How Bitcoin is slowly replacing fiat currencies

From its inception in 2009, Bitcoin has been regarded as one of the most versatile payment methods that exist in current times. It goes a long way in solving the many problems associated with moving fiat currency around the world and in the internet age, the digital currency has the potential to be accepted as a universal form of currency.

Though skeptics have long voiced their doubts about Bitcoin ever being adopted wide enough to replace‘real money’, Bitcoin’s 2016 performance has outperformed most asset classes to date. In fact, Bitcoin’s performance since inception has been nothing but stellar.

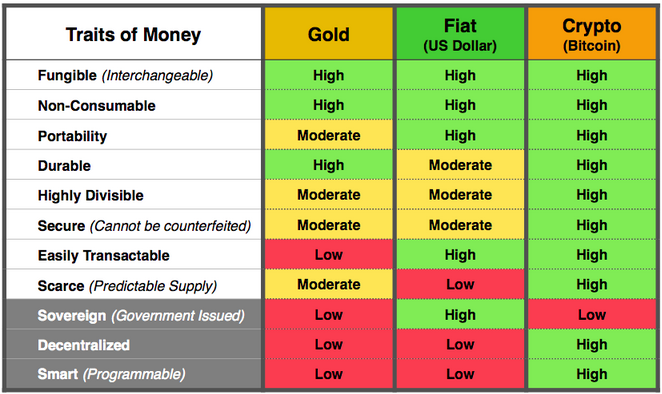

Fiat currencies are deemed acceptable if they meet the following criteria. Let us see how Bitcoin fares on these terms.

- Easy and convenient means of exchange

- Should serve as a unit of account

- Act as a viable store of value

On the first criterion

Bitcoin passes this one with flying colors as this is one of the main reasons why it is on its way to mass adoption so quickly. Bitcoin’s influence is gaining steam, due to its easy, low cost peer to peer network. Anyone can join and use it and there is no authority. From select cafes and restaurants in the developing world to thriving eCommerce giants, many businesses have adopted Bitcoin as a medium of payment. While a major portion of the world is yet to accept adopt Bitcoin, we are tracking its rise.

The second criterion

Would be that the payment medium should serve as a unit of account. This means it has to be used to value goods & services or anything else for that matter. Most currencies have goods valued in its denomination and they have a trading exchange rate that can be used to compare the value of goods across currencies. While the world economy finds its global reserve currency to be the US Dollar, Bitcoin and other digital currencies can serve as a better unit of account on the basis of having uniform value across borders. There is no government intervention when it comes to manipulating it and in today’s internet enabled world, it has the potential to literally become the world’s global reserve currency.

The final criterion

Is that the currency should act as a stable and reliable store of value. Traditionally any asset class can act as a store of value over time but most lack convenience as a universal means of exchange. Bitcoin faces some challenges as well, mostly owing to its high volatility.

Statistically, however, Bitcoin’s high volatility can basically be chalked up to speculation around its potential to disrupt deep rooted industries. This will eventually be resolved once wider adoption occurs and Bitcoin becomes a way of life.

The Bottom Line

However if you’re considering investing in, one of the best ways to do it is through a Bitcoin IRA. Don’t forget to consult a financial advisor to determine how bitcoin would fit with the overall goals of your portfolio.

Click here to Request Your FREE Bitcoin Investment Guide

Leave a Reply