Millennials Can Punt On Bitcoin, Own Gold and Silver For Long Term

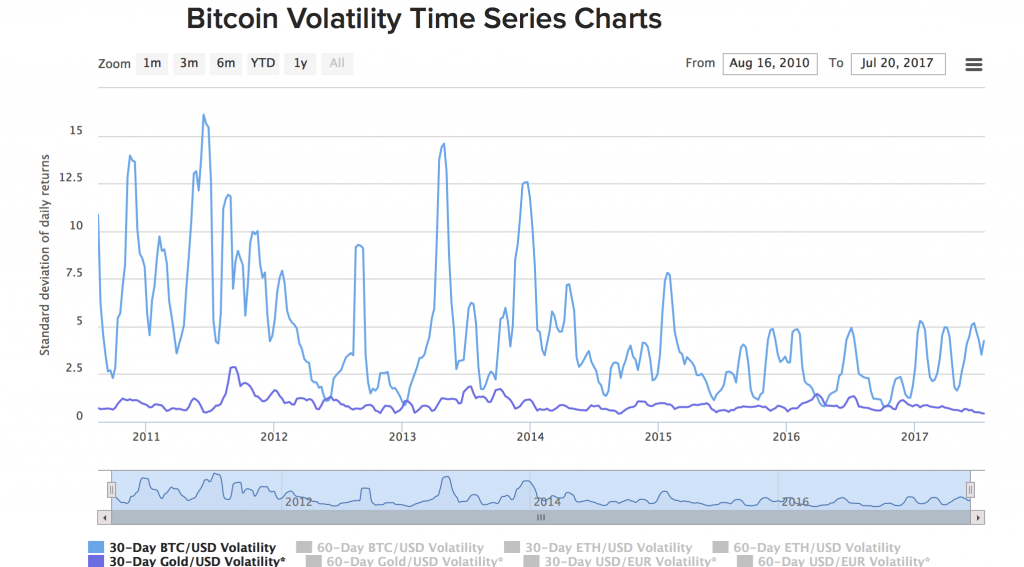

– Bitcoin volatility shows not currency or safe haven but speculation

– Volatility still very high in bitcoin and crypto currencies (see charts)

– Bitcoin fell 25% over weekend; Recent high of $3,000 fell to below $1,900

– Bitcoin least volatile of cryptos, around 75% annualised volatility

– Gold much more stable at just 10% annualised volatility

– Bitcoin volatility against USD about 5-7 times vol of traditional forex trading

– Cryptos remain subject to huge speculation with little fundamental analysis

– Despite major differences many crypto currencies correlated, mimic one another

– Extreme hype – bitcoin expert bets will eat own body part on national television

– Millennials can punt on bitcoin, should also own gold and silver for long term

– Cryptos mere ‘babies’ when compared to time tested gold and silver

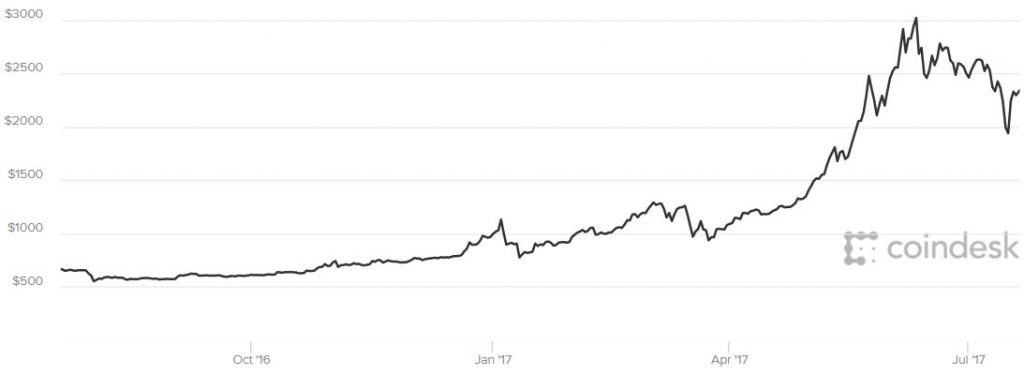

BTC in US Dollars – 1 Year (Source: Coindesk)

BTC in US Dollars – 1 Year (Source: Coindesk)

Editor: Mark O’Byrne

Crypto volatility and hype shows immaturity remains

The joy about working in precious metals is that for part of the weekend you can switch off.

There is a precious time when markets are closed and you don’t have to worry about market movements and what might be happening. You check back in on Sunday afternoon/evening and can delight in the markets starting to wake up for the week ahead. This isn’t the case in cryptocurrencies.

This weekend crypto-currency market participants got a wake-up call as to what 24/7/365 market trading really means. They watched the price of bitcoin plummet around 10% on Sunday morning (EST) alone. This contributed to bitcoin’s overall fall of 25% since last Thursday and into the weekend. Other crypto currencies fell by more.

BTC Versus Gold Volatility (Source: Buybitcoinworldwide.com)

The volatility is so bad that if you are one of the few with a bitcoin app that allows you to actually spend your bitcoin then you might have found yourself paying for a brunch that was a hell of a lot more expensive than when you originally sat down to order it. You then might have noticed as you left the cafe that the currency was in full recovery mode and that brunch needn’t have been so expensive after all.

Click here to read full story…

“It is important to note that all portfolios under all conditions actually perform better with exposure to gold and silver” – David Morgan

In the short video above, David Morgan, the Silver Guru, speaks briefly about the importance of owning silver bullion coins and bars as financial insurance in an uncertain world. He speaks about GoldCore Secure Storage and how he recommends GoldCore’s ultra secure allocated and segregated gold, silver, platinum and palladium bullion storage (Zurich, London, Singapore and Hong Kong) to his retail and high net worth clients.

Leave a Reply