Uncertainty and the Humility of Forecasting an Unknowable Future

Certainty and uncertainty come in a variety of flavors. “Certainty” seems rather definite, but lurking beneath certainty is the more scientifically verifiable notion of probability: the probability of outcomes can be high enough to qualify as certain and low enough to qualify as unlikely.

We can’t know with perfect certainty that our neighbor hasn’t invented a death-ray and may decide to test it on us due to that simmering feud over his dog Fluffy’s antics on our yard.

But we can make an assessment of the probability of this occurring, and conclude the probability is low with a high degree of certainty.

This assessment should change, of course, if we hear strange noises in his shop and notice shrubs in his back yard are now charred in peculiarly symmetric circles–and we learn he previously worked at a national lab on high-energy weapons but was dismissed for pursuing crazy ideas about developing handheld death-ray devices, i.e. phasers. (Star Trek fans, please raise a cheer.)

This brings us to a critical distinction between low-probability events, i.e. known unknowns a.k.a. highly unlikely “long-tail” events, and unknown unknowns, a.k.a. “black swans” made famous by author Nassim Taleb.

What is a known unknown? Death qualifies as a known unknown: we know with a high degree of certainty that the vast majority of living things eventually die (even cancer cells die once their host dies)–but the timing of their individual natural death is inherently uncertain, due to the great number of inputs, variables and causal factors intrinsic to life.

Statistically, there is a high degree of certainty that any dynamic data series will eventually revert to the mean. Spikes in asset prices will typically drop back to the trendline, but the timing of this reversion is intrinsically uncertain due to the unpredictable interactions and feedback loops inherent in complex systems of dynamic inputs and causal factors.

Thus statisticians who are tracking a tulip-bulb (or South Seas Company) like bubble in a speculative asset can forecast the eventual collapse of the bubble, but not the date and time of the reversion.

This collapse (reversion) can be forecast with a very high degree of certainty. (If tulip bulb prices had continued rising with no reversion, tulip bulbs would now cost $1 trillion each).

There are causal mechanisms that explain this eventual collapse: the market eventually runs out of “greater fools” willing to outbid other buyers seeking to buy tulip bulbs, and sellers deciding to cash in their gains overwhelm the few buyers still in the market.

Once the speculative frenzy driven by certainty of staggering profits evaporates into a fear of equally staggering losses, the bubble loses its momentum and prices revert to the long-term trend (often after briefly falling below the mean, requiring a reversion higher).

The bubble in tulips could not be forecast like a reversion to trend. We can forecast that humanity’s attraction to speculative frenzies will not disappear, but we can’t predict the next manifestation of this human trait.

Then there are the unknown unknowns–the stuff that can’t be forecast except as a generalization, i.e. that there are unknown unknowns that will crop up with some regularity– a regularity we can’t forecast with any certainty.

All this should nurture a profound sense of humility in all who dare to forecast an inherently unpredictable future. While humans love a good speculative frenzy that promises unearned wealth for everyone who gets into the game, they also love the illusory certainty of comforting forecasts based on past trends.

Thus we are reassured by long-term forecasts that claim a high degree of certainty that our comfortable lifestyle and all the promises issued by governments and pension plans will come to fruition as promised without any untidy or distressing reversions, phase transitions, collapses triggered by highly unlikely events (those pesky known-unknowns) or even peskier unknown-unknowns).

We are now facing an unpredictable collision of these conflicting sources of certainty and uncertainty. On the one hand, we’re constantly assured our status quo is durably permanent, and all the lines that assure us all the promises that have been issued will be met without any sacrifices or disruptions have been extended with handy pencils and rulers.

But on the other hand, we’re also assured that a certain number of unlikely events will occur despite the low probability we calculate. We’re also assured that unknown-unknowns black swans) will crop up and surprise everyone from time to time.

Can both of these assurances be true? Can we be assured that the odds of something completely upsetting our apple cart of predictable comforts, entitlements, pensions, etc. are so low we needn’t worry about them, and also be assured that highly unlikely events and unanticipated events (black swans) will arise from time to time, threatening the comfortable certainty of all these systemic promises?

The answer is “yes and no.” We can say that based on current trendlines, the future should be predictable with a high degree of certainty, but these trendlines could be completely disrupted by low-probability events and/or black swans.

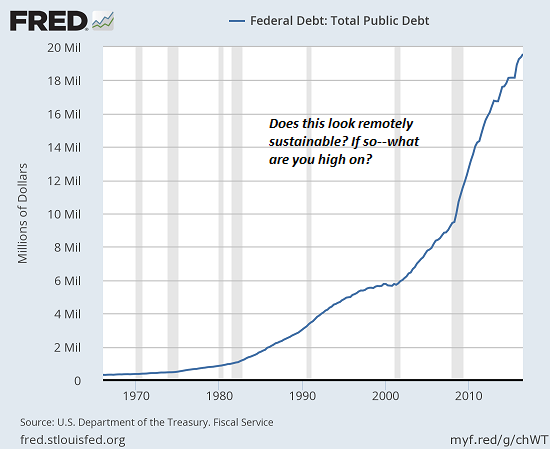

The question boils down to: are “current trends” the bubble equivalents of the tulip bulb craze? Please glance at this chart of skyrocketing federal debt before answering.

In essence, While we’re being reassured that all these grandiose promises are resting on trends that are as reliably predictable as the tides, the next easily predictable crisis will very likely reveal the trends are speculative bubbles that will predictably burst in a devastating reversion. The wise approach forecasting the future with a profound humility, while the soon to be bankrupted foolish are confident in their grasp of what’s knowable, unknowable and predictable.

Leave a Reply