Helicopter Money

The Cleveland Fed’s Loretta Mester is a clueless apparatchik and Fed lifer, who joined the system in 1985 fresh out of Barnard and Princeton and has imbibed in its Keynesian groupthink and institutional arrogance ever since. So it’s not surprising that she was out flogging—-albeit down under in Australia—- the next step in the Fed’s rolling coup d’ etat.

We’re always assessing tools that we could use,” Mester told the ABC’s AM program. “In the US we’ve done quantitative easing and I think that’s proven to be useful.

“So it’s my view that [helicopter money] would be sort of the next step if we ever found ourselves in a situation where we wanted to be more accommodative.

This is beyond the pale because “helicopter money” isn’t some kind of new wrinkle in monetary policy, at all. It’s an old as the hills rationalization for monetization of the public debt—–that is, purchase of government bonds with central bank credit conjured from thin air.

It’s the ultimate in “something for nothing” economics. That’s because most assuredly those government bonds originally funded the purchase of real labor hours, contract services or dams and aircraft carriers.

As a technical matter, helicopter money is exactly the same thing as QE. Nor does the journalistic confusion that it involves “direct” central bank funding of public debt make a wit of difference.

Suppose Washington issues treasury bonds to the 23 primary dealers on Wall Street in a regular manner. Further, assume that some or all of these dealers stick the bonds in inventory for 3 days, 3 months or even 3 years, and then sell them back to the Fed under QE (and most likely at a higher price).

Physical Gold & Silver in your IRA. Get the Facts.

So what!

The only thing different technically about “helicopter money” policy is the suggestion by Bernanke and others that the treasury bonds could be issued directly to the Fed. That would just circumvent the dwell time in dealer (or “investor”) inventories but result in exactly the same end state. In that event, of course, Wall Street wouldn’t get skim.

But that’s not the real reason why helicopter money policy is so loathsome. The unstated essence of it is that our monetary politburo would overtly conspire and coordinate with the White House and Capitol Hill to bury future generations in crushing public debts.

They would do this by agreeing to generate incremental fiscal deficits—-as if Uncle Sam’s current $19 trillion isn’t enough debt—–which would be matched dollar for dollar by an increase in the Fed’s bond-buying or monetization rate. That amounts not only to teaching children how to play with matches; it’s tantamount to setting fiscal forest fires across the land.

There are a few additional meaningless bells and whistles to the theory, which we will dispatch in a moment, but the essential crime against democracy and economic rationality should be made very explicit. To wit, this is a central bank power grab like no other because it insinuates our unelected central bankers into the very heart of the fiscal process.

Needless to say, the framers delegated the powers of the purse—spending, taxing, and borrowing—–to the elected branch of government, and not because they were wild-eyed idealists smitten by a naïve faith in the prudence of the demos.

To the contrary, they did so because the decision to spend, tax and borrow are the very essences of state power. There is no possibility of democracy—-for better or worse—-if these fundamental powers are removed from popular control.

Yet that’s exactly what helicopter money policy would do. Based on some Keynesian gobbledygook about the purported gap between full-employment or “potential GDP” and actual output and employment, the Fed would essentially set the Federal deficit target.

In practice, it would also likely throw in some gratuitous advice about its composition between tax cuts, infrastructure spending, and social betterment. The recommended mix would arise from an economic whim, of course, as to whether the FOMC in its wisdom thought household consumption or fixed asset investment needed to be goosed more.

Alas, the peoples’ elected representatives would relish this “expert” cover for ever bigger deficits and the opportunity to wallow in the pork barrel allocation of the targeted tax cuts and spending increases. There is not a hardcore New Dealer turning in his grave who could have imagined a better scheme for priming the pump.

And that’s not the half of it. Helicopter money turns the inherently dangerous idea of fiscal borrowing in a democracy into an outright monetary fraud.

Even “New Deal” FDR worried about the rising public debt and “Fair Deal” Harry Truman positively loathed it.

Likewise, the power-mad Lyndon Johnson essentially vacated the oval office when he finally agreed to a substantial tax hike in early 1968 order to stem the deficit hemorrhage from his guns and butter policies.

Even the greatest deficit spender of all time—–Ronald Reagan—-thought the resulting explosion of the public debt was half Jimmy Carter’s fault and a half due to defense spending increases, which didn’t count in his unique way of reckoning the national debt.

So what makes helicopter money so positively insidious is that it relieves elected politicians entirely from their vestigial fears of the public debt and from accountability for the burdens it imposes on future generations. And that’s especially true owing to the Bernanke fillip.

Folks, the Bernank is no hero whatsoever—–notwithstanding his self-conferred glorification for the courage to print. He is a demented paint-by-the-numbers Keynesian who has a worse grasp on the real world than the typical astrologer.

Indeed, the crucial element in his helicopter money scheme, as explained in a recent Washington Post op-ed, is an explicit and loud announcement by the Fed that the incremental debt will be permanent. It will never, ever be repaid——not even in today’s fictional by-and-by.

Providing a purportedly scientific monetary cover story so that elected politicians can issue non-repayable public debt is a truly reprehensible idea in its own right. But the reason for it is downright lunatic.

To wit, unless current taxpayers are assured that future taxes will not rise owing to Washington’s helicopter money handouts and tax breaks, says the Bernank, they won’t spend the government gifts they find strewn along the path of flight!

That’s right. When a road building boom from helicopter money appropriations results in surging demand for the sand and gravel pits, the small-time businessman involved won’t buy any additional trucks or hire any additional drivers until Washington assures them that they won’t pay higher taxes 20 years hence!

Only in the Eccles Building puzzle palace does such drivel not elicit uncontainable guffaws. Only in Sweden do they give Nobel Prizes for the academic obscurantism called “rational expectations theory” that is the basis for Bernanke’s toxic assault on fiscal discipline and sound money.

At the end of the day, the operative words here are “groupthink” and “coup d’ etat”. These baleful conditions flow from the essential predicate of modern central banking.

We are referring here to the erroneous notion that economic wealth can be permanently elevated through more public and private borrowing and that central bank falsification of financial asset prices will facilitate the achievement of those ends.

In fact, as we have repeatedly demonstrated, the Fed’s purported macro-management of the economy and business cycle is simply a variation of the old Keynesian parlor trick that is over and done.

That is to say, so long as households and businesses have an unused runway on their balance sheets, they can be induced to leverage-up with cheap money, and thereby be enabled to spend more for consumption goods and capital goods than could otherwise be financed out of current incomes and cash flows, respectively.

But we are now at Peak Debt. There is no balance sheet runway left.

Accordingly, the impact of the massive flow of new central bank credit and the Fed’s sustained falsification of financial asset prices after 2008 never left the canyons of Wall Street. It did not stimulate the main street economy one bit; it merely generated vast windfalls to the top 10% and 1% who own most of the financial assets, while fueling ever more unstable, extreme and dangerous financial bubbles.

In short, the real issue is that the Fed was foolishly given a so-called Humphrey-Hawkins mandate to deliver full employment and stable inflation 40 years ago. But in today’s global economy and the financialized world, the FOMC’s crude tools of interest rate pegging, bond-buying, and wealth effects pumping are utterly unsuited for the task.

And well they should be. In the first place, no politburo of 12 people can define full employment in a gig-based, labor-driven globalized economy. The Fed can do nothing about an auto job that migrates to Germany because American consumers like Mercedes cars better than Cadillacs.

Nor can it fully employ a worker who scams the social security disability system or a road warrior who prefers to work only six months per year and party the rest of the time. Likewise, fiddling with interest rates can’t help a McDonald’s fry cook who gets canned because the Seattle City Council foolishly raised the minimum wage to $15 per hour and invited robots to take over the job.

Pure and simply, there is no such measurable as “full employment”. Nor is there a chance in the world that the Eccles Building can cause the true creators of jobs—-enterprise, capital, and technology—-to make more of them by fueling every larger financial bubble.

As for the inflation side of its dual mandate, there is not a word in the 1977 Act that says a 2% annual gain in consumer prices is what Congress had in mind—even in the midst of its confusion about what central banking can actually do. I remember well voting against it at the time, and not hearing a single speech on behalf of the magic 2%.

That’s because the sacred 2% inflation target was only adopted by the Fed 34-years later in 2011 under Bernanke’s relentless prodding. In fact, the very idea of “inflation targeting” is a stupid academic hobby horse invented by Bernanke in the 1990s— long after the Act was passed——and which bears no empirical relationship to the rate of GDP growth, jobs or anything else.

But it is a thinly disguised excuse for a power grab. That is, the Fed has been massively intruding upon financial markets and distorting and deforming prices in the capital and money markets for nearly two decades now on the pretext that there is a “shortfall” in the inflation rate.

Well, there hasn’t been. Not even close.

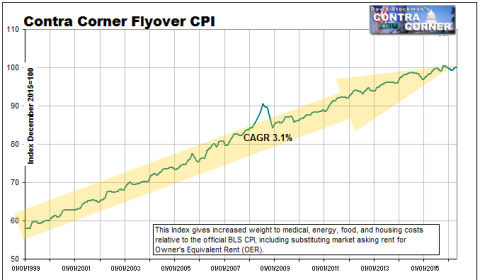

Based on what we call the “flyover CPI”, which weights the four horseman of inflation—–energy, housing, medical and food—–at 64% or by what most of the America spends its paycheck on, inflation has been 3% or better for nearly two decades.

So the single most important thing that could be done by Congress to get the American economy functioning again would be to repeal the Humphrey-Hawkins Act and thereby eliminate the Fed’s legal basis for its rolling coup d’état.

At the same time, it could launch a modern equivalent of the Pecora hearings of the 1930s. Only this time they would be focused on the Fed’s role in generating massive Wall Street bubbles and their subsequent devastating collapses—–including for what will soon be the third time this century.

Such a probe could readily bring to the surface what amounts to the raging elephant in the room of national economic policy. Namely, that the Fed’s massive intervention in the financial markets and its feckless pursuit of ZIRP and QE is a battering ram of dangerous and worsening financial instability.

But the Eccles Building and its 12 branch offices are so mummified in Keynesian groupthink that they cannot even see the obvious. Thus, in touting its next grab for helicopter money power, the aforementioned Cleveland Fed President let loose of the following whopper:

Maintaining stability in financial markets should not be an explicit goal for the Federal Reserve, which should use interest rates to head off a crisis only if more precise and better-suited tools fail, a top Fed official said on Tuesday…….Cleveland Fed President Loretta Mester said in remarks prepared for delivery in Sydney, adding that the Fed’s key price stability and maximum employment goals usually align with its desire for a stable financial sector.

Oh, c’mon. The purpose of the systematic financial repression by the Fed and the rest of the world’s central banks is to flush savers and investors out of the money market and out the risk curve.

That’s why there is $13 trillion of subzero sovereign debt and growing by the day. That’s why there is a mad scramble for yield, and that’s why the global financial system is riven with FEDs (financial explosive devices) waiting to be ignited.

Today, Fitch Ratings spotlighted one more example of the Fed’s destructive regime of Bubble Finance at work.

The trailing 12-month junk-bond default rate hit a 6-year high in June at 4.9%, says Fitch Ratings, highlighting the ongoing pain from the oil patch.

Energy companies defaulted on $28.8 billion of debt the first half of this year, Fitch calculates, putting the sector’s default rate at 15%. For exploration and production, the rate is 29%.

A 29% default rate in the E&P sector!

Does Ms. Mester really believe that in an honest free market several hundred billions of high-yield debt could have been sold by the rank commodity speculators who ply the shale patch?

Not in a month of Sundays.

By contrast, modern central banking is a doomsday machine of financial booms and busts and ever intensifying financial instability. One of these days—-perhaps when the current mother of all bubbles implodes——even the somnambulant Congressional Republicans may figure out the real enemy of American prosperity and productive capitalism.

That is, a rogue central bank that has seized plenary financial power already, and that is so mummified in groupthink that it will stop at nothing in the expansion of its remit. Even to the extent of sending clueless career apparatchiks like Loretta Mester to the ends of the earth to flog the unspeakable folly of “helicopter money”.

Reprinted with permission from David Stockman’s Contra Corner.

The post Helicopter Money appeared first on LewRockwell.

Leave a Reply