London Property Bubble Vulnerable To Crash

– London property market vulnerable to crash

– House prices in London are falling

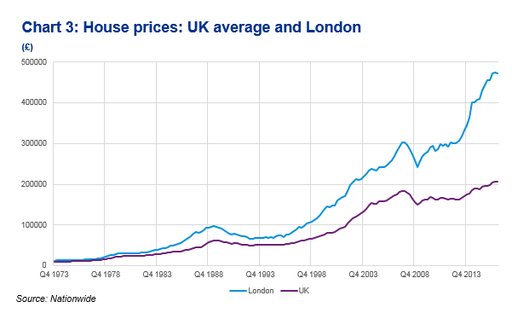

– London property up 84% in 10 years (see chart)

– House prices have risen over 450% in 20 years

– Brexit tensions as seen over weekend and outlook for U.K. economy to impact property

– Global property bubble fragile – Risks to global economy

– Gold bullion a great hedge for property investors

by Jan Skoyles, Editor Mark O’Byrne

For the bargain price of 36 AED (£5) I can buy Global Property Scene magazine, here in Dubai. This month it is running the headline ‘ Could Brexit be the making of the UK Property market?’

Property here in Dubai is a big deal, everywhere you look there are cranes and in the middle of the Malls developers have spent a small fortune placing a stand with a 3D model of their latest development.

The Emirate is looking to position itself as the financial safe haven of the Middle East and with that, they know, comes a solid property market.

London property has long been the poster child for countries such as the UAE who are looking to develop what has for a while appeared to be an indestructible real estate market.

Since 2011 London house prices have climbed by 65%. Between 2006 and 2016, average house prices in the capital grew from £257,000 to £474,000 or by a very substantial 84.4%. These large gains were ‘built’ on the back of the very large appreciation that was seen in prices between 1996 and 2006 (see chart below).

Average house prices in London in 1997 were below £85,000 meaning that in 20 years prices have risen over 450%.

This has created an air around the city’s property markets – residential and commercial – that they are invincible and that they are a safe haven.

House Prices: UK & London Average (KPMG, March 2017)

But London property values might not be as invincible as the world thinks.

UK’s Land Registry data for three London boroughs shows transaction volumes in London — the number of houses being bought and sold — are at an all-time low. Back in December asking prices in London dropped 4.3% in December with inner London down 6%, more exclusive areas dropped by as much as 10%.

Read full story here…

Access Award Winning Daily and Weekly Updates Here

Leave a Reply