It Won’t Be Long Now

This uprising against the rule of the financial and political elites has counterparts abroad among those who voted for Brexit in the UK, against Merkel in the recent German elections in her home state, and among the growing tide of anti-Brussels sentiment reflected in polls throughout the EC.

Myths, Misunderstandings and Outright lies about owning Gold. Are you at risk?

Needless to say, the political upheaval now underway is largely an inchoate reaction to the policy failures and arrogant pretensions of the establishment rulers. Like Donald Trump himself, it does not reflect a coherent programmatic alternative.

But my contention is that liberation from our current ruinous policy regime has to start somewhere—and that’s why the Trump candidacy is so important. He represents a raw insurgency of attack, derision, impertinence, and repudiation.

If that leads to throwing out the beltway careerists, pettifoggers, hypocrites, ideologues, racketeers, power seekers and snobs who have brought about the current ruin then at least the decks will be cleared.

So doing, the Trump candidacy—win or lose—is paving the way for an honest debate about the Fed’s war on savers and wage earners, the phony Bubble Finance prosperity it has bestowed on the bicoastal elites and Imperial Washington’s delusionary addiction to debt, war, and special interest racketeering.

In addition to the political revolt of the rubes, the establishment regime is now imperiled by another existential threat. To wit, the world’s central bankers have finally painted themselves into the mother of all corners.

Literally, they dare not stop their printing presses because the front-runners and robo-traders have taken them hostage. Recent developments at all three major central banks, in fact, provide powerful evidence that the end of the current Bubble Finance regime is near.

Thus, today’s Financial Times carries a piece on the September 1st milestone of one trillion Euro of bond purchases under the ECB’s QE policy, and the dilemma it faces about continuing beyond next March’s end date for the program. In a word, it is running out of sovereign debt to buy, yet even a hint that it intends to stop could spook the “market” into a drastic sell-off:

A global collapse in eurozone bond yields since Britain’s vote to exit the EU has dramatically reduced the stock of eurozone government paper standing above the yield threshold set for the ECB’s €1.7tn bond-buying project — raising concern that the ECB will have to make sweeping changes to avoid running out of bonds to buy….“There are various estimates of when the ECB will hit a wall because it does not provide exact breakdowns of the bonds it already owns — but everyone agrees that it is close to reaching its limit,” said Aman Bansal, interest rate strategist at Citi. “And the bank cannot slow the pace of bond purchases without sending out a signal to the markets that something is wrong.”

The implication is startling. The ECB’s current cut-off for QE purchases is defined as bonds with a negative yield no greater than 0.4%. Yet according to the FT, there will be no German bunds left to purchase under that standard by year-end.

Yes, the Germans have been the last bastion of relative fiscal rectitude on the planet, but that doesn’t mean the nation suffers for want of public debt. In fact, Germany currently has $2.0 trillion outstanding, and it hasn’t been shrinking any time this century.

So the prospect that there will soon be no eligible bunds for the ECB to purchase means that the entirety of Germany’s public debt will be buried in the sub-zero freezer. Already today the 10-year bund is trading at negative 0.09%, meaning that the whole maturity curve will soon represent the essential absurdity of the entire regime of Keynesian central banking.

To wit, there is no sane theory of economics that says any government should be paid to borrow long-term money by its investors. And that’s true even if you ignore the history of the last century in which no government has avoided the temptations of fiscal profligacy and relentless debt build-up; and also the empirical reality that going forward Germany and every other major developed economy is saddled with a fiscal witches brew of a shrinking workforce and monumental welfare state entitlements.

The fact is, there is no plausible basis for subzero bonds even in a world of fiscal rectitude and balanced budgets. That’s because even with zero credit risk long term bonds need at least a 2% real return to compensate savers for the time value of money.

Yet at a negative yield of 0.5%, for example, the general price level would have to decline by 23% over the next 10 years to make ends meet, and by40% in the case of a 20-year bond.

Needless to say, that ain’t going to happen in either this world or the next. Nor is there even a shred of historical experience to suggest it is even possible.

Indeed, notwithstanding the severe deflation of the Great Depression, the price level by 1938 was well above where it started in 1912 prior to the onset of the severe inflation of the Great War. The naïve patriots who bought Liberty bonds never got their money back in real terms.

In short, there is no bond “market” left in the world. What we have is a front-runners casino in which debt is being priced by the Big Fat Bid of the central banks. And unlike real money investors, the latter are completely price inelastic. Draghi is intent on his $90 billion per month of QE and Kuroda on achieving 2% inflation, come hell or high water.

And that’s why the central bankers have truly painted themselves into the mother of all corners. Leveraged bond speculators have had a “put” that pales into insignificance the 1990s equity “put” of the Greenspan Fed.

For example, here is the 5X gain on the Italian 10-year bond since Draghi volunteered to subjugate the ECB to the fast money speculators of London and New York with his “whatever it takes” ukase in July 2012. In round terms, the tiny sliver of equity (<10%) needed to buy these bonds on repo would have been rewarded with a return of several thousand percents.

That’s also why the euro bond trader quoted above hit the nail on the head. By destroying the bond market and touching off a front-runners gambling spree the central bankers of the world have truly taken themselves hostage. If they keep printing money at the current rate of $2.5 trillion per year collectively, they will destroy the monetary system of the world—-and apparently even they recognize that dead end.

But in their foolish resort to running their printing presses at rates never before imagined, they have generated a volcanic tower of capital gains on the trading books of speculators all over the planet. At the first sign that the Big Fat Bid of the central banks is going to be removed, the fast money will sell with malice aforethought in order to capture their gains, and get out of harms’ way before the great bond bubble violently implodes.

In that event, there will be no containing the selling pressure short of monetizing the world’s entire $40 trillion stock of sovereign debt.

This front-runners hostage situation is exactly why the madman Kuroda has once again uttered the absurdity that there is “no limit” to monetary expansion. In recent weeks the Japanese government bond market has been roiled by rumors the BOJ might pause in its massive QE campaign owing to the destructive impact it is having on the Japanese banking system and the fact that it already owns nearly 40% of Japan’s monumental public debt.

Indeed, the 30-year JGB was yielding 0.54 percent on Monday, up from 0.04per cent on July 6. In a sane world, the 50 bps of difference would be a rounding error, but not at the zero bound. To the contrary, if you happen to have been front running the 30-year JGB all the way toward subzero land, you needed to be fast on the “sell” trigger to avoid complete annihilation after the market broke in July.

So Japan’s central bank governor again rode to the rescue, whether he wanted to or not:

Mr. Kuroda also ruled out a retreat on the monetary easing he has carried out for more than three years……”A reduction in the level of monetary policy accommodation, which is being called for by some market participants, will not be considered” in a policy review now under way, he said…Achieving his 2 per cent inflation target would have “enormous” benefits, he said. “There may be a situation where drastic measures are warranted even though they could entail costs,” he said.

Folks, Kuroda’s fanatical pursuit of 2% inflation is not simply evidence that our Keynesian central bankers have become unhinged; it’s a sign of the outright mental disorder.

Anyone competent in elementary math can see that Japan’s so-called deflation problem is essentially imported and utterly beyond the capacity of the BOJ to reverse, and that’s assuming 2% inflation is economically benign, which it decidedly is not.

Japan is an archipelago of materials processors and manufacturers. Its economy generates a great deal of value-added, but its supply chain starts with 100% imported minerals and other raw materials and is powered nearly 100% (aside from its remaining handful of nuclear power plants) by imported hydrocarbons.

So when its import prices drop by 28% over the past two years due to the global deflation now underway, why would anyone in the right mind expect that short-run CPI to rise by 2% annually?

And since it also means that the terms of trade are improving for Japan, why is a flattish CPI even considered to be a problem—let alone a crisis so severe that it warrants throwing out the book on all of mankind’s historical learning about money and sound finance?

Besides that, Japan’s CPI index in July posted exactly where it was in 1993. So there has been no long-term deflation during the last 23 years. Whatever ails Japan is a supply side matter—-not evidence that it needs more inflation, debt, and monetary madness.

And that takes us to the very bottom of the central bankers’ loony bin, which at the moment is occupied by Fed Vice-Chairman Stanley Fischer, who last week opined that the U.S. job market is “very close to full employment.”

Let’s see. Another Jobs Friday, and what did we get? More marginal part-time, low pay “jobs”,102 million adults still without employment, virtually not growth in hours worked since January and an unbroken record where it counts.

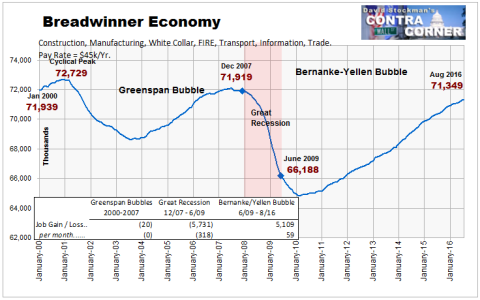

To wit, there are still 1.4 million fewer $50k “breadwinner jobs” in the US than when Bill Clinton was packing his bags to shuffle out of the White House in January 2001.

We will have more to say about this tomorrow, but the key point is this. Fischer’s declaration of “mission accomplished” in the face of a self-evidently failed main street recovery is a purely CYA maneuver.

The impending global deflation and recession will prove that 93 months of ZIRP and $3.5 trillion of QE have been a complete failure. But this insufferable Keynesian snake oil peddler has the gall to claim a roaring success moments before the greatest monetary catastrophe in recorded history begins its inexorable implosion.

The endgame of Keynesian central banking is indeed nigh. The outright lunacy of Draghi, Kuroda and Fischer are more than ample warning.

Reprinted with permission from David Stockman’s Contra Corner.

The post It Won’t Be Long Now appeared first on LewRockwell.

Leave a Reply