Gold Bullion Up 1.6%, Silver Surges 3.7% After Poor U.S. Data and Dovish Fed

Gold bullion was up 1.6% and silver surged 3.7% yesterday, their second consecutive day of gains, after U.S. durable-goods orders dropped sharply, adding to speculation that Federal Reserve policy makers will maintain ultra loose monetary policies. Gold and silver consolidated on those gains in Asia and in early European trading.

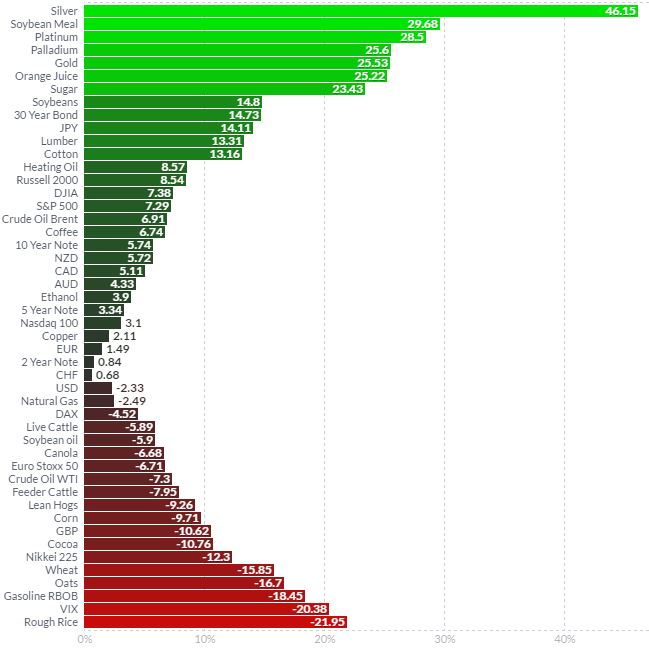

2016 YTD Relative Performance

2016 YTD Relative Performance

Both precious metals are set for further gains in July consolidating on the gains in the first two quarters. This is bullish from a technical, momentum and sentiment perspective.

Bookings for durable goods, goods meant to last at least three years, fell a very sharp 4 per cent in June, a bigger fall than forecast and the most since August 2014.

Gold moved higher as the Fed concluded a two-day meeting, where policy makers left interest rates unchanged claiming risks to the U.S. economy have subsided. This means there is still the possibility of very small rate increases this year. The durable goods number though shows that the U.S. recovery remains fragile at best.

Gold has climbed 26 percent this year in dollars terms and silver by 46%. Both have seen even bigger gains in most currencies and especially sterling. This is largely due to continuing ultra loose monetary policies globally and growing concerns about the financial and economic outlook.

The Fed has indicated it will hold interest rates lower for longer. Central banks have pledged even more monetary easing amid concerns over the fallout from the U.K.’s vote to leave the European Union and geopolitical risk globally. Japan Prime Minister Shinzo Abe announced plans for even more QE – 28 trillion yen ($265 billion) to help prop up the very weak Japanese economy. Read the full post here.

Leave a Reply