The Humpty-Dumpty Economy

The Eccles Building trotted out Vice-Chairman Stanley Fischer this morning. Apparently his task was to explain to any headline reading algos still tracking bubblevision that things are looking up for the US economy again and that Brexit won’t hurt much on the domestic front. As he told his fawning CNBC hostess:

“First of all, the U.S. economy since the very bad data we got in May on employment has done pretty well. Most of the incoming data looked good,” Fischer said. “Now, you can’t make a whole story out of a month and a half of data, but this is looking better than a tad before.”

You might expect something that risible from Janet Yellen——she’s just plain lost in her 50-year old Keynesian time warp. But Stanley Fischer presumably knows better, and that’s the real reason to get out of the casino.

What is happening is that after dithering for 90 months on the zero bound the Fed has run out the clock. The current business cycle expansion—as tepid as is was— is now clearly rolling over. So the Fed has no option except to sit with its eyes wide shut while desperately trying to talk-up the stock market.

And that means happy talk about the US economy, no matter how implausible or incompatible with the facts on the ground. No stock market correction or sell-off of even 5% can be tolerated at this fraught juncture.

Physical Gold & Silver in your IRA. Get the Facts.

That’s because the U.S. economy is so limp that a proper correction of the massive financial bubble the Fed and other central banks have re-inflated since March 2009 would send it careening into an outright recession. And that, in turn, would blow to smithereens all of the FOMC’s demented handiwork since September 2008, and indeed since Greenspan launched the era of Bubble Finance back in October 1987.

So when Fischer used the phrase “the incoming data looked good”, he was doing his very best impersonation of Lewis Carroll’s version of Humpty Dumpty. “Good” is exactly what our monetary politburo says it is:

“When I use a word,” Humpty Dumpty said, in rather a scornful tone, “it means just what I choose it to mean—neither more nor less.”

The fact is, the “lesses” have it by a long shot, but the Fed cannot even whisper a word about the giant risks, challenges and threats which loom all across the horizon.

So for the third time this century, a business cycle contraction will come without warning from the Fed. Once again the Cool-Aid drinking perma-bulls, day traders and robo-machines will be bloodied as they stampede for the exist ramps. But it is the main street homegamers, who have been lured back into the casino for the third time this century, that will suffer devastating losses yet another time.

Indeed, if there were even a modicum of honesty left in the Eccles Building it would be warning about the weakening trends in the US economy, not cheerleading about fleeting and superficial signs of improvement.

Likewise, it would acknowledge the drastic over-valuation of the stock, bond, real estate and other derivative financial markets and remind investors that a healthy capitalism requires a periodic purge of such excesses in order to check mis-allocation of resources and malinvestment of capital.

Most importantly, it would flat out confess the inability of monetary policy—–even its current extraordinary accommodation variant—–to ameliorate the structural and supply-side obstacles to a more robust rate of economic growth and wealth creation in the US.

In that regard, it would especially abjure the hoary notion that an excess of monetary stimulus is warranted because fiscal policy and regulators, for example, are allegedly not holding up their side of the bargain.

In fact, monetary stimulus is not the “only game in town”, as is often asserted; it’s the wrong game. Money printing is not a second best substitute for other pro-growth policies because it’s not pro-growth at all.

At best, it shifts the incidence of economy activity in time, such as when cheap mortgage rates cause housing construction to be higher today and then lower in the future when rates normalize.

But mainly monetary stimulus causes systemic mis-pricing of financial assets. It turns money and capital markets into gambling arenas where speculators capture huge unearned windfalls while the mainstream economy is deprived of growth and productivity inducing real capital investment.

Thus, instead of dispensing sunny-side agit prop Friday morning, Fischer might have noted the startling anomaly that was occurring at the very moment of his CNBC appearance.

To wit, the 10-year US Treasury note——the very benchmark of the entire global financial system—-had just kissed a record low yield of 1.38%. At the same moment, the futures market was signaling an open on the cash S&P 500 at 2110 or within 0.09% of its all-time high and at nosebleed PE ratio of 24X reported earnings.

Not in a million years would an honest, healthy, stable and sustainable free market have produced that combination. Starring at CNBC’s on set monitors, Fischer was looking at a screaming warning sign that financial markets have become radically unhinged. Starring into the cameras, he lied through his teeth in order to perpetuate the Fed’s sunny-side narrative.

Here’s the thing, however. The Fed’s primitive Keynesian models are all about quantity of economic factors and the short-run sequential change in the GDP and jobs data sets. There is not even acknowledgement of qualitative factors or how the “incoming data” aligns with historical trends.

Nor does a positive quarter purchased at the certain expense of a sharp reversal a few periods down the road get discounted. The Fed model is all about sequential GDP gains——even if there are blatant indications that they are not sustainable or compatible with the prerequisites for healthy capitalist prosperity and stability.

All of these considerations were evident in the incoming data releases on Friday and in recent days——the very items that Fischer insisted had gotten better from “a tad before”.

Booming auto sales have been a pillar of the weak overall recovery since 2009, but even they came in for June down by a sharp 4.6% from prior year at 16.7 million light vehicles. Moreover, this was a continuation of the weakening pattern since last fall, and a clear indicator that the peak sales rate for this cycle is already in:

But that’s not the half of it. Given population and household growth since the 2007 peak, 18 million units should be the floor of a healthy sustainable US economy, not a momentary peak, as is evident in the chart.

And this point is made all the more salient given the qualitative factors behind the peak levels that were achieved late last year. To wit, the entire rebound from the 2008-2009 crisis lows was funded with debt, and much of it was issued to anyone who could fog a rearview mirror.

That’s right. Since the auto cycle bottom in mid-2010, retail motor vehicle sales have rebounded at a $360 billion annual rate, whereas auto loans outstanding have risen by $355 billion.

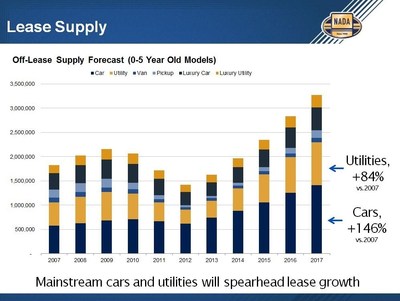

Moreover, the apparent low default rate of recent years was self-evidently misleading in the context of Bubble Finance. Owing to the collapse of new car sales between 2007 and 2011, there has been a sharp reduction in the supply of used cars, causing the resale value of the existing fleet to steadily rise.

Rising used car prices, in turn, made it easy for even marginal consumers to refinance old loans into new vehicle purchases, thereby avoiding defaults. At the same time, artificially low interest rates enabled auto finance companies to finance loans and leases at exceedingly low but unsustainable monthly payment rates.

So the auto contribution to GDP growth during the last few years had an unsustainable “virtuous circle” character. There was no reason, therefore, to believe these gains could be replicated permanently. In fact, there was every reason to believe that the artificial Fed induced auto finance cycle would be eventually reversed, thereby generating substantial, off-setting “payback” down the road.

That risk is now materializing. The entire “virtuous” but artificial auto finance cycle is reversing as a flood of used cars—–reflecting the booming sales of the last four years—–comes into the resale market.

Consequently, used car prices are heading south, thereby undermining trade-in values and eligibility for new loans. The index of used car prices is now down 5% from its recent peak, and based on past cycles has a long way down yet to go.

Alas, downward trending used car prices will also means that default rates will be rising for the simple reason that underwater borrowers will not be able to refinance their “ride” into a new or more recent vintage used vehicle.

Likewise, new car loan and lease finance will be shrinking because the estimated “residuals” on leases and collateral value on loans will be lower. That means loan-to-car price ratios will come down—just as trade-in values on existing vehicles are also dropping. The resulting financing gap means lower sales and production rates in the auto sector.

In short, there has not been a healthy recovery of the auto industry owing to 90 months of ZIRP and the Fed’s massive money printing escapades. This misbegotten monetary stimulus has only generated a deformed auto financing cycle that is now reversing and which will soon be extracting its pound of payback.

Needless to say, Fischer eschewed the opportunity to talk soberly about the headwinds facing the strongest sector of the recent recovery. And this is only illustrative. The same can be said of housing—where cheap mortgages have raised prices far more than output of new housing—and countless others.

The recession will come, therefore, with the Fed flat-footed again and this time, out of dry powder, as well.

Indeed, so thoroughly will the Fed be discredited when the market crashes again by 40% or 50% or more, that modern Keynesian central banking will be faced with an existential crisis.

To use the metaphor, our monetary Humpty Dumpty is heading for a great fall, and all the Imperial City’s potentates and poobahs will not be able to put it together again.

And that would be a very good thing.

Reprinted with permission from David Stockman’s Contra Corner.

The post The Humpty-Dumpty Economy appeared first on LewRockwell.

Leave a Reply