Gold Bullion – The Ultimate Monetary Solution

Gold Bullion – The Ultimate Monetary Solution

Editors Note: We are happy to publish another interesting and thought provoking piece by one of our contributors David Bryan:

Astounding levels of debt in the western world in particular is the greatest financial, economic and monetary challenge facing the world today. To get debt under control is imperative. It could involve a short period when individuals legally opt to become debt free.

A hard currency regime is implemented and private central banking monetary agencies such as the Federal Reserve become totally defunct. Afterwards there is a lengthy period of shock and awe in which every asset deflates against gold until it finds fair market value with a price that is not derived from leveraged finance.

This option to become debt free should not be available to public or private corporations. Corporations continue to have their debt burden and as incorporated assets deflate to fair market value the capital imbalance will motivate a return of wealth resources from the few to the great body of people on the planet.

These steps provide the ultimate monetary solution to the state sponsored ideologies of monetarism, corporatism, socialism, globalism, capitalism and communism, all of which have failed.

Money defines our enterprise, independence, prosperity and economic freedom.

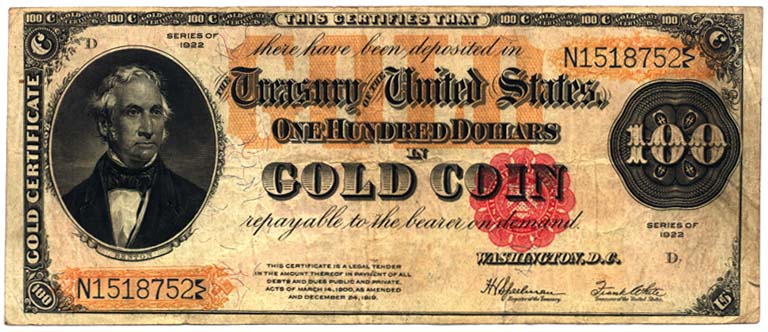

In terms of physics, gold is refined matter with sufficient value to provide tangible monetary capital and is fully accountable money as the entire quantity of gold mined still exists.

Central bank issued money is a monetary ideology and instead of asset wealth to provide monetary capital it relies on faith in a central banks synthetic fiat for monetary transactions.

In a debt creating paradox, the issue of unlimited synthetic money has inflated every asset class beyond affordability and to make financial ends meet, it has forced the great body of people into a life of permanent debt. In a further tragedy against the great body of people on the planet, through the issue of unlimited money the central banks have incorporated most of the world’s wealth creating resources for the exclusive benefit of a privileged few.

The out of control central banks wage vicious monetary wars without having any compassion for the suffering caused to the families in countries they attack. They ruthlessly employ negative interest rates against domestic savers, use money printing, currency devaluations and capital controls that weaken or destroy productive economies.

They inflate bubbles in stock markets, property values, bonds and commodities by flooding the world with synthetic money….. Read More here.

Leave a Reply