Tyranny of the PhDs

Sad to say, you haven’t seen nothin’ yet. The world is drifting into financial entropy, and it is going to get steadily worse. That’s because the emerging stock market slump isn’t just another cyclical correction; it’s the opening phase of the end-game.

That is the end game of the Ph.D. Tyranny.

During the last two decades, the major central banks of the world have been colonized lock, stock, and barrel by Keynesian crackpots. These academic scribblers and power-hungry apparatchiks have now pushed interest rate repression, massive monetization (QE) and relentless rigging of the financial markets to the limits of sanity and beyond. Honest, market-driven price discovery is dead as a doornail.

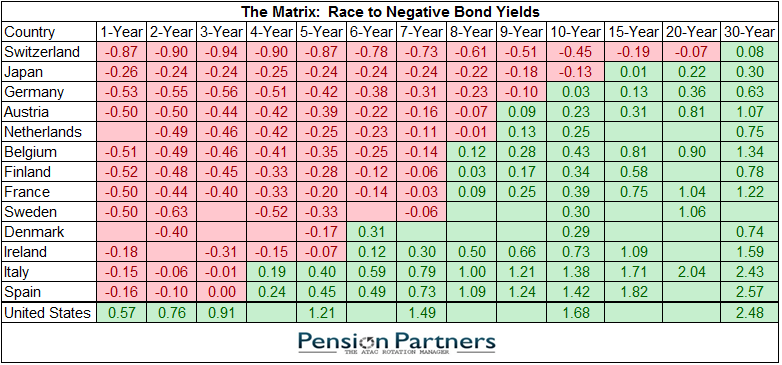

No more proof is needed than the “matrix” below. The very thing that financial history proves, above all else, is that governments can’t be trusted to honor their debts. And that cardinal fact is supposed to be embodied in the yield.

In fact, modern welfare state democracies have a veritable fiscal death wish.

What else can you call Japan’s announcement to defer yet again an increase in the consumption tax? Its public debt is already at 240% of GDP, even as its tax-paying population is rapidly streaming toward its national old age home.

At a 135% debt-to-GDP ratio, Italy is not far behind. Its economy is still smaller than it was in 2007, its banking system has more than $200 billion of bad debt, its public sector squanders more than 50% of GDP and its politically fractured and corruption-ridden government is paralyzed.

Yet these are only advanced cases of the universal fiscal condition of the world’s sovereigns. With $80 trillion of public debt and unfunded entitlement liabilities, the US government is hardly more solvent than the socialist basket cases of Europe.

Once upon a time, the tendency of politicians to bankrupt the state was at least partially held in check by the fear of bond vigilantes and the prospect of soaring interest costs on the public debt. I happened to be there during one such episode when the 10-year treasury note required a 15% coupon.

It was enough to cause even Democrats to denounce deficits!

That is, at least until the GOP took a powder on social security and other entitlement reforms. At length, a tax-cut bidding war and DOD war spending spree supplanted most of the old-time fiscal religion. And then Greenspan finished the job when he threw in the towel on monetary discipline in 1994.

Once upon a time, too, the interest rate on debt reflected compensation for credit risk and inflation—-and a real return to boot.

At the moment, however, “investors” aren’t getting paid for any of these costs. Instead, thanks to the madmen running our central banks they are actually being forced to pay governments to borrow.

Moreover, that’s not an aberrant condition in the far recesses of the global bond market. There is now $10 trillion of sovereign debt securities with negative yields—–and that figure is growing by the week as it cascades across government bond markets and out the maturity spectrum.

There could be nothing more perverse than for the central banking branch of the state to destroy the very government bond market on which modern state finances ultimately depend. But that’s exactly what they are doing, and the end-game could not have been expressed more colorfully than in the recent musings of the once and former bond king, Bill Gross:

Bill Gross, the manager of the $1.4 billion Janus Global Unconstrained Bond Fund, warned central bank policies that pushed trillions of dollars into bonds with negative interest rates will eventually backfire violently.

“Global yields lowest in 500 years of recorded history,” Gross, 72, wrote Thursday on the Janus Capital Group Inc. Twitter site. “$10 trillion of neg. rate bonds. This is a supernova that will explode one day.”

To be sure, a supernova at least has a basis in physics. It’s an end-of-life star that suddenly increases in brilliance owing to a catastrophic explosion that ejects most of its mass.

Not NIRP. There is nothing natural or scientific about it. And it’s the opposite of brilliant.

It’s an economic mutant confected by arrogant Keynesian economists who inhabit a puzzle palace of fantasy. Not only do they have the nerve to believe that a tiny posse of monetary central planners has the capacity to price money, debt, capital and risk more correctly than the millions of agents that once populated free financial markets, but they do so in the name of invisible measuring sticks and prompts.

Thus, a recent piece in the Wall Street Journal highlighted a debate inside the Eccles Building which borders on sorcery.

Fed officials disagree about their likely end point, in part because they are struggling to understand why another underlying interest rate—the mysterious natural rate—has fallen in recent years. And for that many are turning to the musings of Knut Wicksell, a Swedish expert on the subject who died 90 years ago.

According to the textbooks, this so-called natural rate is the inflation-adjusted rate that’s consistent with the economy operating at its full potential, expanding without overheating. Also known as the equilibrium or neutral rate, it balances savings and investment.

The natural rate can’t be observed directly; the Fed knows it has been reached only by how the economy responds. “It’s like discovering Pluto: you can only see the effect of the gravitational pull,” said Eddy Elfenbein, an investor and blogger at the site Crossing Wall Street, comparing it to the dwarf planet whose existence was inferred from the orbits of Uranus and Neptune.

Well, no. There is no such thing as the “natural rate of interest”.

There are pegged rates confected by central bankers who flood the market with printing press cash, thereby artificially tilting the supply/demand balance of savings and borrowings; and there are market rates discovered by the continuous interaction of savers and borrowers.

In an honest free market, savers need a rate high enough to induce them to forgo current consumption from their earnings and profits, while borrowers are constrained by their capacity to service their debts from current income and/or the return on funded assets.

The resulting market rate of interest reflects a continuous adjustment of these supply and demand balances. Its level over time can be influenced by a multitude of factors including demographics, technological change, entrepreneurial dynamics, wars, droughts, floods, taxes and the regulatory intrusions of the state, to name a few.

One thing is certain, however. When the animal spirits get too rambunctious and the herd of speculators causes the demand for credit to soar, bubbles get shut down. When no more savings can be coaxed out of current income by rising interest rates, the market clears; the business cycle self-corrects.

Modern central banking, by contrast, mutes, overwhelms and eventually cancels out all of the price signals that are processed into shaping the market rate of interest. Instead, monetary central planners attempt to peg the rate based on purely theoretical constructs and standards——benchmarks which are ultimately arbitrary and virtually certain to be wrong.

In that context, in fact, the “natural rate of interest” is just a derivative of the mythical notion that there is such a thing as full employment GDP. Indeed, it appears that one of the more intellectually addled members of the Fed board has spent his professional life studying exactly that:

We’re seeing no pickup, none whatsoever, in the natural rate even as the economy has gotten back to full strength,” John Williams, the San Francisco Fed president who has spent years studying it, said in a recent interview with The Wall Street Journal.

That’s right. By the lights of John Williams, the natural rate of interest has dropped from 2-3% as recently as the first decade of this century to a negative level at present. And that implies, according to this Ph.D. soothsayer, that nominal interest rates must be pegged to the floorboard, or even lower, for the indefinite future because the US bathtub of potential GDP has not yet been filled to the brim.

Yet all of the data points represented in the 50-year blue-shaded area of the chart below, which has now purportedly morphed into the sub-zero area of orange, represent the interaction of essentially unknowable economic variables.

To wit, potential GDP, full-employment labor utilization, fixed asset production capacity and the general rate of inflation cannot be measured with enough accuracy or specified with enough precession or remain fixed for a long enough duration to even remotely validate Williams’ calculations, as portrayed in the chart.

The man has essentially been graphing statistical noise. Indeed, he and the rest of the Keynesian posse have turned the financial markets of the world into incendiary gambling casinos while in hot pursuit of what amount to economic unicorns.

That the above 55-year graph of the purported natural rate of interest is pure academic gobbledygook is evident from two of its crucial ingredients——the inflation rate and the level of potential GDP.

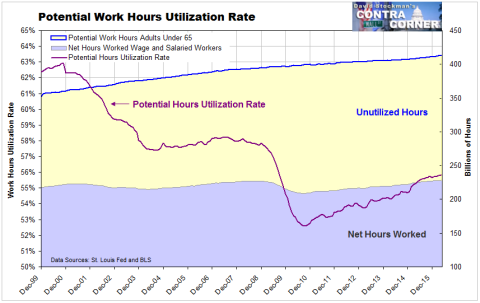

As to the latter, it’s derived essentially from the level of full employment labor and its actual utilization rate. The difference is a proxy for the potential GDP gap, but there is one humungous problem, as depicted in the graph below.

To wit, the full employment utilization rate is an utterly arbitrary guess. It could lie anywhere in the yellow area of the chart, depending upon a myriad of factors as diverse as welfare state policies and family values. If there were no student loans and disability benefits were based on 1980 standards, for instance, the number of employed hours from the 182 billion unutilized hours at present would be considerably higher.

As we demonstrated recently, in a world in which labor has been globalized and atomized into hours and gigs, the notion of headcount based labor metrics, as embodied in the U-3 unemployment rate and the monthly jobs count, is obsolete and essentially meaningless. Yet that’s what academic shamans like Williams use to estimate the natural rate of interest.

By contrast, the only thing that can really be said about the potential labor supply (accepting for the moment the convention that the retirement age begins at 65 years) is that it vastly outstrips current utilization levels.

In fact, the “unemployment ”gap between potential and actual labor hours is due to countless changing factors which are far beyond the reach of monetary policy; and which respond weakly or not at all to the zero and sub-zero interest rates that are purportedly required by the natural rate.

Thus, the chart above starts with the maximum parameter. It assumes that adults under 65 can potentially supply a standard work year of 2000 hours or about 413 billion hours per year. At the same time, the vast yellow-shaded area in the chart, representing unutilized potential hours, embodies a whole variety of policy factors and cultural values and mores which keep labor hours on the sidelines.

As we pointed out last week, there are upwards of 18 billion hours unavailable due to social security disability recipients; 40 billion outside the production economy owing to post-secondary education enrollments; 28 billion due to the part-time nature of “jobs” in the leisure, hospitality and related service sectors; and 25 billion because mothers with children have chosen to work at child-rearing and homemaking in the unmonetized household economy. Yet 20 years ago, all of these factors generated a substantially different supply effect.

Moreover, for all of these reasons, and countless more, the utilization rate of potential adult labor hours in the US economy has slide sharply lower—–from about 63% at the turn of the century to just under 56% today.

You could call the reciprocal of 44% the true unemployment rate and be no more arbitrary than are the natural interest rate calculations of Williams and his fellow money printers at the Fed and other central banks.

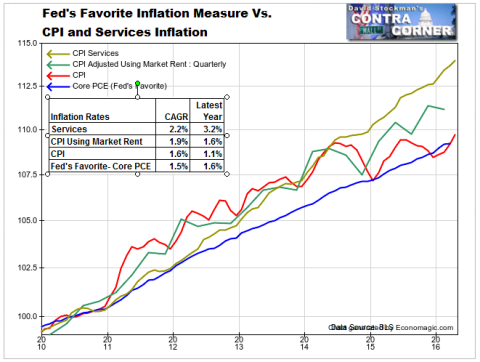

The story is even more preposterous with respect to the inflation component of the calculation. The above depiction of the natural rate of interest slouching into the sub-zero zone assumes that there has been a sharp, secular decline in the rate of consumer level inflation.

There hasn’t been. What has happened is that the BLS and other government statistical agencies have continuously shortened the inflation-measuring stick over the last four decades in the name of purely academic theories like hedonics.

That is, they adjust the rising retail price of new autos sharply downward because features like 10 airbags and navigation supposedly represent higher utility and more car for the buck.

Perhaps they do, but the amount of gain is a completely subjective matter, and its quantification by GS-16s is little more than a stab in the dark. What hasn’t changed, by contrast, is that more than 100 million workers need much higher priced cars to get to work, airbags or no and whether they need navigation to get there or not.

So if the secular rate of inflation is falling, it’s because other agencies of the state have been clipping the measuring stick. That is no proof that the natural rate of interest is falling, and it’s no justification whatsoever for interest rate policies which capriciously crush savers and subsidize borrowers.

Even then, by most measures the rate of inflation is still above 2% on a trend basis. The exception is the PCE deflator less food and energy.

Over any reasonable period of time, however, that particular measure of the general inflation rate is experienced by exactly no one.

Yet it has been adopted by the central banker PhDs for no better reason than it is the shortest stick in the pack and thereby provides a maximum license for pegging money market rates at artificially low levels.

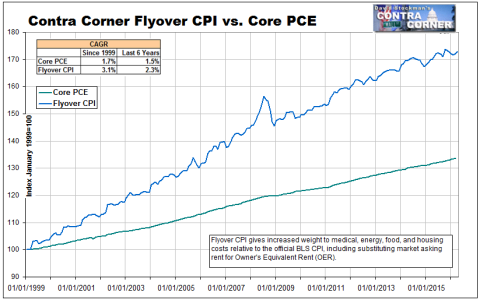

Indeed, our recent calculations show that since 1999, the core PCE deflator has risen at barely half the rate of what we have termed the Flyover CPI.

The latter, in fact, gives a 65% weight to the four horsemen of inflation—-food, energy, housing and medical—-that constitute the overwhelming share of living costs for 85% of the American public. It also reflects market-based measures of housing and medical inflation in lieu of the drastically understated components for those items in the standard CPI.

Needless to say, there is plenty of scope for debate as to whether the 16-year trend of US inflation has been 3.1% or 1.7%. But the point is there is no correct or knowable answer.

Accordingly, there is no scientific basis for calculating the natural rate of inflation, either, or for knowing whether it is going down, up or sideways over time.

But one thing is certain. Williams’ official calculation that it’s sub-zero is entirely preposterous.

And it is also certain that such academic gobbledygook is the foundation for the tyranny of the PhDs who have destroyed honest price discovery in the capital and money markets.

Tomorrow we will explore the most recent examples. Microsoft’s lunatic $26 billion bid for an on-line jobs billboard called LinkedIn, which has never generated one time of free cash flow during its entire history, is the poster boy.

Reprinted with permission from David Stockman’s Contra Corner.

The post Tyranny of the PhDs appeared first on LewRockwell.

Leave a Reply