What Happens When Rampant Asset Inflation Ends?

The collapse of asset inflation will implode all the fiscal and financial promises based on ever-inflating assets.

Yesterday I explained why Revealing the Real Rate of Inflation Would Crash the System. If asset inflation ceases, the net result would be the same: systemic collapse. Why is this so?

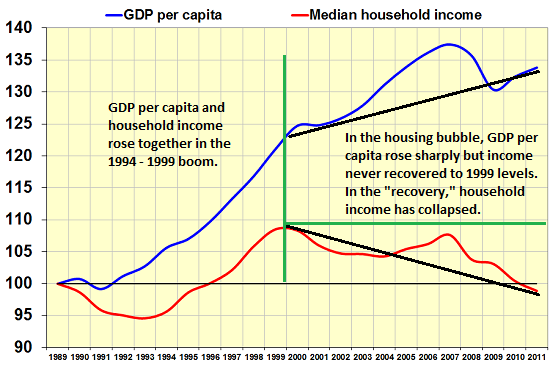

In effect, central banks and states have masked the devastating stagnation of real income by encouraging households to take on debt to augment declining income and by inflating assets via quantitative easing and lowering interest rates and bond yields to near-zero (or more recently, less than zero).

The “wealth” created by asset inflation generates a “wealth effect” in which credulous investors, pension fund managers, the financial media, etc. start believing the flood of new “wealth” is permanent and can be counted on to pay future incomes and claims.

Physical Gold & Silver in your IRA. Get the Facts.

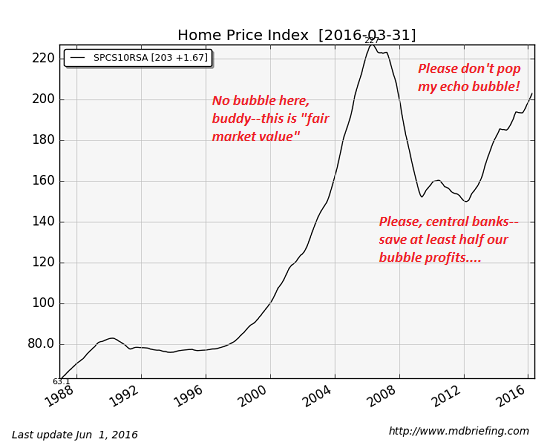

Asset inflation is visible in stocks, bonds, and real estate:

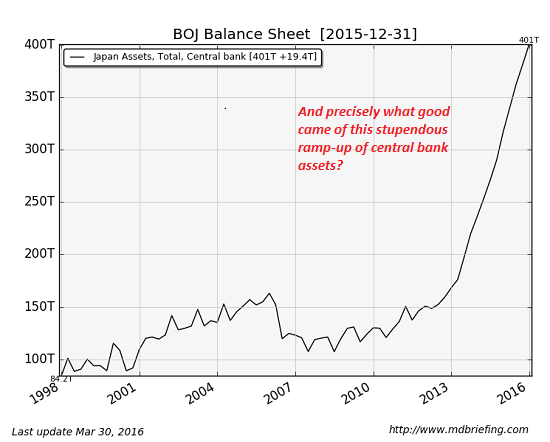

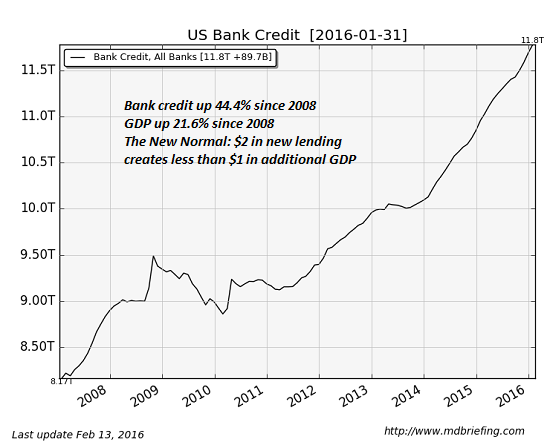

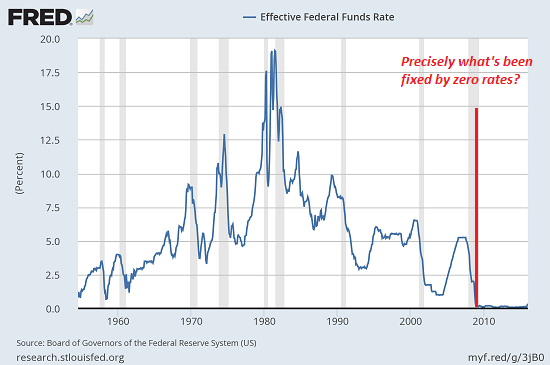

The sources of asset inflation are highly visible: soaring central bank balance sheets, credit expansion that far outpaces GDP growth and ZIRP (zero interest rate policy):

Destroying the return on cash with ZIRP and NIRP (negative interest rate policy) has forced capital to chase any asset that offers any hope of a positive yield. As asset inflation takes off, the capital gains attract more capital (never mind if yields are low–we’ll make a killing from capital gains as the asset inflates further) which creates a self-reinforcing feedback: the more assets inflate, the more attractive they become to the capital seeking any kind of return.

The post What Happens When Rampant Asset Inflation Ends? appeared first on LewRockwell.

Leave a Reply