Gold Up 1.8%, Silver Up 2.6% After Dovish Fed Signals Slow Rate Rises

– Gold up 1.8%, silver up 2.6% – Fed signals slow rate rises

– Dollar sells off as Fed raises 0.25% to target range of 0.75 percent to 1 percent on inflation outlook and “ebullient” stocks

– Gold’s biggest 1 day percentage gain since September 2016

– Fed raises rates for only the third time since crisis

– Fade out Fed “jibber jabber” and focus on still ultra low rates (see chart)

– Rising rates bullish for gold as seen in 1970s and 2003 to 2007 (see table)

– Silver rose 26% in 2003, 14% in 2004, 29% in 2005 and 46.6% in 2006

– Raise is too little, too late … Dovish Fed creating asset bubbles

– Dutch pro EU government have marginal win and populist Wilders does not see gains expected

– Pro-EU Dijsselbloem PvdA party likely biggest losers – risking his position as head of Eurogroup of Euro zone’s finance ministers

– Europeans will continue to reject increasingly undemocratic federal EU super state and risk of contagion remains high

– Geopolitical risk in form of Brexit talks and French elections seeing safe haven demand in UK, France and other EU countries

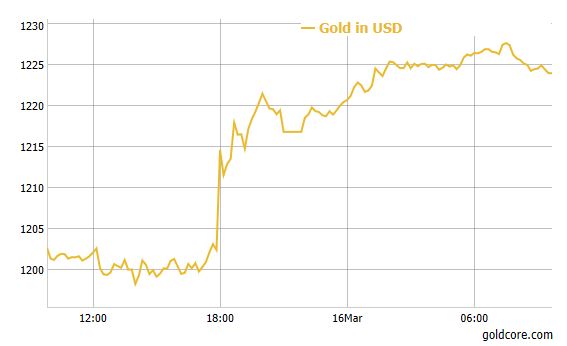

Gold rallied 1.8 percent yesterday as the U.S. Federal Reserve raised interest rates by an expected 25 basis points for the second time in three months.

Spot gold maintained those gains and moved as high as $1,228/oz overnight in Asia and gold has consolidated on those gains in European trading.

Gold had its biggest one-day jump since September. The Fed said in its policy statement that further hikes would only be “gradual,” with officials sticking to their outlook for two more rate hikes this year and three more in 2018.

Fed raises rates for the third time since crisis

Fed raises rates for the third time since crisis

Source: Newsreportonline.com

Silver rose 2.6 percent to $17.31 an ounce and traded another 1% in trading this morning to $17.50 an ounce. Platinum was up 2.8 percent at $965 per ounce while palladium was up 2.5 percent at $771 an ounce.

The Fed remains ‘dovish’ and signaled just three more rate hikes in 2017 as expected. They attempted to appear hawkish and suggested they would increase interest rates three times in 2017.

It is worth remembering that they promised three rate hikes for 2016 and yet only one rate hike materialised. We expect given the fragile nature of the so called economic recovery that this will be the case again.

Read full story here…

Interested in learning more about physical gold and silver?

Call GoldCore and speak with a gold and silver specialist today

Leave a Reply