The Fed’s Monetary Politburo

Now that’s more like it. Echoing Donald Trump’s Monday night bull’s-eye regarding the Fed’s thoroughly political essence, Rep. Scott Garrett put more wood to Janet Yellen during yesterday’s hearing:

Rep. Scott Garrett, R-N.J., seized Trump’s mantle during Wednesday’s hearing, saying “the Fed has an unacceptable cozy relationship” with the Obama administration and Democrats.

“As the saying goes, perception is reality,” Garrett told Yellen. “Whether you like it or not, the public increasingly believes that the Fed’s independence is nothing more than a myth.”

Of course, it’s a myth and a dangerous one at that. The truth is, Keynesian monetary central planning is inherently, massively and irremediably “political”.

That’s because it interjects the state deeply into the money and capital markets—-the very heart of capitalism—-and thereby in plenary fashion manipulates, rigs and falsifies the prices of all financial assets.

That is, borrowers or savers, speculators or entrepreneurs, money shufflers or wage earners, bankers or depositors, the risk-prone or the risk-averse, day-traders or business-builders, etc. It’s really not all that hard to rig markets if you have a printing press and plenary authority to redistribute economic gain and pain and societal income and wealth by political fiat, and without the inconvenience of periodic elections.

Needless to say, there is one hell of an argument in favor of market-based price discovery by capital providers and capital users in their tens of millions as opposed to a tiny posse of politicians in the Eccles Building or in the Rayburn Building or from the phone book. But until very recently, the choice between financial rule by politicians versus markets wasn’t even on the radar screen of public discussion.

No more. Donald Trump deserves the nation’s eternal gratitude for finally raising the topic—–even if his point was narrowly partisan and electoral. But politics is politics, and now that Flyover America has been reminded that the Fed is knee deep in it, hopefully, the drumbeat will grow louder.

Fortunately, the obtuse arrogance of the monetary politburo itself is helping to screw up the courage of politicians like Rep.Garrett. He has apparently come out of the monetary closet and hopefully has provided an example for his Capitol Hill colleagues.

In this instance, Hillary Clinton’s Treasury Secretary-designate, and lifelong financial apparatchik, Lael Brainard, made it easy. She’s been an in-your-face contributor to the Clinton campaign, and has been visibly lobbying for the high office that Jack Lew, Tim Geithner, and Hank Paulson have recently so thoroughly defiled with their bailouts and booty:

Federal Reserve Chair Janet Yellen’s defense of the central bank as non-partisan came under attack on Wednesday, as a Republican congressman cornered her on whether a key policy maker would have a conflict of interest in discussing a post in the next U.S. president’s administration.

Fed Governor Lael Brainard has donated to Clinton’s campaign and is widelyviewed as a potential Clinton pick for Treasury secretary. Yellen hesitated and then demurred when Representative Scott Garrett of New Jersey asked whether Brainard would have a conflict of interest if she were indeed in talks with Democratic nominee Hillary Clinton’s campaign about a position. The election takes place Nov. 8.

As it happened, this isn’t the first time. Our Wall Street/Washington financial rulers have become so brazen in their political machinations that Tim Geithner actually confessed to lobbying Obama for the Treasury job in the white heat of the October 2008 meltdown.

That is, when as the President of the New York Fed he was supposedly helping to administer the secret ministrations by which the best and brightest go about saving capitalism from itself, he actually had his head far up the Democratic candidate’s keister in pursuit of politics:

In his memoir, Timothy Geithner recalls meeting with then-Senator Obama in his room at the W Hotel in midtown Manhattan before the 2008 election, where the future president suggested that he might ask Geithner — then head of the New York Fed — to come to Washington as Treasury secretary. That meeting was in mid-October; Geithner voted at the next Fed meeting, at the end of the month, to cut interest rates by a half percentage point amid the deepening financial crisis.

The process of defrocking the high priests of the monetary temple might even become contagious. This morning one Ruchir Sharma, who is a chief global strategist at Morgan Stanley Investment Management, let loose a real stunner. Excerpts from his Wall Street Journal piece are highlighted below.

But first let’s cut to the chase. Approximately 3,200 days have elapsed since January 2008 and on 70 of those days, or 2% of the time, the monetary politburo was in session at the Eccles Building. Yet, mirabile dictu, (wonderful to relate) 60% of the entire stock market gain during that nearly nine-year period occurred on exactly those 2% of days.

Can you say, rigged!

Donald Trump did. Scott Garrett did. Now even the Morgan Stanley guy has let the cat out of the bag.

…….Since the Fed began aggressive monetary easing in 2008, my calculations show that nearly 60% of stock market gains have come on those days, once every six weeks, that the Federal Open Market Committee announces its policy decisions.

Put another way, the S&P 500 index has gained 699 points since January 2008, and 422 of those points came on the 70 Fed announcement days. The average gain on announcement days was 0.49%, or roughly 50 times higher than the average gain of 0.01% on other days.

This is a sign of dysfunction. The stock market should be a barometer of the economy, but in practice it has become a barometer of Fed policy.

Yes, you could call it “dysfunction”. But the right word is sheer madness.

In effect, the politicians at the Fed have entered a symbiotic embrace with the gamblers on Wall Street. Yet, finally, even an honest voice from the latter has dared to describe the untoward results.

Here is more unpeeling of the Fed “independence” lie from Ruchir Sharma’s blockbuster op ed:

Fed policy proclamations had little influence on the stock market before 1980. Between 1980 and 2007, returns on Fed announcement days averaged 0.24%, about half as much as during the current easing cycle. The effect of Fed announcements rose sharply after 2008 when the Fed launched the early rounds of quantitative easing (usually called QE), its bond purchases intended to inject money into the economy.

Whether this is a “big, fat, ugly bubble” depends on how one defines a bubble. But a composite index for stocks, bonds and homes shows that their combined valuations have never been higher in 50 years. Housing prices have been rising faster than incomes, putting a first home out of reach for many Americans.

Mr.Trump was also right that despite the Fed’s efforts, the U.S. has experienced “the worst revival of an economy since the Great Depression.” The economy’s growth rate is well below its precrisis norm, and the benefits have been slow to reach the middle class and Main Street. Much of the Fed’s easy money has gone into financial engineering, as companies borrow billions of dollars to buy back their own stock. Corporate debt as a share of GDP has risen to match the highs hit before the 2008 crisis.

In this way the Fed’s policies have fueled a sharp rise in wealth inequality world-wide—and a boom in the global population of billionaires. Ironically, rising resentment against such inequality is lifting the electoral prospects of angry populists like Mr. Trump, a billionaire promising to fight for the little guy. His rants may often be inaccurate, but regarding the ripple effects of the Fed’s easy money, Mr. Trump is directly on point.

So now perhaps another question can be raised. Why do we even need politicians to peg and falsify the price of money and financial assets?

Has there been a shortage of debt that requires artificially low interest rates to encourage households, businesses and government officials to borrow?

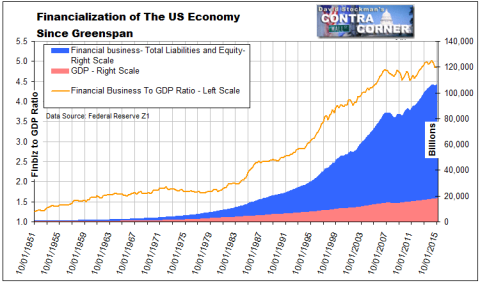

Has the financial sector languished and dragged down the real economy—especially since Alan Greenspan discovered the printing press in the basement of the Eccles Building during the stock market crash of October 1987?

Do we need chronic, egregiously “easy money” when the financial sector’s size has risen from 1.5X national income during the halcyon days of the 1950s and 1960’s to 5X the flat-lining economy of the present era?

Do we need a posse of politicians at the Fed empowered to ride roughshod over every financial asset price for the absurd purpose of generating more inflation? Is that not the equivalent of carrying coals to Newcastle when the American economy already has nearly the highest costs and wages in the world?

Have these central bank politicians ever offered a smidgeon of proof that consumers don’t buy flat screen TVs, computers or i-Phones because their prices are falling? Or that they delay purchasing food, fuel, and necessities because the CPI is too weak? Or that they need to be smacked in the forehead by “sticker shock” in order to buy a car?

To the contrary, in a world in which massive amounts of jobs and incomes have been off-shored owing to the China Price for goods and the India Price for services what would be so bad about a little deflation, exactly?

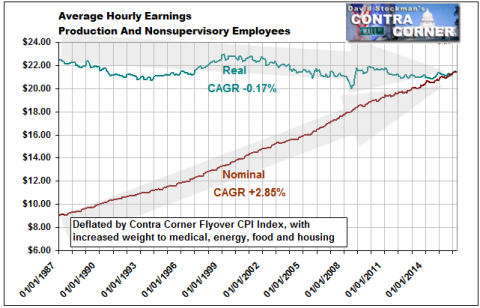

In fact, workers in the middle and lower reaches of the jobs market have not even kept up with the average nominal wage, which has nearly tripled since 1987, even as their after-inflation paychecks—-measured by an honest cost-of-living deflator—-have been shrinking for decades.

At the end of the day, the current regime of the political rule of financial markets is based on the monetary politburo’s self-serving myth that flexible, mobilized, market-set interest rates will impair economic prosperity and that left to its own devices capitalism has a death wish.

To the contrary, mobilized, free-market interest rates are the only route to financial stability, efficient capital allocation and the extinguishment of the rampant speculation and malinvestment which is bringing American capitalism to ruin. Accomplish that much, and the business cycle will self-correct and capitalist prosperity will be off to the races.

To be sure, there is a long way from here to there. But calling out the politics-ridden nature of the Federal Reserve and the myth of its vaunted “independence” is a least a start in the right direction.

Reprinted with permission from David Stockman’s Contra Corner.

The post The Fed’s Monetary Politburo appeared first on LewRockwell.

Leave a Reply