Buy Gold and “Real Assets” Says the ‘Bond King’

Buy gold and “real assets” and not bonds is the financial advice of the “Bond King”, Bill Gross in his latest must read newsletter which covers everything from his favoured assets to sex.

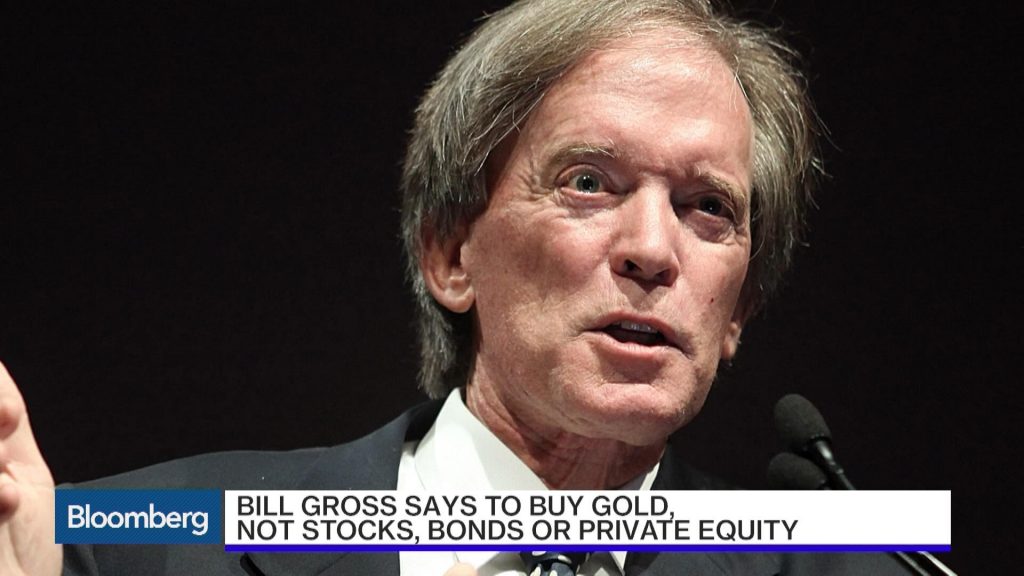

‘Bond King’ Bill Gross (Bloomberg)

‘Bond King’ Bill Gross (Bloomberg)

Gross, the founder of and ex boss of the largest bond fund in the world PIMCO, now manager of the Janus Global Unconstrained Bond Fund, says buy gold and warns of the risks in the bond market. He favours allocating funds to physical assets such as gold and real estate and he explained why in interviews on CNBC and Bloomberg yesterday.

He is warning that there will be a new global financial crisis and that “our credit-based financial system” is likely to “break down”. Current conditions, with global central banks keeping interest rates low and the fact that there is more than $11 trillion in sovereign debt is now carrying negative yields, presents severe challenges to investors, markets and the very financial system itself.

“I think we should be investing in real assets as opposed to financial assets,” Gross told CNBC yesterday afternoon.

Earlier in the day, Gross released a letter to investors, warning them off stocks and bonds and advising them to buy gold and look elsewhere for return.

“I don’t like bonds, I don’t like most stocks; I don’t like private equity. Real assets such as land, gold, and tangible plant and equipment at a discount are favored asset categories.”

Gross also amusingly writes in the newsletter about sex and his mother asking him if he knew where little kittens come from.

Gross did not specify whether he favours gold ETFs or physical gold bullion but given his express preference for “real assets” and “hard assets” including land, it is highly likely that he favours actual physical bullion and not paper or digital proxies with their significant levels of indemnification and counterparty risk. Read More….

Leave a Reply