Ireland’s Biggest Bank Charging Depositors – Negative Interest Rate Madness

Deposits at Bank of Ireland are soon to face charges in the form of negative interest rates after it emerged on Friday that the bank is set to become the first Irish bank to charge customers for placing their cash on deposit with the bank.

This radical move was expected as the European Central Bank began charging large corporates and financial institutions 0.4% in March for depositing cash with them overnight.

Bank of Ireland is set to charge large companies for their deposits from October. The bank said it is to charge companies for company deposits worth over €10 million.

The bank was not clear regarding what the new negative interest rate will be but it is believed that a negative interest rate of 0.1 per cent will initially be charged to such deposits by Ireland’s biggest bank.

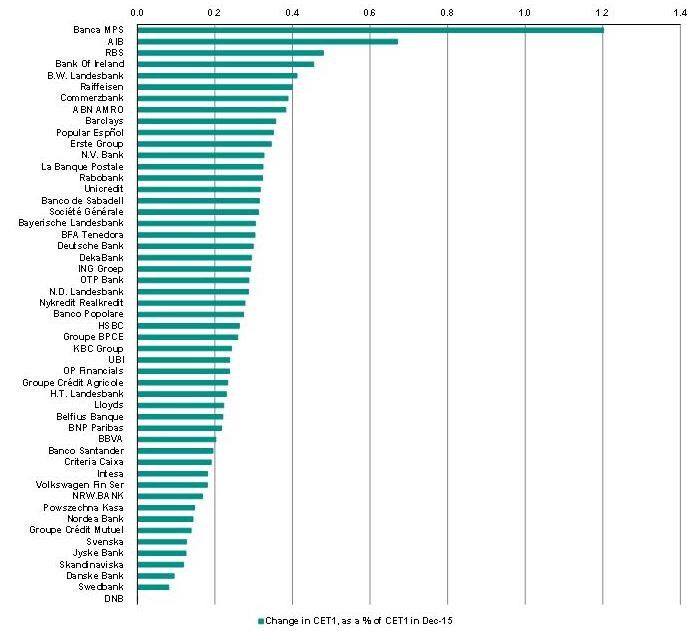

BOI recently failed the EU stress tests and is seen as one of the most vulnerable banks in the EU – along with Banca Monte dei Paschi di Siena (MPS), AIB and Ulster Bank’s parent RBS. All the banks clients, retail, SME and corporates are unsecured creditors of the bank and exposed to the new bail-in regime.

Only larger customers will be affected by the charge for now. The bank claims that it has no plans to levy a negative interest rate on either personal or SME customers but negative interest rates seem likely as long as the ECB continues with zero percent and negative interest rates. Indeed, they are already being seen in Germany where retail clients are being charged 0.4% to hold their cash in certain banks such as Raiffeisenbank Gmund am Tegernsee. Read More…

Leave a Reply