The Frogs Are Boiling Again

Yesterday’s spasm of machine rage begs a question. After the S&P 500 has chopped sideways for 600 days in no man’s land either side of 2060 and given the baleful headwinds now gathering from all points in the global economy, there is absolutely no reason to stay in the casino.

At Tuesday’s closing level there was, at best, a 2% upside back to the May 2015 high of 2130, and a momentary one at that. In the other direction stood the prospect of at least a 40% of downside to 1300 (15X current shrinking earnings of $87/share) when the third great central bank bubble of this century inexorably bursts.

Anyway, the likelihood was that the machines would take it all back at the first chance. That was today.

So why do the frogs of Wall Street stay in the boiling pot?

Some do because they are perma-frogs. Not having been boiled for 7 years, they have apparently forgotten the pain.

Jeffrey Saut of Raymond James, for instance, told CNBC today that the water is actually still a tad on the cool side. Why earnings this year are projected at $118 per share and next year’s looking like $135.

So that’s a perfect 15.4X and, besides, we are not merely heading for a second half rebound from the Q1 GDP bottom. According to Saut, public policy is fixing to get more effective and supportive of the market, too.

You could wonder, of course, whether he had Hillbama or Wild Man Trump in mind as to the latter point. Or you could just say the man feels no heat because he has wetted himself in his own Cool-Aid and be done with it.

But either way, he’s not alone. Wall Street’s sell side machinery can’t seem to let loose of its perma-hockey stick or faith that Washington’s bailout squad stands at the ready. Accordingly, punters believe they have perpetual leave to stay in the pot.

In March 2014, for instance, the street consensus was for operating earnings of $137 per share in 2015. The year’s done now, and the outcome was 37% lower at $100 per share.

But never mind. In March 2015, the hockey stick for 2016 also pointed to$135 per share, including $30.91 per share in Q1. The latter’s now mostly in too, and it came 33% short at $20.70 per share. So the full year has already been marked down to $115 per share and there are still nine months to go.

Yes, Saut is right. The estimate for the LTM period ending in December 2017 is currently $134.15 per share. But then it always is—-meaning that the magic 15X doesn’t mean anything at all.

What actually explains the lack of fear is the false narrative of financialization and the absolute dominance of capital and money markets by central bankers wedded to a primitive Keynesian economic model. Along with their camp followers on Wall Street, the latter has propagated an alternative reality that is based on rank speculation, not a capitalist enterprise.

For instance, there has been no meaningful growth of breadwinner jobs, real household incomes, labor inputs to the business economy or real net investment since the turn of the century, or even longer. But no matter. The BLS establishment survey says that jobs are being created at a healthy monthly rate. According to our Keynesian monetary masters that mean rising incomes, spending and growth are just around the corner.

No, they are not. The establishment survey is not a survey; it’s a cycle-adjusted model projection that is always a day late and a dollar short when it comes to macroeconomic turning points.

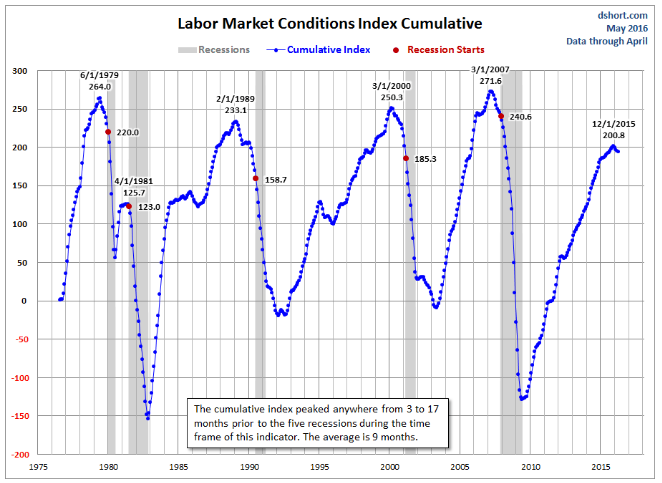

As elaborated in a nearby post, the “labor market conditions index” has a far better record anticipating an oncoming recession. As shown below, it has generally issued warning signals a year in advance and is doing so now.

The next chart is a calculation of the cumulative value of LCMI (each month is the sum of all previous months). We’ve highlighted the peaks and recession starts. The cumulative value peaked anywhere from 3 to 17 months prior to the five recessions during the time frame of this indicator. The average is 9 months. We are now four months beyond the most recent post-recession peak in December 2015.

The above shouldn’t be surprising. The domestic expansion cycle is already long in the tooth at 84 months, and it is now being battered by an unprecedented global deflation. The latter originated in China’s Red Ponzi, has cascaded through its global EM supply base where exports and output are plunging, and is leaping up on the shores of Japan and Germany-led Europe, as well.

In fact, Japan is entering its second recession since embarking on the madness of Abenomics, and German industrial production has now dropped for two months in a row. On the margin, as China’s $30 trillion credit and madcap construction bubble finally collapses, the export of high-end capital goods and luxury products to China from Europe and Japan is slumping, too.

But the global credit bubble has reached its apogee—–with total debt outstanding having exploded from $40 trillion in the mid-1990s to a growth-smothering total of $225 trillion at present. During the interim, debt grew at a rate nearly 4X faster than GDP, but now the laws of arithmetic and sound money are catching up.

That is, the world is at Peak Debt and more money pumping can have only one result. Namely, a finally blow-off of liquidity driven financial market bubbles, and a race to the currency bottom.

The desperate stop/go monetary machinations in China should be proof enough. After the lunacy of last year’s stock market bubble in which upwards of $4 trillion of market cap was created between March and June 2015, an even crazier commodity bubble has just exploded and then burst—-all within the last 45 trading days.

But then again, when you generate new debt at a rate of $4 trillion per year or 40% of GDP, as the Red suzerains of Beijing did during Q1, monumental bubbles are exactly what should be expected.

The frogs of Wall Street, of course, have no clue. Even as the water temperature rises to the boiling point, you can still hear them declaiming that the crude oil bottom is in and that commodities and the materials sector are on the mend. Load up on some Exxon and BHP!

Needless to say, the global deflation is just getting started and the US economy has not decoupled from the world in the slightest—even if Donald Trump wants to make it so.

Macy’s disastrous Q1 results, which included a 6% decline in same-store sales, are as indicative of anything else. Management pointed out that US sales charged to foreign credit cards plunged by 20% and that its stores in Texas and elsewhere in the energy belt have now taken an unexpected turn for the worse. Exactly.

The fact is, domestic business sales are down by 5% from their mid-2014 peak, and inventory ratios have climbed to outright recessionary levels. Likewise, CapEx is weakening rapidly, domestic trucking and rail indices have lunged into negative territory and even subprime-fueled auto sales are rolling over.

Last time the Fed’s money-pumping exercise in bubble finance ran out of steam in 2007, an unmistakable “X” appeared in the labor market data. That is, the index of labor conditions rolled over in January 2007, even as the monthly BLS job count continued to rise, adding nearly 1 million “new jobs” before peaking 12 months later in January 2008.

Alas, another year later 4.5 million of this peak “jobs” had disappeared—–on the way to an eventual plunge of 9 million.

Here’s the thing. About 90% of Q1 earnings are now in, and the S&P’s LTM EPS has posted at $87 per share. That figure, of course, is the GAAP number reported to the SEC on penalty of jail time.

Accordingly, actual profits are down by 18% from the $106 per share peak of September 2014, and that means Wall Street’s frogs are now boiling in water that has heated to 23.7X.

But don’t tell the Jeffrey Saut brigade. The abominable “X” is back, too, and even the casino empties out when the recession actually hits.

But that’s not the half of it. Wall Street’s cockeyed faith that another stock market bailout is on the way rests on the idea of a post-election return to fiscal stimulus—-since even the casino punters now see that the jig is up on ZIRP, NIRP, and QE.

Here’s the problem. When General (Paul) Ryan gets together in the oval office with either Hillbama or the Donald next February the budget projections will already be deep in trillion dollar deficits under current policy. Therefore, what will get stimulated, if anything, is a colossal political firestorm over who bankrupted the nation.

There will not be another fiscal stimulus this go round. This time, the frogs of Wall Street will be left to boil.

Reprinted with permission from David Stockman’s Contra Corner.

The post The Frogs Are Boiling Again appeared first on LewRockwell.

Leave a Reply