Labor Day Summary: Wage Earners Have Taken a Beating

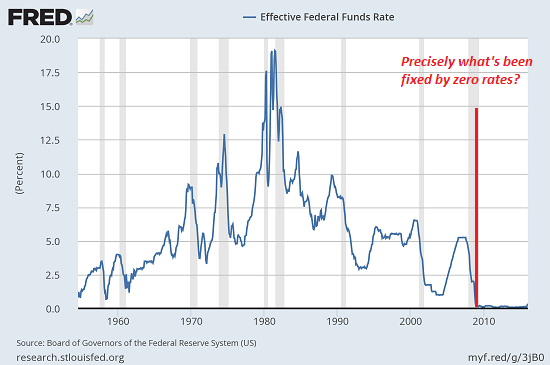

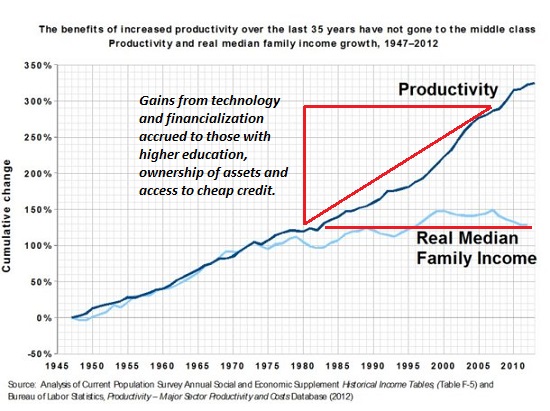

Let’s honor Labor Day by reviewing what’s happened to wage-earners in the eight years since central banks “saved the financial system” with free money for financiers: wage-earners have taken a beating and been dumped in a ditch.It’s really very simple: wage-earners have seen their real earnings (as measured by purchasing power) stagnate or decline while those chosen few with access to near-zero interest borrowed capital have seen their net income and wealth explode higher.

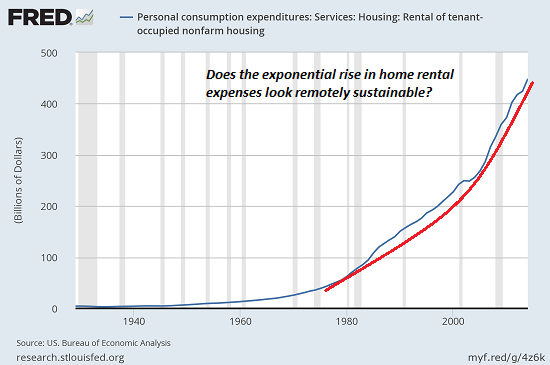

Do the math, people: annual wage increases once real-world inflation is factored in (roughly 7% to 10% annually for those who rent, have significant healthcare expenses or buy higher education) are either negative or are measured in the hundreds of dollars–in other words, trivial increases for all but the very top echelon of wage earners.

Increases in wealth for those with central bank-supplied free money for financiers are measured in the millions of dollars. Even small-fry with capital invested in bubble markets have experienced gains in the hundreds of thousands of dollars–entire lifetimes of earned income for those earning $25,000 to $35,000 annually.

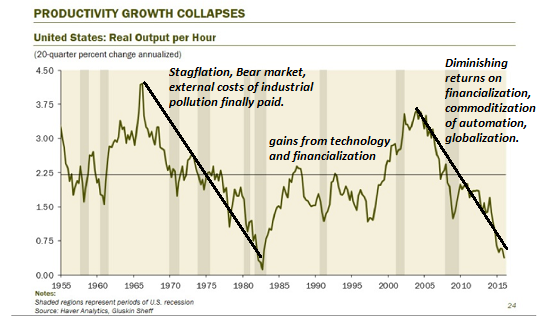

There are forces at work that are beyond the power of central banks: the technologies of automation, robotics and software are replacing human labor not just in low-skill sectors but increasingly in sectors that provided the bulk of middle class jobs.

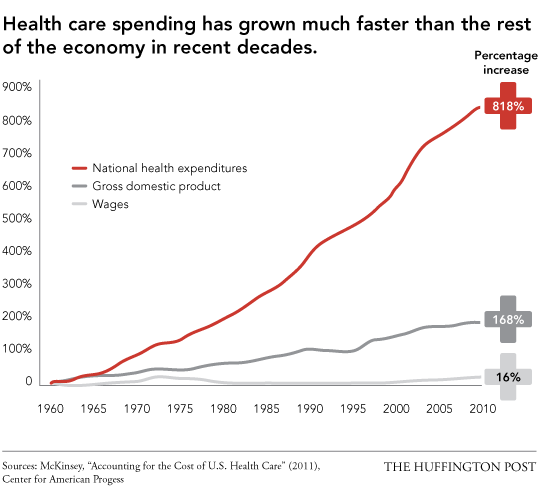

One reason why automation is gaining ground is the soaring cost of healthcare (paid by the employers and employees in America, except for those on federally funded Medicaid). Healthcare expenses are labor overhead–employers don’t pay labor overhead on robots or software.

While wage earners see their tiny raises wiped out by inflation, employers see theirtotal compensation costs skyrocketing due to employee healthcare expenses.

Then there’s globalization. Capital and technology are mobile, labor is not. Capital and technology can chase higher returns anywhere on the planet, but most workers cannot easily move to another country, and then move again a year later, and so on in an endlessly disruptive search for higher returns.

I have covered these longstanding trends for years.

Inflation Hidden in Plain Sight (August 2, 2016)

Here’s Why Wages Have Stagnated–and Will Continue to Stagnate (August 15, 2016)

Globalization’s Few Winners and Many Losers (July 20, 2016)

Sickcare Will Bankrupt the Nation (March 21, 2011)

How Healthcare Is Dooming the U.S. Economy (Three Charts) (May 2015)

What Killed the Middle Class? (March 24, 2016)

Central bank policies that boil down to free money for financiers have stuck a poisoned knife in labor’s back. And in magnifying the immense advantages of borrowed capital, the Federal Reserve has also stuck a poisoned knife in the back of the U.S. economy.

A debt-funded consumption-based economy like America’s needs higher wages and employment to enable higher levels of debt, higher tax revenues and higher levels of consumption. Without increases in real earnings to support higher debt and taxes, the system stagnates and then implodes.

The economy and government both need higher wages and higher employment to keep the debt bubble expanding. If the debt stops expanding, consumption and tax revenues plummet and the system collapses under the staggering weight of existing debt.

Wage earners are being stripmined by financialization, the glorification of financial speculation, the decline of productivity and rising costs imposed by state-enforced cartels such as healthcare. Take a look at these charts:

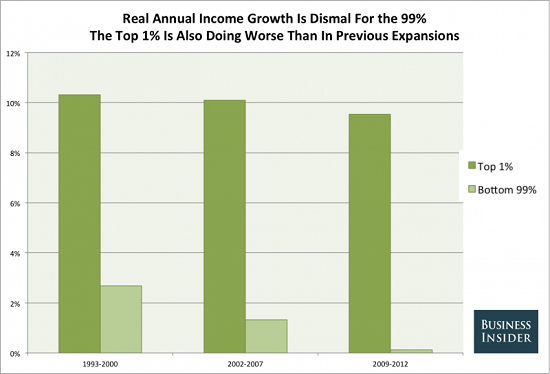

But surely the Fed’s vaunted wealth effect has trickled down to wage-earners? Not even close–wealth/income inequality has soared:

95% Of Income Gains Since 2009 Went To The Top 1%:

Berkeley economics professor Emmanuel Saez put out an update to his estimates of income inequality, and the headline figure has everybody outraged: 95% of income gains since 2009 have accrued to the top 1%.

Gordon T. Long and I discuss the decline of wages and employment and how this dooms the status quo:

Of related interest:

My new book is #8 on Kindle short reads -> politics and social science: Why Our Status Quo Failed and Is Beyond Reform ($3.95 Kindle ebook, $8.95 print edition)For more, please visit the book’s website.

Leave a Reply