Assets Most Likely to Survive a ‘System Re-Set’

Your skills, knowledge and social capital will emerge unscathed on the other side of the re-set wormhole. Your financial assets held in centrally controlled institutions will not.

Longtime correspondent C.A. recently asked a question every American household should be asking: which assets are most likely to survive the “system re-set” that is now inevitable? It’s a question of great import because not all assets are equal in terms of survivability in crisis, when the rules change without advance notice.

If you doubt the inevitability of a system implosion/re-set, please read Is America In A Bubble (And Can It Ever Return To “Normal”)? This brief essay presents charts that reveal a sobering economic reality: America is now dependent on multiple asset bubbles never popping–something history suggests is not possible.

Why are the most advertised Gold and Silver coins NOT the best way to invest?

It isn’t just a financial re-set that’s inevitable–it’s a political and social re-set as well. For more on why this is so, please consult my short book Why Our Status Quo Failed and Is Beyond Reform.

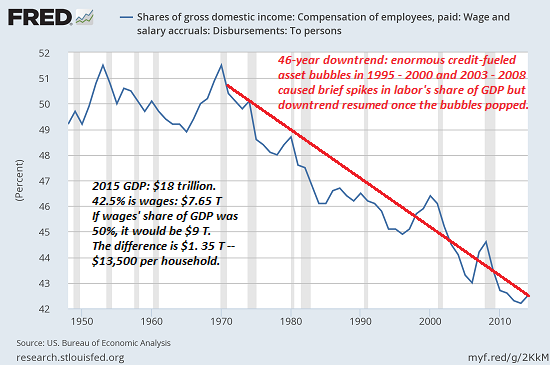

The charts below describe the key dynamics driving a system re-set. Earned income (wages) as a share of GDP has been falling for decades: this means labor is receiving a diminishing share of economic growth. Since costs and debt continue rising while incomes are declining or stagnating, this asymmetry eventually leads to insolvency.

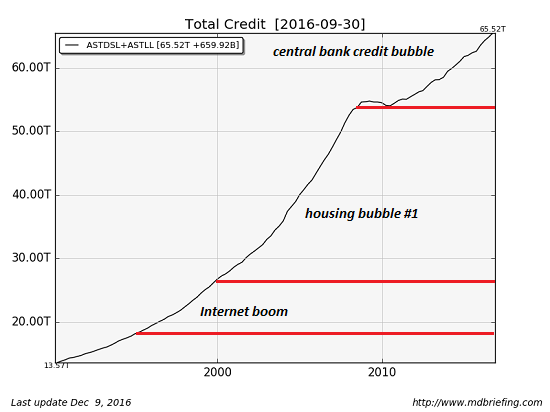

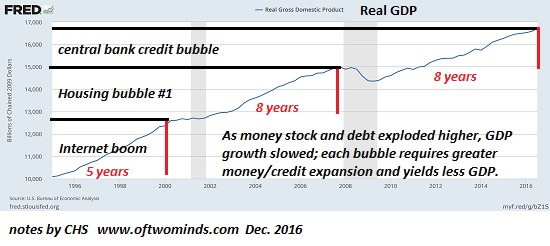

The “fix” for insolvency has been higher debt and debt-based spending–in essence, borrowing from future income to fund more consumption today. But each unit of new debt is generating less economic activity/growth. This is called diminishing returns: eventually the costs of servicing the additional debt exceed the increasingly trivial gains.

What happens when the bubbles pop, despite massive central bank/state interventions? The entire socio-political/financial system goes through a “system re-set” in which all the fantasy-based valuations, political denials, false promises and fraudulent claims collapse in a heap.

In a crisis, the privileged Elites will change the rules in a desperate attempt to expropriate the income and wealth of the bottom 99.5% to preserve their own power.

The trick is to do so in ways that won’t spark an immediate political insurrection.

The post Assets Most Likely to Survive a ‘System Re-Set’ appeared first on LewRockwell.

Leave a Reply