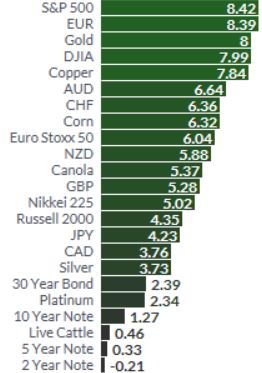

Gold Up 8% In First Half 2017; Builds On 8.5% Gain In 2016

– Gold up 8% in first half 2017; builds on 8.5% gain in 2016

– U.S. dollar down 6.5% – worst quarter in seven years

– Gold higher in all currencies except Draghi’s euro

– Gold outperforms bonds; similar gains as stock indices

– S&P 500 and Dax outperform gold marginally

– World stocks (MSCI World) up 10%; gold outperforms Eurostoxx (+6%) & FTSE (+2.3%)

– Silver up 3.7% in first half ; builds on 15% gain in 2016

– Stocks, bonds, property buoyed by stimulus

– Resilience in gold as world struggles to hold confidence

– “If one hasn’t diversified this would be a good time to do that” – Shiller

Editor: Mark O’Byrne

From President Trump taking office, Fed policy tightening to European and UK elections, Brexit rumblings and growing Middle Eastern risks, the first half of 2017 gave witness to a few trends which look set to impact markets in the coming months.

Gold and silver are amongst the best performing assets in 2017, with gains of 8% and 4% respectively and stayed resilient despite poor sentiment.

Demand drivers such as geopolitical uncertainty, a weak dollar and low interest rates continue to provide support for the precious metals as does renewed robust demand in the Middle East, India and China.

Given 2016 finished with a sell-off in the precious metals, both gold and silver have remained impressively resilient in the face of overwhelmingly bearish sentiment in much of the media and with the retail investing public in the U.S. and most of the western world.

Gold rose in value in all currencies except the euro in which it fell 1.2%. Read full story here…

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Leave a Reply