Bernanke’s Black Helicopters

Ben Bernanke is one of the most dangerous men walking the planet. In this age of central bank domination of economic life, he is surely the pied piper of monetary ruin.

At least since 2002 he has been talking about “helicopter money” as if a notion which is pure economic quackery actually had some legitimate basis. But strip away the pseudo-scientific jargon, and it amounts to monetization of the public debt—–the very oldest form of something for nothing economics.

Back then, of course, Ben’s jabbering about helicopter money was taken to be some sort of theoretical metaphor about the ultimate powers of central bankers, and especially their ability to forestall the boogeyman of “deflation”.

Indeed, Bernanke was held to be a leading economic scholar of the Great Depression and a disciple of Milton Friedman’s claim that Fed stringency during 1930-1932 had caused it. This is complete poppycock, as I demonstrated in The Great Deformation, but it did give an air of plausibility and even conservative pedigree to a truly stupid and dangerous idea.

Right about then, in fact, Bernanke grandly promised during a speech at Friedman’s 90th birthday party that today’s enlightened central bankers—led by himself—-would never let it happen again.

Presumably, Bernanke was speaking of the 25% deflation of the general price level after 1929. The latter is always good for a big scare among modern audiences because no one seems to remember that the deflation of the 1930’s was nothing more than the partial liquidation of the 100%-300% inflation of the general price level during the Great War.

Instant Access to Current Spot Prices & Interactive Charts

In any event, Bernanke was tilting at windmills when he implied that the collapse of the US wartime and Roaring Twenties boom had anything to do with the conditions of 2002. Even the claim that Japan was suffering from severe deflation at the time was manifestly false.

In fact, during the final stages of Japan great export and credit boom, the domestic price level had risen substantially, increasing by nearly 70% between 1976 and 1993. It then simply flattened-out—–and appropriately so—-after the great credit, real estate and stock market bubble collapse of 1990-1992.

So even by the evidence of Japan, there was no basis anywhere in the world for Bernanke’s fear-mongering about Great Depression-style “deflation” at the turn of the century.

Instead, Bernanke was already showing himself to be a dangerous academic crank with no compunction about dispensing among democratic politicians the most toxic ideological poison known to history. Namely, an invitation to plunge the public fisc deep into the red so that the central banks would have bonds to buy in their fight against the purported scourge of deflation.

During the years since 2002, there has been no sustained deflation anywhere on the planet. During his tenure at the Fed, Bernanke cried wolf about the potential threat of US deflation early and often, but never a hint of it appeared. From the time of his pretentious pledge on Friedman’s birthday until the present, the CPI has risen an average of 1.8% per year.

But that didn’t stop Bernanke. He even managed to hoodwink those non-Keynesians still around at the Fed in 2011 into formally embracing his pet scheme of inflation targeting. This wrong-headed idea was based on the delusional view that the US did not have enough inflation, and that, in fact, at least a 2% yearly gain on the CPI was essential for maximum economic growth and full-employment.

There is not a shred of evidence anywhere that 2.00% inflation has any different implications for real economic growth than 1.80% or 1.00% or even the absence of CPI inflation altogether.

It’s just a case of magic numbers gussied up in econometric jargon by central bankers and their Keynesian acolytes and hirelings. Its real function is not to enable higher growth and living standards for the people, but, instead, to justify 24/7 monetary intrusion and management of financial markets by an unelected but all-powerful monetary politburo.

At length, Bernanke’s insidious notion of inflation targeting has spread to virtually every central bank of the world. In the case of the ECB, it is the very reason d etre for Mario Draghi’s insane monthly purchase of $90 billion of sovereign bonds and other securities. Yet aside from the evident impact of externally originated oil and commodity deflation during the last two years, there is not a scintilla of evidence for deflation in Europe.

In fact, since 2002, the euro zone CPI has increased at an average rate of1.8% per year. In truth, that much inflation probably hindered economic growth there, and certainly eroded the living standards of retirees and wage-earners.

Even Japan has not suffered from CPI deflation since the time Bernanke started talking up his helicopters.

Yes, it’s vastly inflated real estate and stock markets even today stand well below their bubble peak levels of 1989. But that is not owing to the absence of monetary stimulus in the years since then; it’s the inexorable consequence of the massive financial bubble created by the BOJ during the years before the 1990 crash.

What Japan has experienced is financial asset price deflation, not a shrinking CPI. What actually lies behind the idea of inflation targeting, therefore, is the even more insidious doctrine of wealth effects. That is, the idea that by funding speculators to drive stock and bond prices higher, central banks can actually create lasting gains in real wealth and living standards.

So it can be well and truly said that rarely has a more insidious and destructive policy idea gained wide currency than has Bernanke’s 2.0% inflation target. The proof of the pudding lies in Japan——the misfortunate recipient of two decades of destructive advice from Bernanke and his propagators and assigns.

Full retard 2% inflation targeting was adopted by the current government of Japan with almost reckless abandon in early 2013. At the time, Prime Minster Abe literally manhandled the BOJ and installed a compliant puppet who had no compunction about running the printing presses white hot.

That Kuroda-san has done in spades. The balance sheet of the BOJ is now pushing 50% of GDP—-compared to say 3.3% of GDP for the US Fed at the time Alan Greenspan became chairman and inaugurated the present era of Bubble Finance.

Yet what Kuroda has to show for it is $8 trillion of government debt buried in the subzero zone and the virtual destruction of the government bond market in a country that is the greatest debtor the world has ever seen.

By contrast, the BOJ’s madcap pursuit of the 2% inflation target has not elevated the CPI at all. It is still churning on the flat-line, but more importantly, the real economy has not lifted off, either.

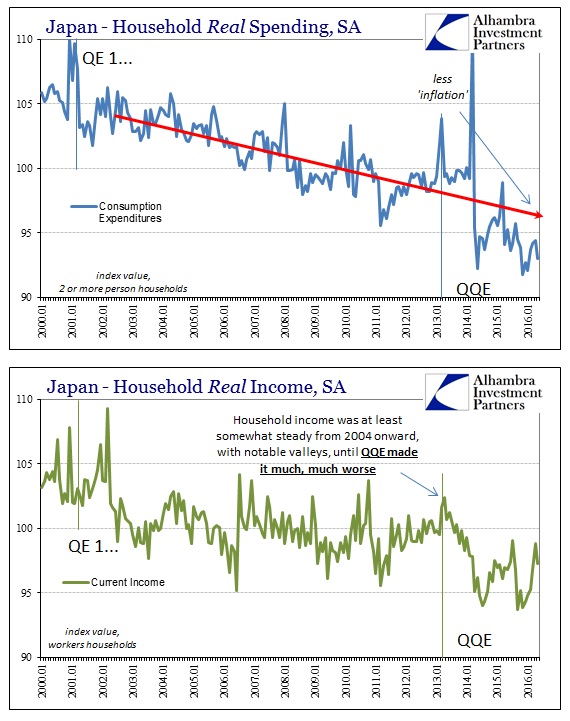

Real household incomes in Japan are still nearly 7% below their 2011 levels and 5% lower than they were when Kuroda revved up the printing presses at the BOJ.

Needless to say, real household spending, as shown above, has followed the same dismal pattern. Whereas Japan was once considered the kingdom of savers, that attribute disappeared years ago. Today the household savings rate has slumped to zero, meaning that consumption growth depends on production and income gains. The latter, however, have not been delivered in the slightest by Abenomics.

In fact, real GDP is currently heading for its fifth recessionary dip since the great financial crisis and is no higher than it was in early 2013. Yet upon his victory in the upper chamber elections on Sunday, Prime Minister Abe announced that he will now double down on “stimulus”.

And this time, he is making no bones about calling in the helicopters. Why even Ben Bernanke himself is on hand to help launch Japan’s final spree of monetary madness.

Needless to say, the initial response of Japan’s busted stock market was uproarious enthusiasm. In the last two days, the market was up more than 6%. A recent Bloomberg story left no doubt as to why:

The Topix….had its largest advance since Feb. 15, as Abe said he will order the preparation of an economic stimulus package tomorrow. A person familiar with the matter said Bank of Japan Governor Haruhiko Kuroda met with former Federal Reserve Chairman Ben S. Bernanke over lunch in Tokyo on Monday, also boosting speculation for easing. Japan stocks further benefited as better-than-expected U.S. payrolls helped spur a global equities rally.

“With hopes that stimulus will come earlier than expected, investors are seeing it as an opportunity to buy,” said Hiroaki Hiwada, a Tokyo-based strategist at Toyo Securities Co. The report on Bernanke’s visit “makes it natural for speculation to emerge on additional easing.”

Abe will hold a cabinet meeting on economic measures on Tuesday and consider more than 10 trillion yen ($98 billion) in stimulus, the Nikkei newspaper reported. Following the meeting with Kuroda on Monday, Bernanke will meet with Abe tomorrow, Reuters reported.

In fact, the whole point is that this $100 billion fiscal expansion package will be financed by an equivalent increase in bond purchases by the BOJ. That is helicopter money plain and simple.

It’s also fiscal and monetary suicide. Japan’s debt is so massive and has risen so relentlessly even as its population and labor force has started to shrink that this latest round of fiscal stimulus can have only one outcome.

To wit, the government of Japan will ultimately be forced to repudiate its debts to the BOJ. When that happens a terminal monetary implosion will not be far behind.

In the interim, Bernanke’s abominable doctrine of helicopter money may spread to Europe or even here. Already the universal adoption of its QE variant—-that is, helicopter money lite—-has made a farce of global bond markets.

The Big Fat Thumb of central bankers on the supply/demand scales of the global bond markets has pushed $13 trillion of government bonds into the subzero zone. And this madness, which has already engulfed 33% of all government bonds outstanding, is happening at an accelerating pace.

Before the Brexit vote two weeks ago there was less than $11 trillion of subzero debt, and only three years ago there was virtually none at all.

A roundup supplied by today’s Wall Street Journal speaks for itself.

In Switzerland, government bonds through the longest maturity, a bond due in nearly half a century, are now yielding below zero. Nearly 80% of Japanese and German government bonds have negative yields, according to Citigroup.

Now the yield grab is spreading to bonds that have a riskier profile. The more investors search for yield, the more bond yields fall.

“It’s a bit self-fulfilling,” said Iain Stealey, a fund manager at J.P. MorganAsset Management.

Italy, which is in the throes of a banking crisis, has about $1.6 trillion worth of negative-yielding sovereign debt.

The yield on Lithuania’s 10-year government debt has more than halved this year to around 0.5%, according to Tradeweb. The yield on Taiwan’s 10-year bonds has fallen to about 0.7% from about 1% this year, according to Thomson Reuters.

And that’s not the half of it. According to the same WSJ story, there are now $275 billion of European corporate bonds trading at subzero yields. Indeed, money managers and punters in fixed income market throughout the world have literally gone berserk chasing yield.

Clients don’t care if it is Mexico or Poland or South Korea, he said, “they just want a higher yield.”

Emerging-market debt funds saw their highest inflow on record in the week ending July 6, according to Bank of America Merrill Lynch.

When all of this blows sky-high it is to be hoped that the war crimes tribunal in the Hague will see fit to expand its remit to include economic crimes against humanity. Ben Bernanke would surely be the first one in the docket.

After all, the black helicopters of printing press money are certain to do more harm to the people of the world than any war yet recorded.

Reprinted with permission from David Stockman’s Contra Corner.

The post Bernanke’s Black Helicopters appeared first on LewRockwell.

Leave a Reply