Peak Silver Cometh – Supply Deficits Continue Meaning Higher Prices

- Peak Silver – Supply deficits continue meaning higher prices

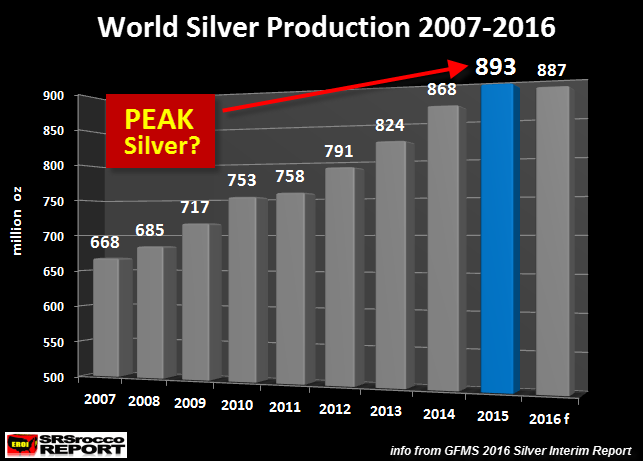

- May have experienced a peak in world silver production

- Global silver market suffered another large net supply deficit in 2016

- Peak silver likely as global silver production will decline to 887 million oz (Moz), down from 893 Moz in 2015

“While forecasted global silver production for 2016 is down only slightly versus last year, GFMS also stated this in their report:

We estimate that mine supply peaked in 2015 and will trend lower in the foreseeable future.

Declining total supply is expected to be a key driver of annual deficits in the silver market going forward.

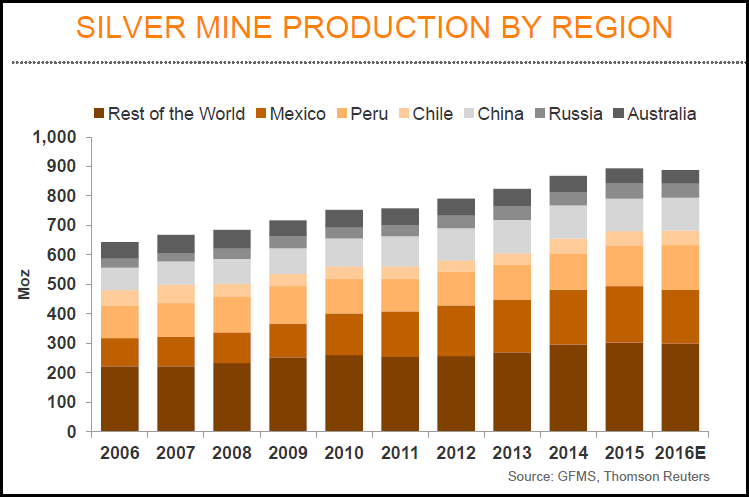

I will get to the annual silver deficits in a minute, but let’s look at their world silver mine supply by region:

“What is interesting here, is that GFMS forecasts the number one silver producer, Mexico, to be down in 2016 by more than 6 Moz. Last year, I forecasted that global silver production would likely be lower in 2015. I was going by data by the “World Metals Statistics.” However, Mexico’s INEGI (government agency) considerably revised their figures higher for 2015. While I have seen revisions take place, the revisions by Mexico’s INEGI for 2015 were quite substantial.

Leave a Reply