a debt-serf indentured to banks and stripped of opportunities to own the sort of assets the Financial Nobility use to accumulate ever-greater wealth and income.

The injustice of this central-bank enforced neofeudalism cannot be suppressed like interest rates.

Leave a Reply