“Bigger Systemic Risk” Now Than 2008 – Bank of England

– Bank of England warn that “bigger systemic risk” now than in 2008

– BOE, Prudential Regulation Authority (PRA) concerns re financial system

– Banks accused of “balance sheet trickery” -undermining spirit of post-08 rules

– EU & UK corporate bond markets may be bigger source of instability than ’08

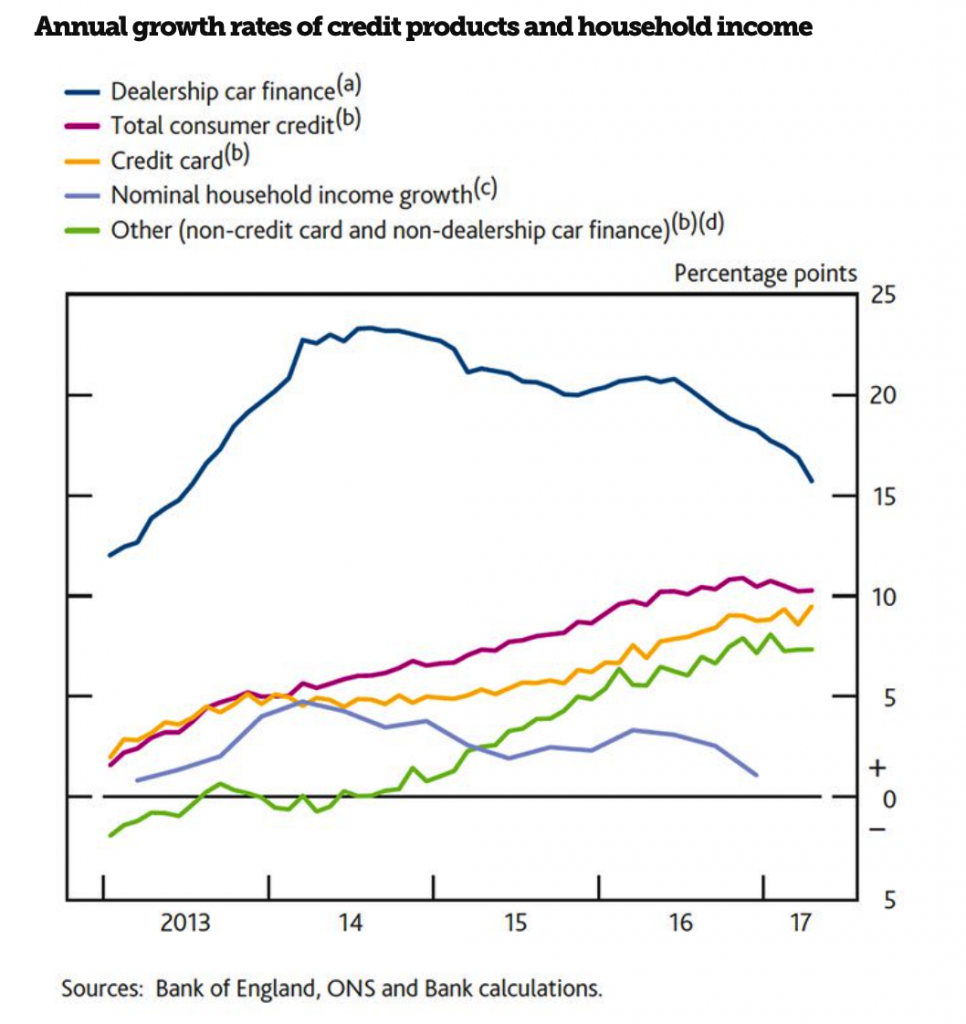

– Credit card debt and car loan surge could cause another financial crisis

– PRA warn banks returning to similar practices to those that sparked 08 crisis

– ‘Conscious that corporate memories can be shed surprisingly fast’ warns PRA Chair

Bank of England sees bigger financial risks than in 2008

Bank of England sees bigger financial risks than in 2008

Editor Mark O’Byrne

Stark warnings have been issued by the Bank of England and its regulatory arm, the Prudential Regulation Authority (PRA).

In less than one week the two bodies issued papers and speeches to warn industry members that many banks are showing signs of making the same mistakes that led to the 2008 financial crisis – the outcomes of which are predicted to be worse than those seen just nine years ago.

Increased risks have been noted at different ends of the financial system, from the European corporate bond markets right through to retail lenders.

The Bank of England’s ‘Stimulating Stress Across the Financial System’ was released last week. It looks at how it will assess risk in future studies on the European corporate bond market. It concludes that the corporate bond market could create more instability during the next financial shock than it did in the crisis of 2008.

Just two days before this stark warning, the PRA’s chief-executive Sam Woods told lenders that they were on thin ice with their innovations designed to reduce their capital requirements and buoy earnings. Woods said that whilst their innovations “might meet the letter of the regulation” they must not be “designed to circumvent the spirit” of banking rules.

Bank of England’s Woods accused banks of engaging balance sheet trickery to “circumvent the spirit” of post-financial crisis rules.

Both warnings over both sets of practices is yet another reminder of the stark difference of interests between taxpayers, regulators and the banking industry.

News of institutions circumventing regulations and non-bank corporate lenders creating more risk in the system begs the question if the financial system as we know it will ever be fit for purpose in terms of looking after the needs of borrowers and savers. It also rises concerns about how safe the banks are for depositors and whether banks are ‘safe for savers?’

Balance sheet shenanigans

One of the ‘innovations’ being used by banks is the very same that was used in the run-up to and exacerbated the 2008 financial crisis. It is the use of special purpose vehicles which are used to hold riskier assets in order to free up capital.

Woods told the news conference:

“We have noticed that some institutions are now moving on-balance-sheet financing to off-balance-sheet formats using special purpose vehicles, derivatives, agency structures or collateral swaps.”

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Special Offer – Gold Sovereigns at 3% Premium – London Storage

We have a very special offer on Sovereigns for London Storage today. Own one of the most popular and liquid of all bullion coins – Gold Sovereigns – at the lowest rates in the market for storage.

- Limited Gold Sovereigns (0.2354 oz) available

- Pricing at spot + 3.0% premium

- Allocated, segregated storage in London

- Normally sell at spot gold plus 6.75% to 10%

- One of most sought after bullion coins in the world

- Mixed year, circulated bullion coins

- Minimum order size is 20 coins

These coins are at a very low price and with limited amounts at these record low prices we expect them to sell out very fast.

Call our office today

UK +44 (0)203 086 9200

IRL +353 (0)1 632 5010

US +1 (302)635 1160

Leave a Reply