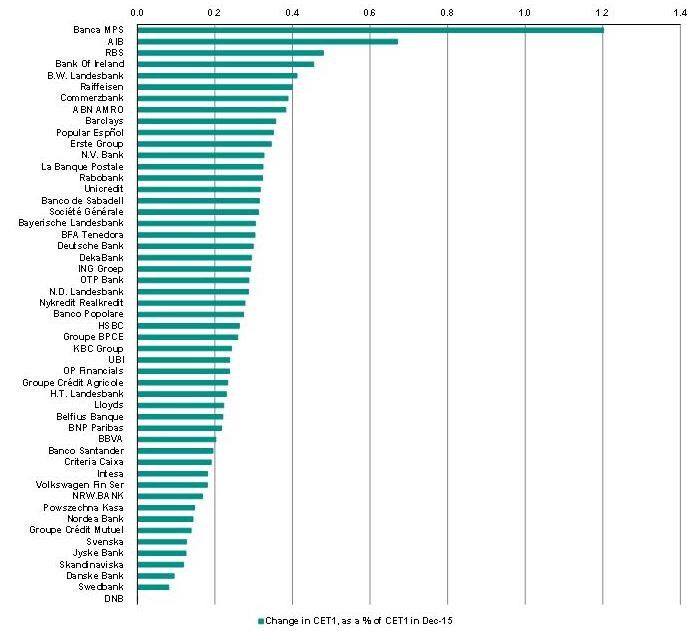

Irish Banks Most Vulnerable In Stress Tests – UK Banks RBS and Barclays At Risk

– Irish banks vulnerable in stress tests: AIB/ BofI amongst worst 5 banks in EU

– Ulster Bank’s parent Royal Bank of Scotland emerged as 2nd worst bank

– AIB, Banca MPS especially vulnerable & ‘failed’ in adverse scenario (see table)

– Impairment of financial assets was the largest negative contributor to results

– Bad loans continue to pose risks to Irish financial system

– Diversification of deposits & allocation to gold prudent for individuals & companies

– Experts advise diversifying into gold – Eddie Hobbs, Jill Kerby, Dr Gurdgiev, Dr Lucey, Jim Power, Cormac Lucy etc

Irish banks AIB and Bank of Ireland, are some of the most vulnerable banks in Europe according to the European Banking Authority stress test of capital strength, which examined 51 institutions across 15 countries and was released last week. Italy’s Monte dei Paschi (MPS) and the UK’s Royal Bank of Scotland, which owns Ulster Bank, emerged as the biggest losers in the stress tests.

The country’s two main lenders, Allied Irish Banks (ALBK.I) and Bank of Ireland (BKIR.I), saw sharp falls in their share prices and they were placed second and fourth worst respectively among the 51 banks scrutinised over their ability to withstand a three-year economic shock.

An economic shock which seems increasingly likely after the Brexit vote, the increasing risks posed by the insolvent Italian, Portuguese and Greek banking system and the risk of systemic contagion should a large country or indeed bank go bankrupt.

Read the full article here.

Leave a Reply